When you think of Chinese companies expanding overseas, what comes to mind first? Is it BYD and Geely cars cruising down the streets? Or platforms like Temu, Shein, and Aliexpress, exporting "low prices" and "a wide variety of products"? Perhaps it's brands like Pop Mart, Miniso, and Mixue Ice Cream & Tea. These brands or platforms all carry a distinct Chinese style, representing a visible form of expansion.

However, there's also a more subtle way of expanding overseas. A group of consumer brands quietly downplay their Chinese origins, leveraging efficient production, management, and marketing capabilities to blend with overseas cultures and trends, standing out in foreign markets. In the article we're translating today, there's a shoe brand that focuses on comfort, eco-friendliness and machine washability. It has successfully joined the ranks of the "that girl aesthetic (*)," becoming popular in North America, Europe, Japan, South Korea, and Singapore, capturing the hearts of many professional women. This brand is Vivaia, and it comes from Shenzhen, China.

[*Baiguan Note: "that girl aesthetic" (also named as white girl aesthetic in China's social media) is primarily a style. It features coordinated light-colored outfits, solid or pastel crystal manicures, pink or white home decor meticulously arranged, and natural-looking American minimalist makeup. This aesthetic is a consumerist lifestyle shaped by American white women. The essentials include the dumbbell-like Stanley water bottle, classic Lululemon yoga pants, and yellow UGG boots, collectively known as the "that girl trio."]

Machine-washable, quick-drying, eco-friendly shoes: the "white girl" obsession

Vivaia, founded in 2020, is reportedly the top choice for professional women aged 25-44 in overseas market. Its stores in Singapore are always crowded, you need to queue to try on shoes in Tokyo, and lines in New York stretch for hundreds of meters, reminiscent of luxury brands announcing price hikes or limited-edition hype sales. However, the bustling Vivaia stores aren't filled with resellers but mainly with working professionals.

According to SimilarWeb, Vivaia's website had over ten million visits in 2023, with an average of over 630,000 monthly visitors, boasting a growth rate of 654.6%, making it a standout leader in the U.S. apparel and accessories market.

Vivaia's parent company, Stellar Inc., founded in 2017, has quickly made a strong presence. It showed rapid growth from the start, with revenues exceeding RMB 100 million (USD 14 million) in 2018, RMB 1 billion (USD 138 million) in 2019, and RMB 2 billion (USD 276 million) in 2020. This money-making powerhouse is also popular in the capital market: it secured RMB 300 million (USD 41 million) in Series A funding in September 2020, with Sequoia Capital as one of the investors. In 2021, it received an additional RMB 700 million (USD 96 million) in Series B funding from Sequoia Capital and ByteDance.

In Hong Kong, Vivaia is known by a simple yet resonant name: "Commuter Shoes"—shoes for commuting, taking the subway, going to work. We've heard of sneakers requiring queues and raffles for limited releases, but how did these unassuming commuter shoes achieve such hype? How did an unknown brand gain such high attention in just a few years?

Leveraging China's tech and supply chain, embracing local cultures overseas

Product strength 1: Comfort

A great pair of commuter shoes must first and foremost be comfortable. After all, work is tough enough without having to deal with uncomfortable shoes.

Vivaia stands out by being seemingly more comfortable than other flats. Some shoes have non-slip soles, some have shock-absorbing soles, some insoles relieve pressure, some use the same material as yoga mats, some offer arch support, and some have extra padding in the heel. These features set them apart from "beautiful instruments of torture" that hurt heels.

There's also a series called Aria 5°, which features a toe box with an additional 5° of curvature compared to typical women's shoes, making them less likely to pinch your feet.

Product strength 2: Machine washable

Another noteworthy feature of Vivaia is its machine washability. While many in China might think of shoes and washing machines as incompatible, with public washing machines often causing cultural shock when used for shoes, Vivaia aims to address overseas needs precisely.

Once you accept this concept, machine-washable, quick-drying shoes are indeed convenient. They stay clean and presentable without the need for manual scrubbing, meeting professional and social demands at all times.

Product strength 3: Eco-friendliness

"Eco-friendly" is a strong selling point in Western markets. For example, Allbirds, endorsed by Leonardo DiCaprio, gained fame by promoting 30% lower carbon emissions compared to similar products.

Vivaia's core brand story revolves around sustainability: recycling six plastic bottles to make an eco-friendly shoe. The process involves shredding the bottles, compressing them into pellets, spinning them into yarn, and using 3D knitting technology to create shoes without traditional fabric cutting. These shoes are made from recyclable materials and can be recycled again.

The eco-friendly approach complements other appealing features like comfort, lightweight design, and relaxation:

The upper made from recycled plastic bottles is skin-friendly, elastic, breathable, and antibacterial.

The knitting technology reduces production waste by 30% while creating a stylish honeycomb pattern.

The shoes are lightweight, with each pair weighing the same as six empty bottles, making them easy to carry.

Moreover, China is one of the largest producers and consumers of plastic, with a complete supply chain and leading footwear production bases. Even Rothy's established its factory in Guangdong, China, to ensure a stable supply chain.

Compared to Allbirds, Vivaia offers more styles, catering to a broader audience beyond the casual Silicon Valley workforce. Compared to Rothy's, Vivaia shares the eco-friendly reputation and value proposition, with a more affordable price range of USD 79-189, making it a high-value choice.

