Chinese companies going global: merchandise and manufacturing exports in the new era (Part II)

Manufacturing globalizes production capacities

In the previous issues, we observed that Chinese companies experienced a resurgence in global expansion efforts in 2023 after pandemic-related challenges in 2022. In particular, the manufacturing sector leads in overseas job postings, showing resilience. In today's post, we will take a deep dive into China's manufacturing exports, especially Chinese manufacturing companies' presence in emerging markets such as Southeast Asia and Mexico.

Part II: Manufacturing globalizes production capacities

The expansion of China's manufacturing sector, driven by factors like the US-China trade tensions and industrial shifts, has led to significant developments. Companies exporting advanced technologies are boosting local economies and knowledge transfer abroad. Southeast Asia is emerging as a prominent manufacturing hub for Chinese companies, while Mexico's automotive industry is thriving through intermediate goods processing and re-exports to the US.

Leading companies exports technologies and operational knowhow, rather than just goods

Industry leaders exporting their innovations abroad don't merely sell products; they act as catalysts for profound change. It encompasses the transfer of valuable knowledge, creation of job opportunities for local workforces, and active contribution to the development of local economies in the host countries where they operate.

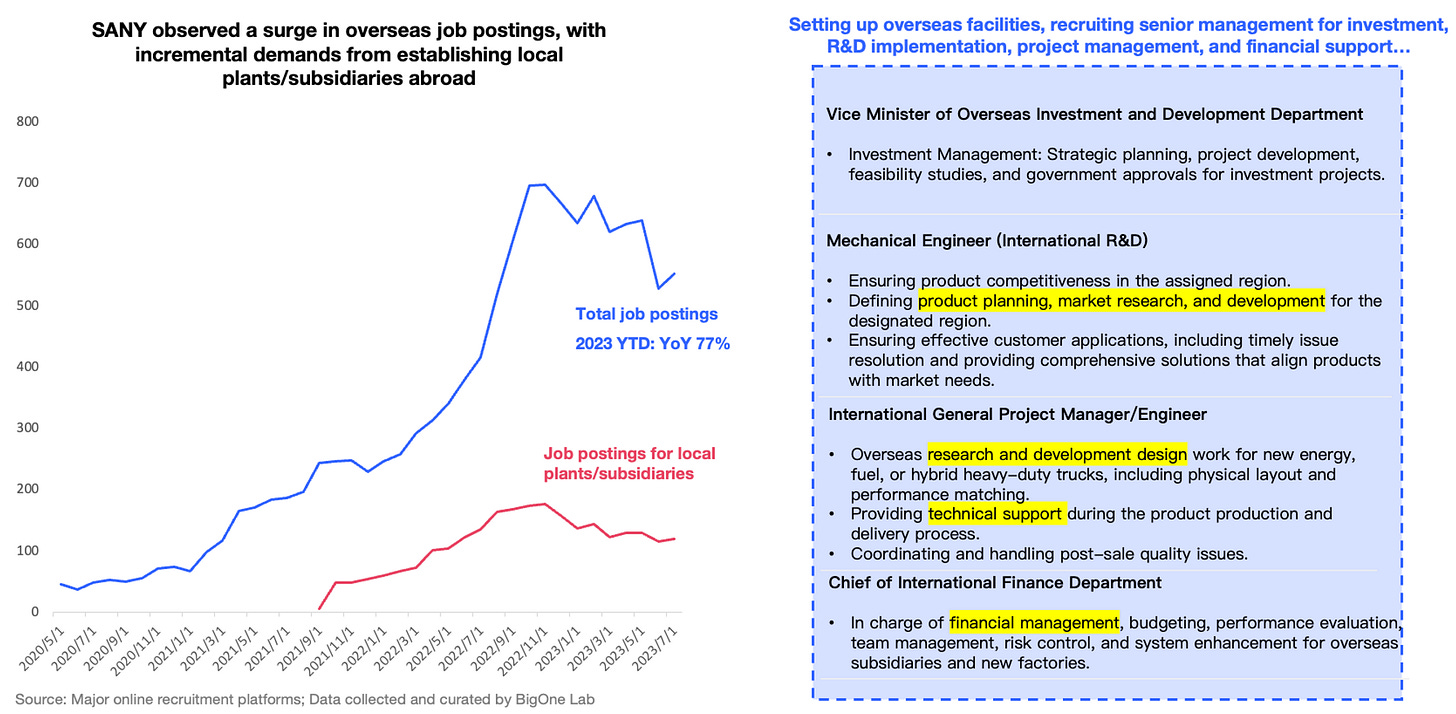

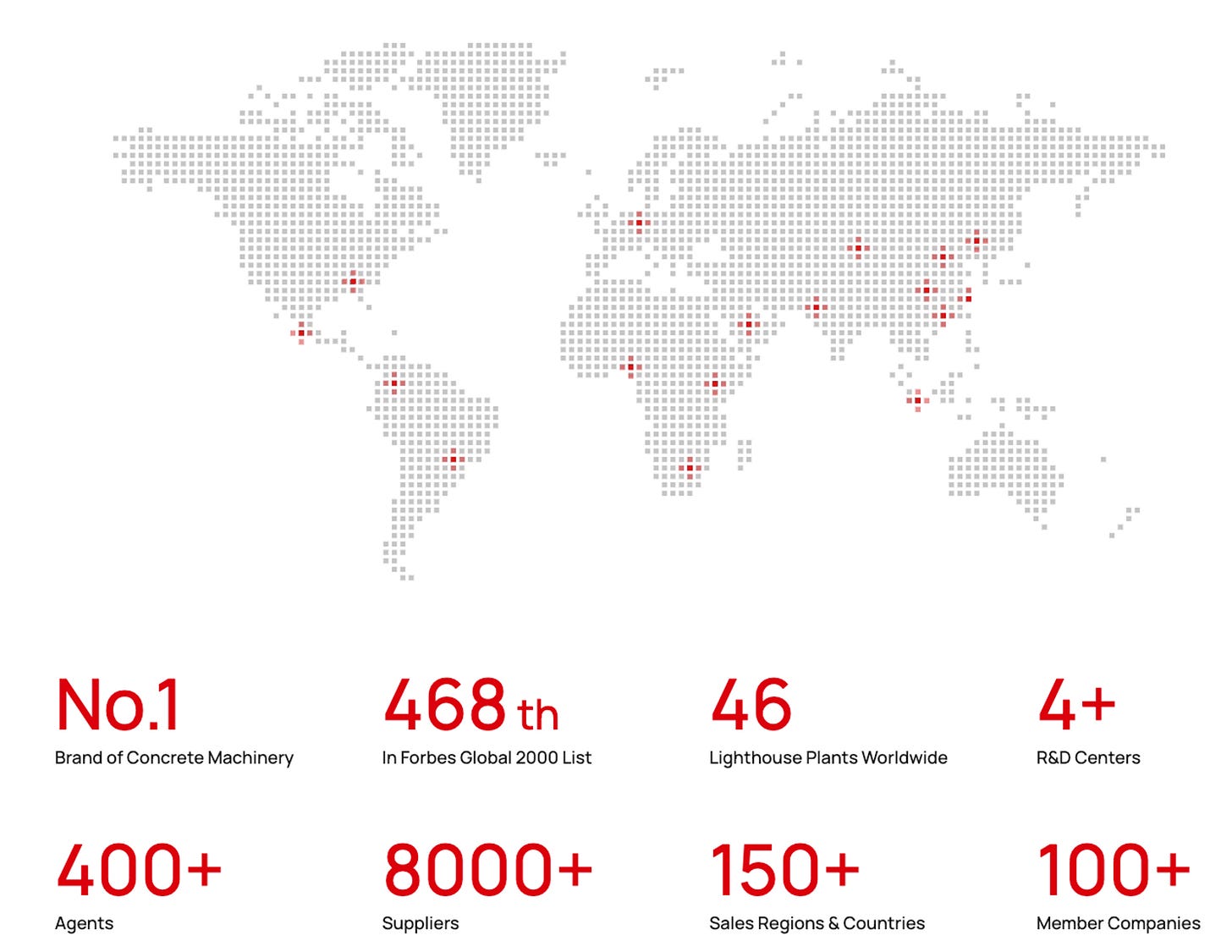

Based on BigOne Lab tracked job posting data, SANY, China’s largest and the world’s third largest engineering machinery manufacturer, has accelerated its expansion to overseas market since 2022, with incremental job demands from establishing local factories and subsidiaries.

According to the 2022 annual report, SANY's international expansion was marked by sending hundreds of R&D personnel to the US, Germany, and India in 2022. The company developed 79 international products, including excavators, loaders, cranes, and concrete pumps, with a coverage of nearly 70% in Europe and America. These efforts led to an 8% excavator market share overseas. SANY achieved a 47.19% YoY increase in overseas revenue, with significant YoY growth of 41.1%, 44.0%, 85.8%, 63.8%, and 35.4% in Asia-Pacific/Oceania, Europe, North America, South America, and Africa.

