6 themes for Chinese equities in 2024 H2 - Charts of the Week

Themes and opportunities to watch in China's stock market for 2024 H2

"Charts of the Week" is Baiguan's series that features key data points to help you quickly grasp the general state of affairs in China in just a few minutes. We handpick the highlights of the data charts from a variety of sources, analyzing and delivering insights trusted by 100+ top institutional and corporate clients worldwide at BigOne Lab. Don't forget to subscribe before you continue reading!

Sponsorship

This post is proudly sponsored by Scrapyman, a leading web-crawling API service provider, enabling businesses to effortlessly gather vast amounts of data from China's leading e-commerce and social media platforms. Scrapyman's cutting-edge technology and user-friendly APIs enable your brand consultancy, data analytics, LLM and market research teams to monitor market trends, track competitors, or aggregate content. Visit Scrapyman today and use the coupon code "Baiguan" to enjoy a minimum 5% discount on any of their services.

Welcome to this week's edition of "Charts of the Week." In today's newsletter, we've selected 12 charts that highlight six themes for Chinese equities in H2 2024. These themes include the latest trends in domestic consumption, Chinese companies going global, Meituan's expansion into the "sinking market," price wars among coffee chains, the real estate market, and the education sector. Let's dive in!

Chinese companies going global

Despite ongoing concerns about the highly competitive domestic market in China, Chinese companies expanding globally—both through merchandise and manufacturing exports—continue to dominate recent trends and are poised to shape future directions. Since the post-pandemic era began in 2023, job positions targeting overseas markets by Chinese enterprises have been on the rise, reaching new highs in 2024.

Manufacturing has been particularly robust. According to the online recruitment data we monitor at BigOne Lab, manufacturing jobs account for over 30% of all overseas positions posted by Chinese enterprises as of April 2024, supported by overseas infrastructure projects.

Companies in focus: In April, Nanjing Hanrui Cobalt (300618.SZ) experienced significant growth in overseas job postings, driven by its 60,000-metal-ton nickel high-pressure leaching construction project in Indonesia; Beijing Roborock Technology (688169.SS) had 19% of its positions targeted overseas; Pinduoduo (NASDAQ: PDD) continued to hire at a fast pace and had 14% of its roles overseas.

Buying domestic brands

In recent years, there has been a noticeable shift among Chinese consumers toward domestic brands, driven by a preference for better price-for-value, product-market-fit, and a growing national sentiment that supports locally made products. The Personal Care & Makeup category has particularly seen this trend.

Companies in focus: After the Fukushima treated radioactive water release raised safety concerns about Japanese products, Chinese consumers accelerated the switch from well-known Japanese brands like Shiseido and SK-II to local alternatives. Domestic skincare companies such as Proya Cosmetics (603605.SS) and Giant Biogene (2367.HK) continued to achieve higher-than-industry-average growth in online sales throughout 2024.

The "sinking market"

The "sinking market," comprising county-level towns and regional centers in lower-tier cities, is drawing a younger population inflow due to job opportunities and lower living costs. As this market becomes a pivotal growth engine for domestic consumption, consumer habits from major cities are beginning to permeate these smaller areas. (For those interested in exploring this topic further, check out Nina Chen's previous post "consumption potential in China's lower-tier cities".)

