China's Spring Festival tourism revenue surpassed 2019, reaching a record high — Charts of the Week

Understand China’s latest domestic consumption, real estate, and employment in 9 charts

The 2024 China Spring Festival, lasting from February 10th to 18th, marks the Year of the Dragon. The 2024 Spring Festival saw a surge of tourists as people satisfied their pent-up travel demands. (The 2023 Spring Festival was the first Spring Festival post-COVID, but many people chose to return home rather than travel.)

In today's Charts of the Week series, we will share the key data point handpicked by the team to brief you on the latest tourism, domestic consumption, real estate, and employment situations in China in under 10 charts.

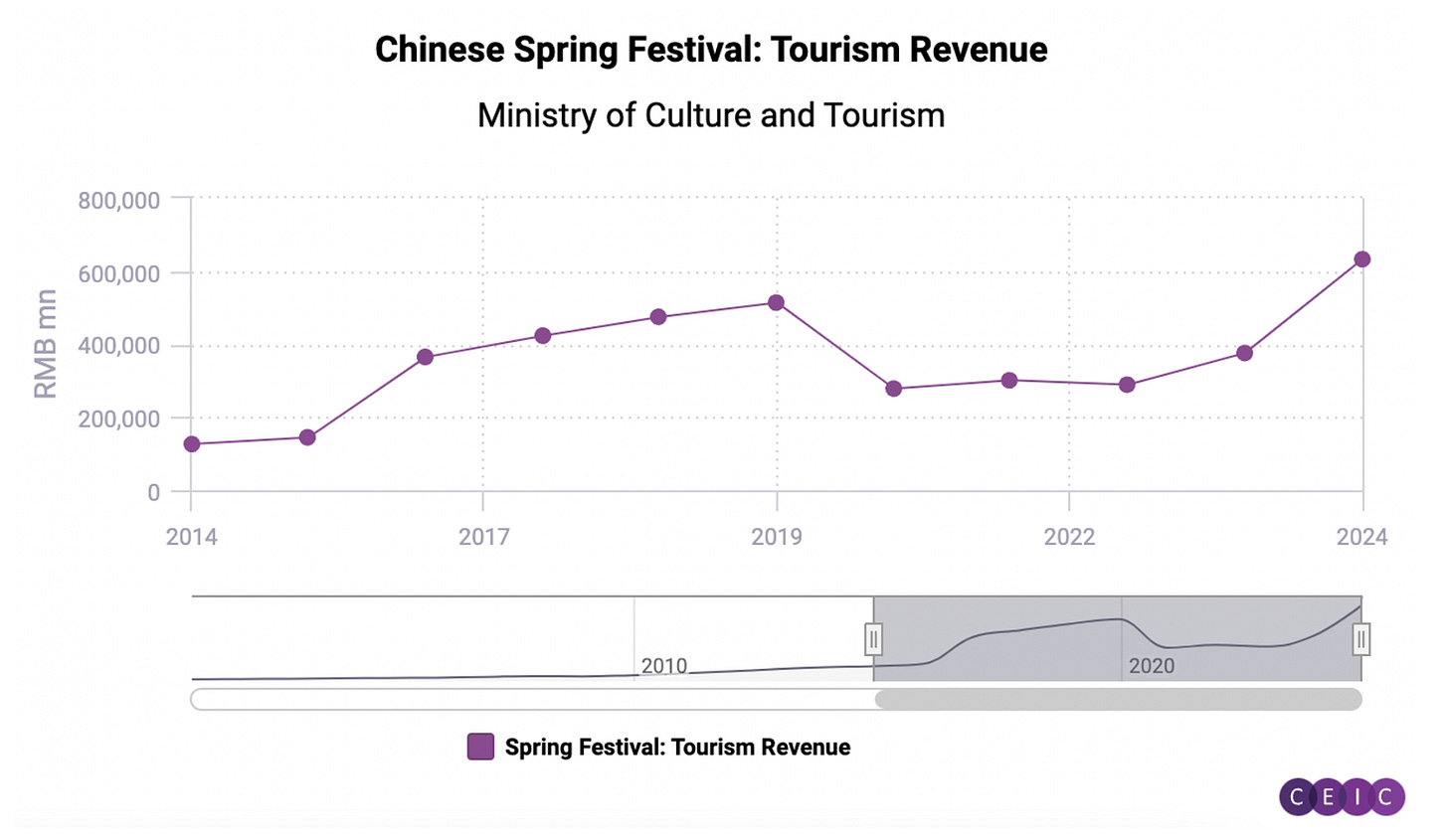

Tourism revenue during the 2024 Spring Festival surpassed that of 2019, reaching a record-high

Tourism revenue reached 632.7 billion Yuan, a 7.7% increase from 2019 and a 47.3% increase year-on-year.

However, the per-person expenditure has not yet returned to the levels of the comparable 2019 period. According to the Ministry of Culture and Tourism's estimates on February 18th, the number of visits increased by 19% compared to 2019. This is a faster pace than the 7.7% growth in total revenue, indicating that per-person spending has not recovered to pre-pandemic levels. [source]

International travel returned to roughly 90% of the 2019 levels

According to the National Immigration Administration, the total number of entry and exit trips during the holiday period returned to 90% of the 2019 levels. The total number of inbound and outbound trips reached 13.52 million, representing a year-on-year growth of 2.8 times.

Based on booking data from major Online Travel Agency (OTA) platforms in China, the most popular international destinations among Chinese travelers are Thailand, Japan, Malaysia, Singapore, Korea, Australia, Indonesia, and the United Arab Emirates.

