China's economic crossroads: Has sentiments bottomed out? - Charts of the Week

Understanding China's June economic situation in 15 charts

Dear valued readers, we have recently migrated to a paid subscription model. As a token of our appreciation for your ongoing support and engagement, we are offering a limited-time 50% off discount for a 1-year subscription.

If you enjoy reading Baiguan, consider sharing posts to earn free months through our referral program. For existing institutional clients of BigOne Lab, you are entitled to 1 complimentary professional-tier subscription for each $10,000 spent annually at BigOne Lab. Please contact your sales representative for complimentary access if you meet this criteria.

*This post is exclusive to our paid readers. To get a sense of what is offered, you are welcome to check out this older post in the same series: Charts of the Week

Economic data highlight

China’s manufacturing PMI shrank for the third consecutive month, recording 49 in June, a slight increase from May's 48.8. The non-manufacturing PMI also decreased to 53.2, the weakest year-to-date. With the PPI falling by 5.4% year-on-year in June, marking its ninth consecutive decline, and the CPI remaining unchanged, fears of deflation are rising. On the positive side, Total social financing and Yuan loans both beat expectations in June.

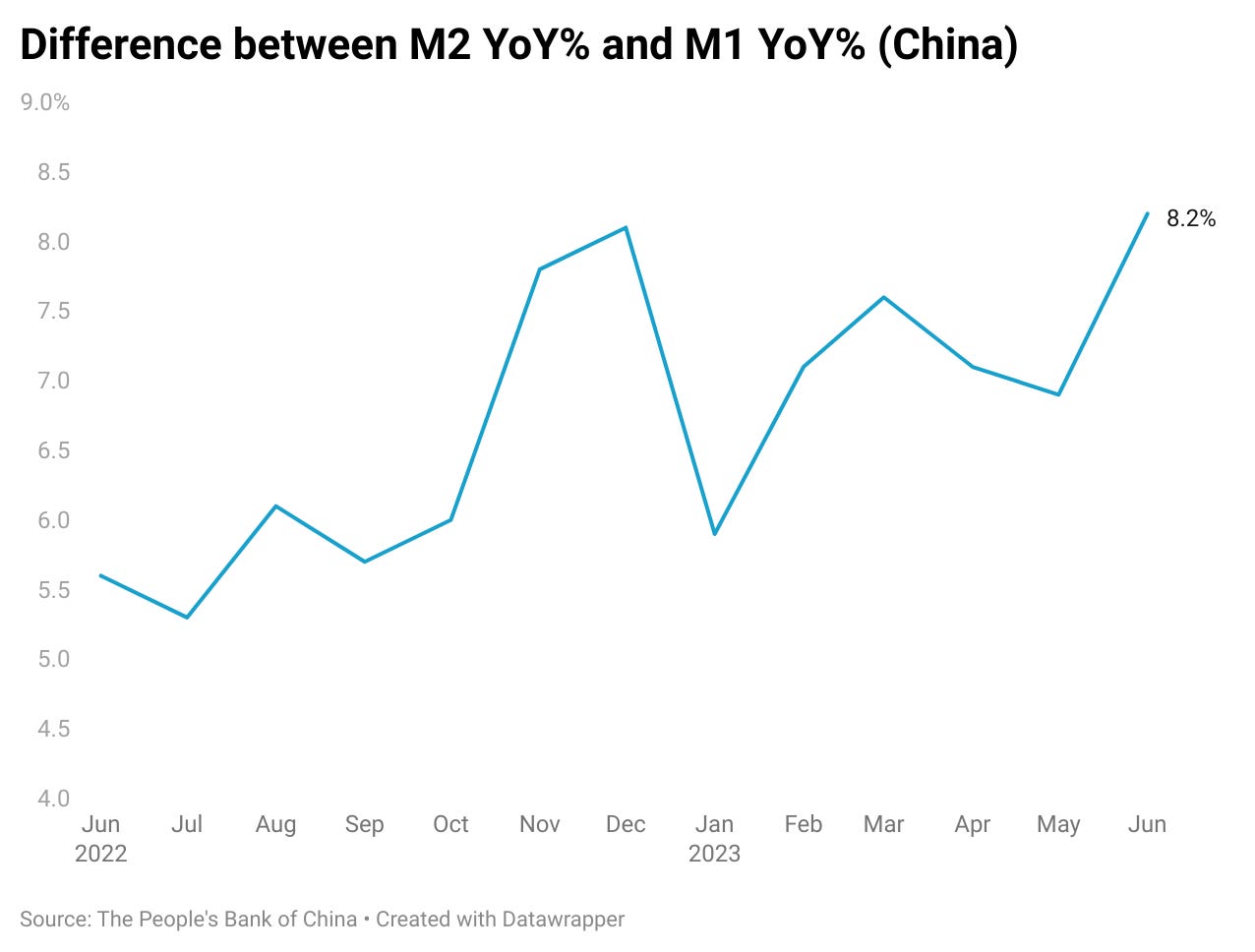

In June, the difference between the year-on-year increase in M2 and M1 supply continued to widen. This indicates that both enterprises and households remain conservative, and economic activity remains slow.

