Domestic demand in China, real estate, and job market trends - Charts of the Week

China's top trends in under 3 minutes; week of June 17, 2024

"Charts of the Week" is Baiguan's series that features key data points to help you quickly grasp the general state of affairs in China in just a few minutes. We handpick the highlights of the data charts from a variety of sources, analyzing and delivering insights trusted by 100+ top institutional and corporate clients worldwide at BigOne Lab. Don't forget to subscribe before you continue reading!

IMPORTANT Community Announcement

We are planning to launch a paying member-only online community for you to exchange ideas. We have yet to decide on details, but very likely it will be a Discord community. We welcome other suggestions from you.

Starting from July 15, we will increase our subscription price from $100/year to $188/year, $15/month to $20/month. Prices will NOT increase for paying subscribers who sign up by July 15th, so please subscribe before then to lock in the old price.

Paying members of Baiguan enjoy free access to China Translated, the personal newsletter of Robert Wu, which is currently worth $100/year. Please DM us if you wish for this access.

Welcome to this week's edition of "Charts of the Week." In today's newsletter, we've selected 15 charts that highlight the latest macro and consumer trends in China. These include the latest domestic consumption demand, consumer sentiments, the real estate market following the announcement of supportive policies, and youth employment and other recruitment trends. Let's dive in!

China's latest macro data reveals moderate domestic demand growth

Domestic supply > demand: China's retail sales grew by 3.7% year-on-year in May 2024, surpassing expectations. However, total retail sales from January through May 2024 increased by only 4.1%, showing single-digit growth. Retail sales growth continues to lag behind industrial production growth, indicating that supply still outpaces overall domestic demand.

