Ebb and flow of China's middle-class "cool sports" China New Consumption #5

From social currency to personal choice - What it reveals about investing in consumer sectors

Despite ongoing doubts about Chinese consumption and persistent deflationary pressures, some of the best-performing stocks in recent years have come from "new consumption"—discretionary brands that deeply resonate with consumers.

This makes "new consumption" a compelling focus—not as a broad market beta play, but as a source of high-potential alpha opportunities. This newsletter series explores those opportunities and the consumer psychology behind them.

Disclaimer: This post is not sponsored by any of the companies mentioned.

The boom of "niche" sports

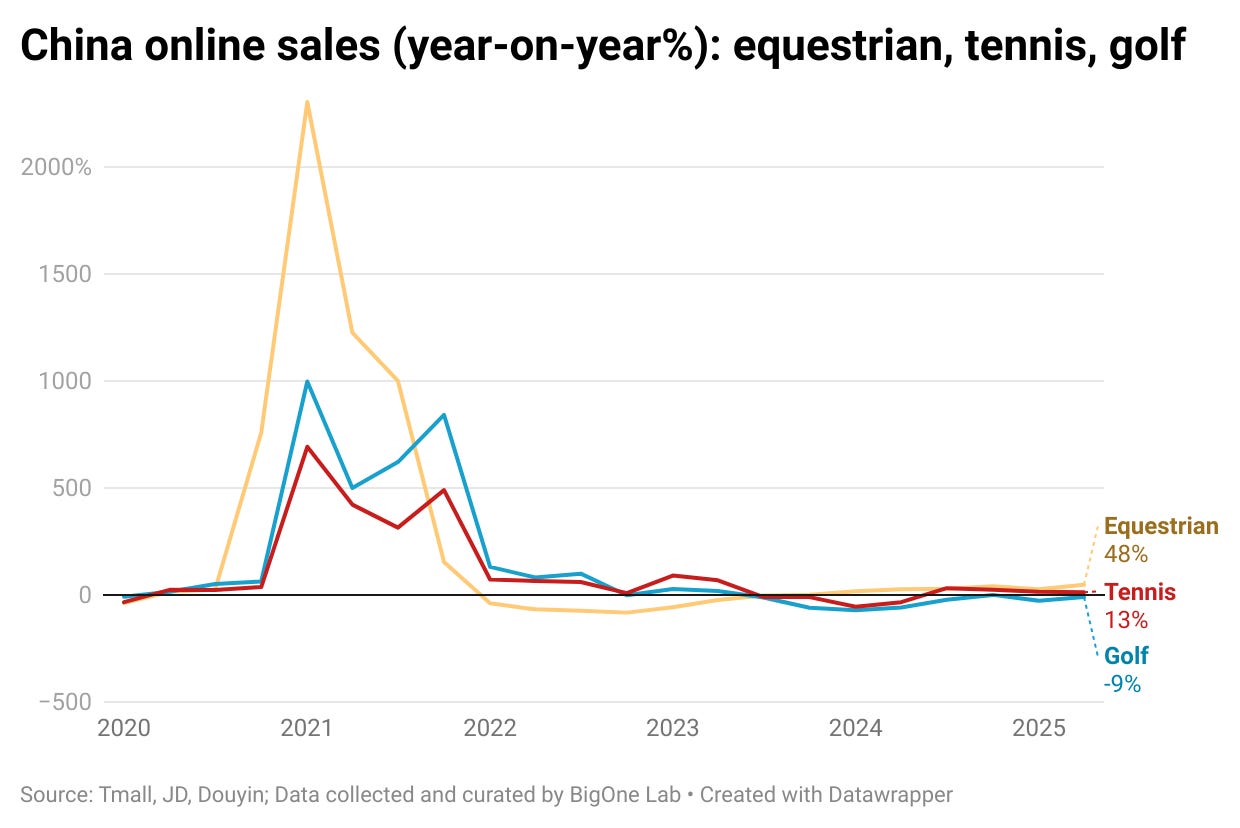

For much of the past decade, middle-class sports trends in China were as much about appearances as they were about the activities themselves. Equestrian lessons, tennis, and golf—dubbed the "middle-class trifecta"—were once the ultimate status markers. These Western imports, often celebrated as "elite sports" on Chinese social media, carried not just athletic appeal but a cultural stamp of sophistication. Middle-class families spent generously, often enrolling their children to signal both ambition and taste.

Golf, in particular, offered something beyond fitness: it was a networking tool, a stage for business deals. In 2021, when China just came out of the first wave of COVID, the appetite for these sports was still strong—activities that the international community deemed "cool" and "exclusive" held powerful sway in Chinese cities.