Given the disappointing economic data, market sentiment has fallen to its low point, resulting in the underperformance of both Hong Kong and onshore equities globally in the first half of 2023.

However, it is important to remember that China still has policy stimulus in its toolbox, and domestic consumption is still recovering, albeit at a slower pace. The release of positive data, such as the upcoming Q2 GDP, inflection points in discretionary domestic consumption, and the job market rebound, could mean great buying opportunities for investors looking for attractive valuations.

Today's post will present a compilation of charts exploring whether market sentiments have bottomed out, specifically:

Whether there are early signs of a rebound in discretionary shopping and the job market? (my quick answer is yes)

Could real estate rebound, and could the hot automobile market sustain?

Sentiments towards consumption and investing, and a breakdown of the sentiments behind the high savings rate.

Datapoints in this issue:

Online and offline consumption trends, automobile sales, real estate (property showings, transaction volumes, and home renovation and improvement-related purchases), job postings by industry, and consumer sentiments

The pace of consumption recovery continued to cool down

Nationwide catering revenue, which historically serves as a reliable indicator for offline consumption activity, increased by 12% year-on-year but decreased by 12% month-on-month.

Online consumption on Tmall and JD continued the tepid recovery, recording single-digit year-on-year increases in online sales in June. Douyin's live-streaming business extended the momentum, increasing by 54% year-on-year in online sales.

But discretionary categories, including home appliances and digital electronics, have rebounded in June

Home appliances, which remained subdued in Q1 2023 but showed early signs of recovery in May, continued to recover in June with a 22% year-on-year increase. Online sales were mostly driven by air conditioners and refrigerators, due to the continuing heat waves in China.

Digital electronics, which recorded very bleak sales from January to May, rebounded significantly in June with a 17% year-on-year increase. Mobile phones, smart devices, cameras, and video equipment, as well as electronic education products, all recorded double-digit year-on-year increases. Electronic education products rebounded significantly with a 100% year-on-year increase.

Sports and health products continued to rebound. The "Chillax" lifestyle remained a trend among consumers, driving up sales of outdoor equipment (37% YoY) and outdoor clothing (73% YoY) in June.

Real Estate: existing home sales remained grim, and home renovation sales also ticked lower

The transaction volume of existing homes in 82 cities in China did not show signs of an increase. The total number of property showings for existing home listings also declined in the first week of July, indicating weak hopes of a rebound in the real estate market in the months ahead.

Sales of home renovation materials and furniture also decreased in June, but sales of home soft decorations continued to trend up with a year-on-year increase of 16% across major e-commerce platforms. This trend could continue, as we have previously observed that consumers prioritize the quality of their home life.

Automobile sales continued to rise but the pace cooled down in June

In June, overall passenger car sales in China increased by 2% year-on-year, and sales of new energy vehicles increased by 35%.