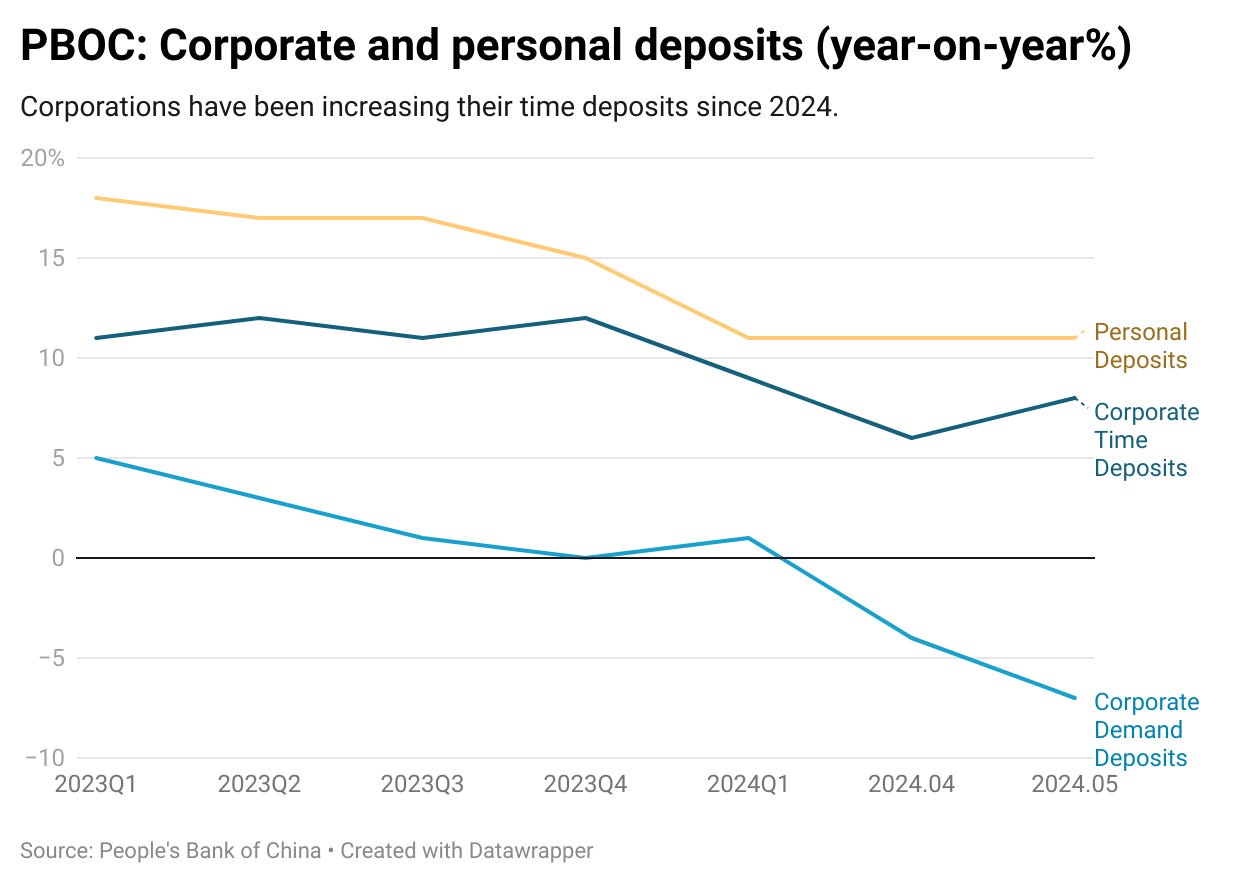

Time deposits > demand deposits: As bank deposit interest rates decrease in China, more households and corporations are choosing time deposits as their preferred investment. Additionally, data from the China Association for Public Companies (CAPCO) shows that corporations faced profitability challenges in 2023: in 2023, 5,330 listed companies saw total revenue rise by 0.86% to 72.7 trillion yuan, while net profit fell by 1.56% to 5.71 trillion yuan. (State-owned enterprises performed better, with revenue, net profit, and net profit attributable to the parent company growing by 1.45%, 2.56%, and 2.93% respectively. ) The slow profitability growth is causing more corporations to avoid risky ventures, and potentially leading to cash flow issues.

E-commerce: Tmall's online sales grew by 2.5% year-on-year in May, a significant improvement from the -3.3% decline in April. Live-streaming e-commerce platforms Douyin and Kuaishou continue to grow rapidly, driven by competitive pricing.

Declining average selling price: Despite overall growth, the average selling price for most categories experienced a year-on-year decline in April and May, indicating that consumers are prioritizing lower prices and that deflationary pressure still looms.

Consumers hold back from large-ticket purchases: take car purchases as an example, sales continue to cool down in 2024 amid the ongoing "price war" among major automakers in China.

Consumers hold back from luxury purchases: we observe that the retail prices of premium baijiu, such as Moutai Feitian 53% ABV and Moutai 1935, have been declining. Although this may not significantly affect the overall sales of liquor companies, it reflects that consumers are adopting a more responsible and cautious mindset. (These premium baijiu are also considered quasi-investment products among Chinese consumers due to their prestige.)

We also observe similar trends for other luxury items such as watches, leather goods, and bags.

Real estate: Volume rebounds as prices drop, driven by "authentic" housing needs

Secondary housing market shift: From joint price-volume decline to price drop, volume rise since 24Q2

In the secondary housing market, since the second quarter of 2024, we have observed a shift from a simultaneous decline in both volume and price to a situation where prices are falling while transaction volume increases. Our analysis has identified a negative correlation between the inventory clearance indicator and transaction prices, which has been evident since the beginning of 2022. This trend indicates that sellers, anticipating further price reductions, have been increasingly motivated to list their properties.

However, in April and May 2024 (as shown in red dots in the charts), the decline in prices has led to an increase in transaction volume, thereby improving inventory clearance rates. This improvement is attributed to a series of supportive policies that have stimulated the market.

Moreover, the recovery in the secondary property market's transaction volume, driven by individuals looking to sell their current homes to purchase new ones, has the potential to positively influence the primary housing market. This connection is significant, as the primary market's performance is closely linked to the financial health of real estate developers and local governments, which have long depended on land finance for revenue.

Continue reading our insights on the latest real estate market, including listing prices, public sentiments, and recruitment trends such as youth employment, Chinese companies going abroad, and industries experiencing challenges. To get a sense of what is offered, you are welcome to check out this older post in the same series: Charts of the Week. You can also get free access by sharing us.