Emerging economies: key intermediaries in manufacturing expansion and global re-exports

As China Merchants Securities pointed out, emerging economies, such as Mexico and Vietnam, are receiving intermediate goods exported from China, capitalizing on cost advantages and geographical proximity in these emerging economies to process and re-export them.

Regarding the value added domestically to indirect intermediate goods exports, China has seen soaring exports to countries like Vietnam and Mexico, followed closely by the Netherlands, Poland, Malaysia, Thailand, India, among others…This tells us two compelling stories: first, in addition to being major consumers, various ASEAN nations and emerging economies opt to import Chinese intermediate goods for further export. Second, countries such as Vietnam and Mexico, capitalizing on their cost-efficiency and geographic proximity to production hubs and end markets, are rapidly becoming key players in reprocessing Chinese intermediate goods for export to final consumers.

Note: The value added in direct intermediate goods exports refers to the portion of intermediate goods imported by a country, processed into final products locally, and consumed domestically. The value added calculated in indirect intermediate goods exports points to the portion of intermediate goods imported by a country, processed, and then re-exported to a third country.

Continue reading to uncover in-depth case studies on China's foreign expansions in Vietnam and Mexico, two rapidly evolving markets in recent years.

As Vietnam takes control over key production stages, it is partially replacing China in industries such as leather, footwear, and textiles. Our job posting data will provide insights into labor market transitions as Chinese workers pivot towards other industries in Vietnam.

With China's exports to Mexico soaring beyond pre-pandemic levels and Mexico emerging as a pivotal US outsourcing hub, we'll delve into China's auto manufacturing presence in Mexico — a sector poised to spearhead China's international growth in the coming decade.