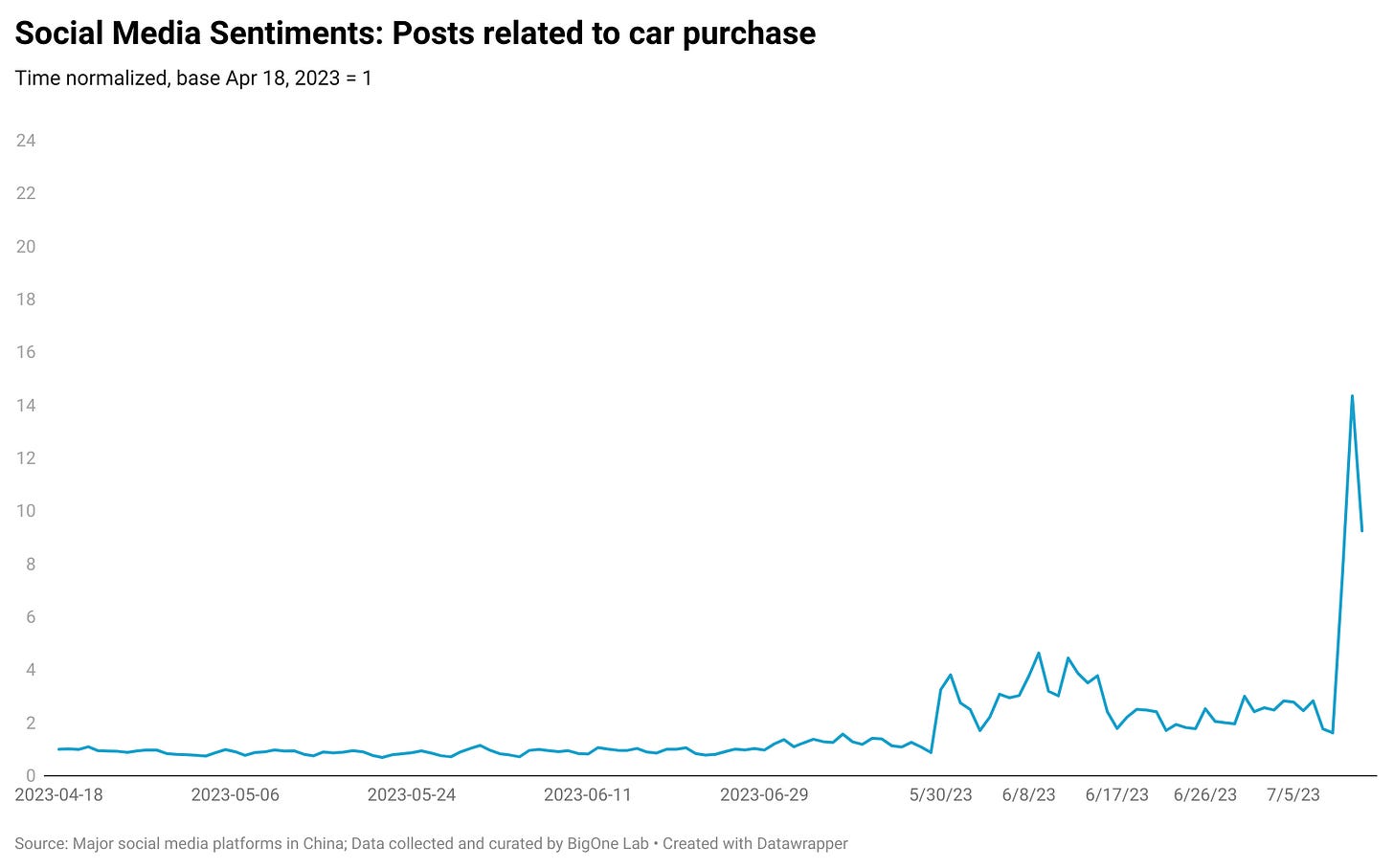

While automobile sales may cool off from their peak, we expect the market to continue growing. We have observed an increasing number of consumers discussing car purchases on social media in the first half of July, including posts about "buying cars," "test driving," and "car delivery.”