Leveraging traffic: personalized online ads, celebrity endorsements, and offline pop-up stores

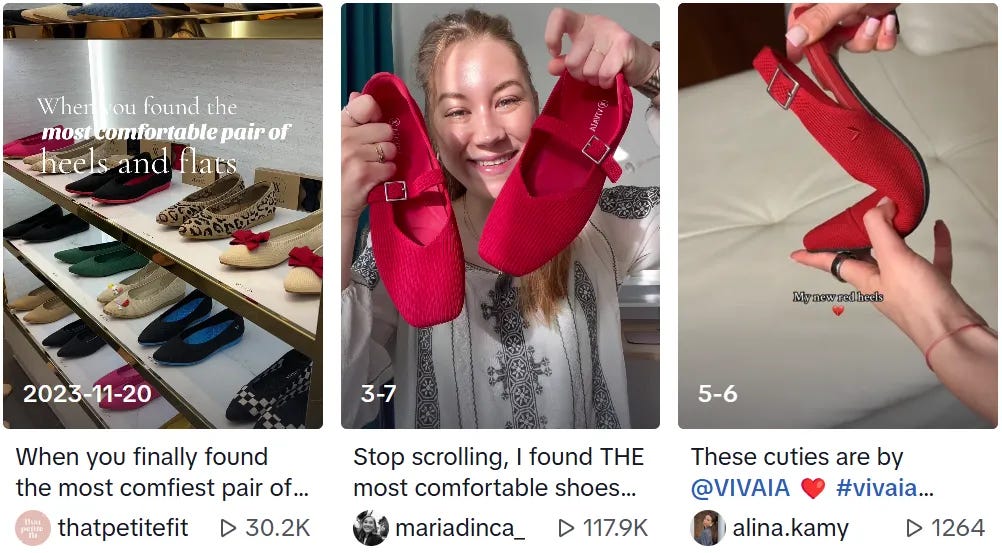

Stellar Inc. understands that in the age of social media, the first step in marketing is to become a favorite product recommended by influencers. Vivaia collaborates extensively with celebrities, stars, and KOLs (Key Opinion Leaders) across various social platforms and follower tiers. Through influencer endorsements and promotions, Vivaia quickly gained recognition among overseas audiences—similar to how Shein initially gained traction.

High-profile celebrities such as "Instagram Queen" Selena Gomez, "White Girl Street Style Icon" Emma Roberts, Scarlett Johansson, and Katie Holmes have all been seen wearing Vivaia at public events.

Additionally, Vivaia encourages customers to share their experiences with photos, dedicating a section on their website to showcase these images.

Stellar Inc.'s advertising strategy is also known as precision. According to Ptengine, Vivaia tailors ads to different audiences on various social platforms. Some ads highlight color variety, leading users to a page showcasing diverse designs. Others emphasize comfort, explaining why and how the shoes are comfortable. These detail pages undergo extensive A/B testing to optimize the shopping experience.

User interactions provide data for personalized content. For instance, if a user ignores an ad about comfort, they might see one about eco-friendliness next time. If a user hesitates to buy after viewing details, they might receive a discount offer later.

Since May 2023, Vivaia has ramped up its "paid traffic" strategy. In February 2024, 25.34% of over 2 million website visits came from paid traffic, second only to 31.4% from direct visits, showing increasing brand recognition.

Initially focused online, Vivaia is now exploring offline retail. In 2023, pop-up stores appeared in five major Japanese department stores, followed by openings in Singapore, New York, and Los Angeles. Although specific numbers weren't disclosed, Vivaia reported high customer engagement, with queues and record-breaking sales at the Japanese pop-ups.

Our take

From a sociological standpoint, "that girl aesthetics" (also named as "white girl aesthetics" on China's social media) represents a form of consumerism—where a collection of material goods constructs an enviable lifestyle (wealth, leisure, fitness, healthy food, etc.). Commercially, it's an undeniable success, embraced not only by white women but also admired and emulated by a broader, younger audience, including Asian girls. This trend offers significant business opportunities, and brands like Vivaia smartly capitalize on it.

Many brands, like Vivaia, position themselves not by promoting or replicating the Chinese market/products but by targeting overseas markets from the outset. They refine their product design, marketing, and operations to align with local cultures. Examples include Bloomchic, which specializes in plus-size women's clothing, Luvme, offering wigs for African American women , and Lilysilk, offering light luxury silk products.

However, Vivaia's business model could face risks:

Fashion trends are transient or cyclical; the popularity of "that girl aesthetics" will eventually wane.

The concept of eco-friendliness and renewable technology is not unique, and materials can be easily replicated, making entry barriers low.

The key barrier, from my perspective, lies in the ability to respond quickly to fashion trends and consumer preferences, involving rapid design iteration and precise marketing operations. This agility is a core strength of Chinese brands. As we mentioned in the article "How Homegrown PROYA Disrupts L'Oreal's Dominance in the Chinese Beauty Industry," consumers have became more knowledgeable about ingredients/effectiveness of beauty products, and they are willing to pay for products that meet their various, specific and evolving demands.

Chinese brands, with their close consumer proximity, wield substantial influence in riding and even shaping the market trends.

*Today's post is not sponsored by Vivaia.