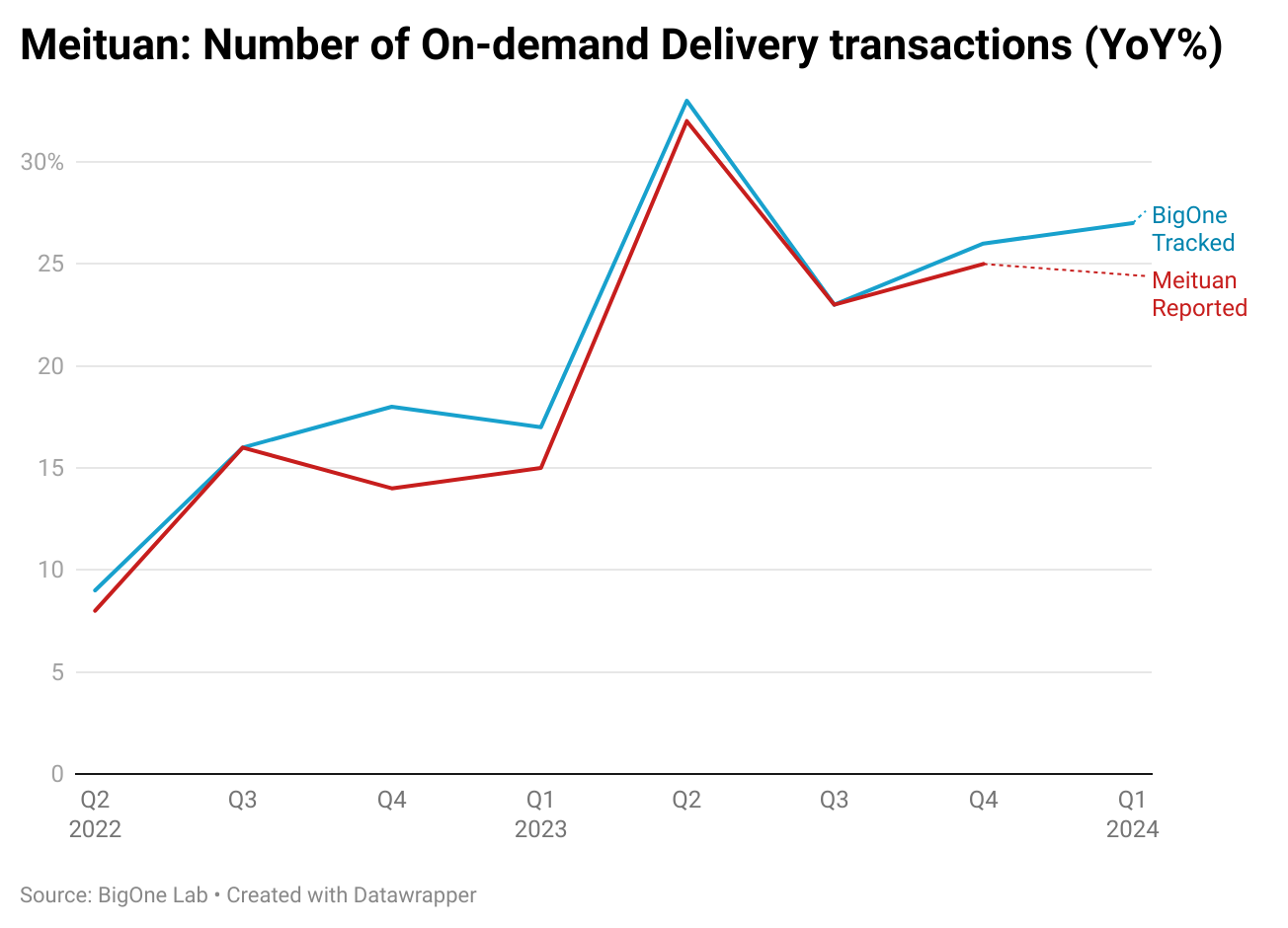

Company in focus: Meituan (3690.HK) continues to expand into the "sinking market." In April 2024, the on-demand delivery orders increased by 9% year-on-year, primarily driven by cities categorized as tier 3 and below. Specifically, while tier 1 cities (Beijing, Shanghai, Guangzhou, Shenzhen) saw a 3% decline in order volume, tier 3, 4, and 5 cities exhibited increases of 28%, 13%, and 16% respectively. Active stores on Meituan in tier 3 cities, which mostly include regional centers and county towns, have now overtaken those in the more developed tier 1 and tier 2 cities, which include municipal capitals, metropolitans, and mega-cities.

Continue reading to get updates on Meituan's latest on-demand delivery orders, domestic consumption trends (featuring online sales from sports companies like ANTA, Lululemon, Nike, etc.), real estate, and education (featuring TAL Education). To get a sense of what is offered, you are welcome to check out this older post in the same series: Charts of the Week. You can also get free access by sharing us.

IMPORTANT Community Announcement

We are planning to launch a paying member-only online community for you to exchange ideas. We have yet to decide on details, but very likely it will be a Discord community. We welcome other suggestions from you.

Starting from July 15, we will increase our subscription price from $100/year to $188/year, $15/month to $20/month. Prices will NOT increase for paying subscribers who sign up by July 15th, so please subscribe before then to lock in the old price.

Paying members of Baiguan enjoy free access to China Translated, the personal newsletter of Robert Wu, which is currently worth $100/year. Please DM us if you wish for this access.