Employment outlook: early signs of recovery in job demands

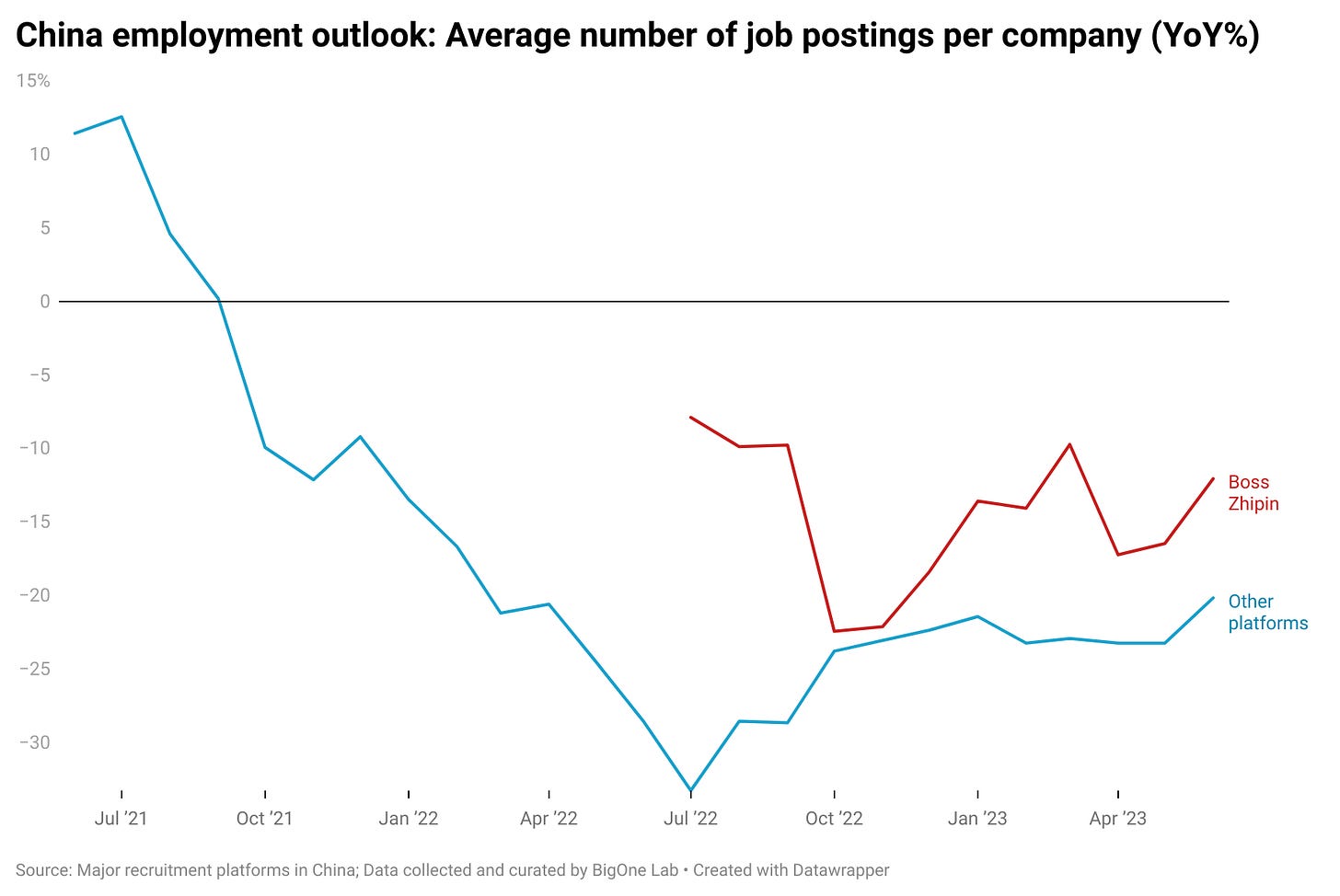

In June, the average number of job postings per company on Boss Zhipin, the largest online recruitment platform in China, decreased by 12%. However, this was an improvement from the previous months. Other online recruitment platforms exhibited similar trends.

Boosted by the rebound of the tourism and offline catering businesses, the catering and hospitality industry continued its fast rebound in June. Knowledge-driven services(mainly including finance, education, and scientific research sectors) also continued to rebound. Information Technology, which remained weak in the first half of 2023, also showed an improved year-on-year change in June.

As we have previously discussed, the ongoing recovery of the catering and hospitality industry, which provides blue-collar jobs for young job seekers, as well as the information technology industry, which absorbs a significant number of entry-level college graduates, could help stabilize the high youth unemployment rate going forward.

Consumer and market sentiments

Social media sentiment shows that deflation concerns picked up again in June following disappointing CPI, PPI, and PMI data. The number of social media posts mentioning "deflation" surged, but the level did not exceed previous levels.

Consumer confidence shows restoring trends, but investors remain cautious

The People's Bank of China Urban Household Survey for Q2 2023 shows that both employment and income expectations deteriorated in Q2. 58% of residents prefer "more savings", an increase of 0.1% from the previous quarter. The percentage of residents who prefer "more spending" increased by 1.2%, while those who prefer "more investing" decreased by 1.3% from the previous quarter.

The growth rate of short-term consumer loans continued to recover, indicating restored consumer confidence. However, medium and long-term loans (which mainly include mortgages) remained subdued.

Among the newly increased Yuan loans, household loans rebounded beyond expectations in June, indicating a slight increase in consumer willingness to spend. However, enterprise loans still dominate.

RMBS conditional prepayment has come down from its peak, but still remains historically high, indicating that investors are being cautious and households are prioritizing repaying mortgages to reduce leverage.

Key takeaways

The data points mentioned above indicate that China's employment and consumer confidence are not deteriorating and are even showing early signs of a rebound, albeit at a slow pace. This is evident from the recovery of discretionary spending, strong automobile sales, and an improving number of job postings.

The economic data is consistently disappointing, and it appears that the real estate market is unable to sustain the substantial recovery of household medium and long-term loans—these are widely accepted as the consensus. Currently, the market is driven by bearish sentiments toward China's market, and investors remain cautious.

However, as long as the three conditions persist, there is no need to be overly pessimistic. 1) The consumption and employment outlook continues to recover, albeit gradually. 2) The US dollar peaks as the Fed eventually eases into a rates-cutting cycle. 3) The expectation of more stimulus is still on the horizon (with the potential catalytic role of the Central Political Bureau meeting scheduled for the end of July). Taking these factors into account, we believe that both the Hong Kong and onshore markets could offer favorable buying opportunities in the second half of 2023.