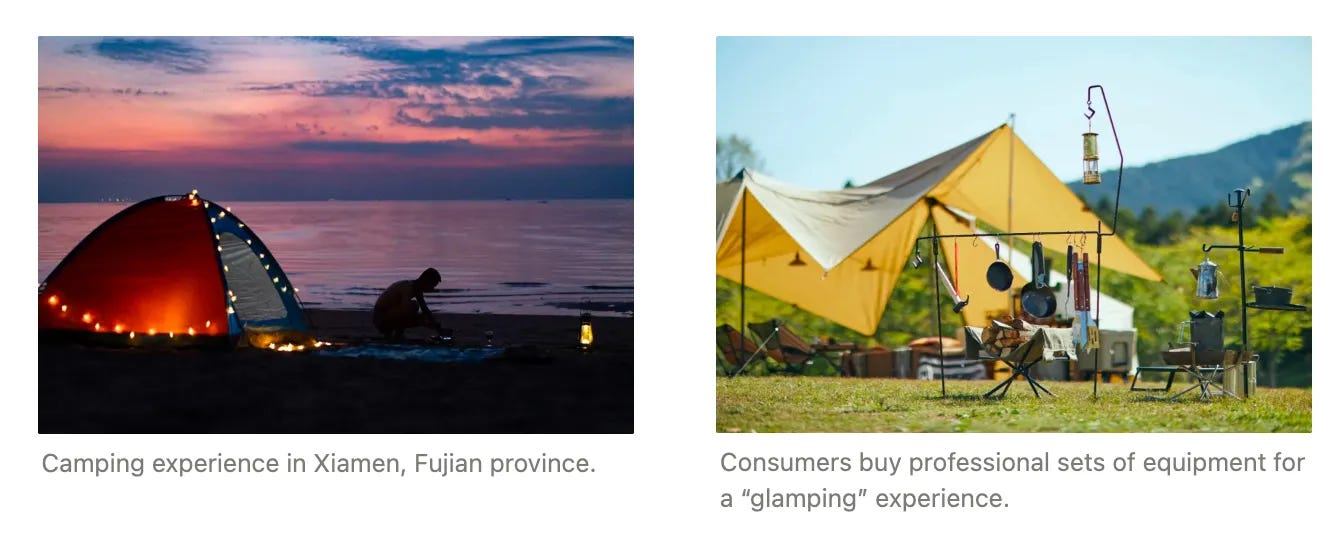

But by late 2022 and into 2023, after enduring far stricter and longer lockdowns, urban consumers craved the outdoors—not just the prestige of a sport. Novel and outdoor experiences began to edge out expensive hobbies. Frisbee, camping, skiing, and hiking exploded in popularity, driven in part by their social-media-friendly aesthetics.

For many, these were first-time encounters: southern residents without winter snow traveled north to ski and snowboard; urbanites pitched their first tents on city outskirts.

When the 2023 snowboarding season opened in Beijing, I was even a bit frustrated to see an entire lane occupied by a snowboard club that had traveled all the way from Shanghai—a journey involving a four-and-a-half-hour high-speed train plus local shuttles. But it was also a vivid snapshot of the enthusiasm among Chinese willing to invest so much time, money, and effort to experience a sport that, for them, was entirely new.

Other upscale outdoor experiences were also eagerly sought after by China's middle class. For instance, I wrote about how camping became so popular in China by late 2022 that middle-class consumers were opting for "glamping"—short for glamorous camping—a luxury camping experience featuring stylish setups, beautiful aesthetics, and picturesque locations perfect for social media–worthy photos, while happily plunking down thousands of yuan on their weekend getaways.

But this boom was not uniform. For a portion of consumers, the enthusiasm was driven by the thrill of novelty and the desire to ride social trends. Once the "IT sport" moment passed, some dropped out—put off by high equipment costs or simply realizing the sport wasn't something they genuinely enjoyed. A smaller portion, however, discovered a real passion and stayed.

But the coming and going of such waves is telling. In a consumer market as large as China's, even short-lived fads can move billions in spending.

From social display to personal fulfillment

In the slower economy of 2025, the middle class has become more selective. The social currency of sports—how "cool" they look in a feed—has lost its dominance. Instead, activities that provide personal fulfillment over public image are holding ground or growing.

Outdoor running and hiking have kept their momentum, appealing to those seeking a mindful escape rather than a performance for the camera. Marathon running is one such winner—I wrote about how marathon competition has become a sought-after activity among the Chinese middle class and affluent, who are willing to spend real money and time on specialized gear and personal training.

Continue reading to learn about the latest sales trends of sports brands such as Lululemon, Hoka, and On Running, along with broader implications for investors interested in equity market opportunities.

*Our parent company, BigOne Lab, collects online data via major e-commerce channels such as Tmall, JD, Douyin, and an offline panel of malls and specialty retail stores.