Employment

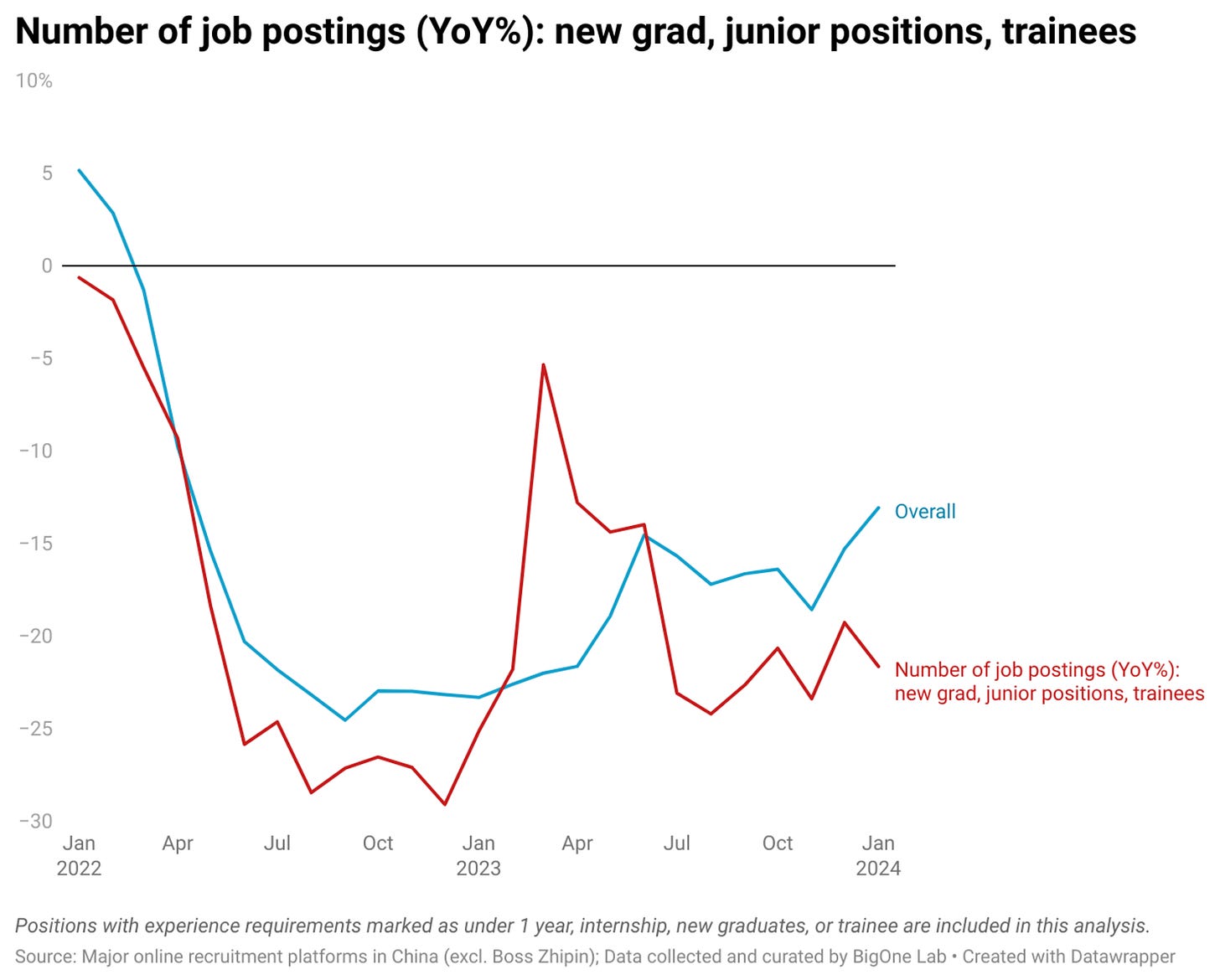

The total number of job postings on major online recruitment platforms in China continues to recover, primarily driven by the growth of job postings on Boss Zhipin, China's leading online recruitment platform.

Job postings for junior positions, new graduates, and trainees, however, still lag behind the overall market.

*Please note that the panel for analyzing junior positions does not include Boss Zhipin, which results in a negative year-on-year growth overall. This panel may be biased towards white-collar positions.

Offline catering and restaurant consumption are off to a good start

In the first half of January 2024, the revenue per store (restaurant and catering site) exceeded that of the comparable period from 2019 to 2023. (The panel tracks restaurants and catering sites nationwide)

The "consumption downgrade" still remains a concern

Online sales across Tmall, JD, and Douyin for most categories saw a year-on-year increase in January against a low base. (Note that January 2023 was the Spring Festival holiday period, a time when consumption activities are typically lower).

However, the average selling price (ASP) declined for most categories, except digital electronics (+21%) and Chinese & Western Medicine (+7%). This indicates that consumers are prioritizing value for money.

The Gold hype

Chinese consumers have shown increasing interest in purchasing gold and silver, including both jewelry and investment-grade products such as gold bars, in recent months. In January, online sales of gold jewelry rose by 42% year-on-year, while gold and silver investment products increased by 41%.

Real estate

In January 2024, the number of existing home transactions in 82 major cities grew by 42% year-on-year, while transaction volume increased by 64%. The average price decreased compared to the previous year, with the decline expanding from December 2024.

During the two weeks of the Spring Festival in 2024 (2/4-2/17), compared to the same period in previous years, the transaction area and transaction volume in over 140 sample cities decreased by 28% and 31% respectively (compared to 1/15-1/28 in 2023), and decreased by 7% and 13% respectively compared to 2022 (1/23-2/5).