Insights into the current Chinese real estate market: will China's real estate bubble burst?

Recent analysis from Dr. Shanwen Gao, Chief Economist of SDIC Securities

The real estate sector, pivotal to China's economic growth, faced challenges in 2023. Many people are now considering the outlook for the real estate market in 2024, with growing speculation about whether China's real estate market is showing signs of a bubble that could burst. The collapse of Evergrande, once China's largest real-estate developer, further deepened worries regarding liquidity risk in the real estate market. At the same time, the Chinese government has implemented a series of policies to stabilize the real estate market, and market participants have been closely monitoring the effectiveness of these policies.

Today, we will translate the analysis and viewpoints on China's current real estate market from Dr. Shanwen Gao, who believes that the price correction of existing homes is close to an end. Dr. Gao is the Chief Economist of SDIC Securities and a member of the China Finance 40 Forum, a Chinese think tank specializing in economic and financial policies.

Below is Baiguan's translation of Dr. Gao’s original article:

Several issues regarding the current real estate market

Over the past two years, the real estate market has been crucial in shaping the Chinese economy. This has become a widely acknowledged consensus among the government and the market. However, there are still many uncertainties regarding the future direction of the real estate market in 2024. In response to these uncertainties, relevant government departments have introduced a series of policies regulating the real estate market, and market participants are closely monitoring the effectiveness of these policies. In light of this, I would like to share some observations about the real estate market as a basis for understanding and evaluating the impact of these policies, aiming to shed light on the future direction of the real estate market and the broader macroeconomic landscape beyond 2024.

China's real estate investment has been overadjusted

There is a prevalent belief that China is currently facing a real estate bubble on the verge of bursting. It is commonly believed that every bubble eventually ends, but the timing and circumstances of its demise remain uncertain. We can only confirm that the bubble has burst when it happens, leaving us to speculate beforehand about its existence and when and under what conditions it will burst.

Many people believe that the Chinese real estate bubble should have burst earlier. However, for various reasons, the burst and correction have been postponed until 2021-2022, when they finally began to be thoroughly liquidated and corrected. Although the correction may be delayed, an inflating bubble will eventually burst. From a global perspective, the bubble bursting always brings social pain, and the government should not rescue the bubble, nor can it afford to do so.

Following this train of thought, many believe the current situation will inevitably come at a cost. Throughout history, countries like the United States, Japan, and many others have paid the price of a bursting bubble. Since China has benefited from an inflated real estate bubble, it must also bear the consequences of its collapse.

Based on international experiences of the correction process after a bubble burst, it may take around five years or even longer for the bubble to be fully absorbed before the economy can return to a relatively weaker period of normal expansion. During the correction process, overall demand will be soft, and various aspects of the economy will face difficulties.

From this perspective, if China's real estate bubble were to begin bursting in 2022, it would take at least until 2027 for the economy to normalize. During this period, there will inevitably be problems such as insufficient demand, economic downturn, deflation, increasing bad debts in banks, and financial difficulties for the government, which many countries have experienced before. Following this, there will be no fundamental difference in whether or not measures are taken to stimulate domestic demand. Market clearance will eventually occur, and it will be highly destructive.

This is a widespread view, and many aspects are worth contemplating. However, further careful observation of the data reveals that many factors are worthy of further discussion and scrutiny.

The term "bubble" refers to a situation in which a significant amount of speculative demand floods the market within a specific timeframe, leading to prices reaching unsustainable levels that are disconnected from the underlying fundamentals. This speculative demand is not driven by fundamental investment but rather by the goal of profiting from price increases. Essentially, it involves purchasing assets today to sell them tomorrow to generate a profit. An increase in leverage accompanies this process, as the gains from price increases are magnified through the use of leverage.

When prices deviate significantly from their fundamental value, they will inevitably experience a correction. Price corrections can be substantial but often accompanied by the rupture of leverage and deleveraging, resulting in significant pain.

During rising bubbles, the influx of speculative demand leads to an abnormal supply amplification. However, when speculative demand diminishes, the increased supply creates an oversupply situation. The bursting of a bubble involves the reduction of excessive leverage and the correction of oversupply. Resolving the oversupply requires the supply to return to an abnormally low level, which often takes a long time.

Let's examine the process of the Japanese bubble burst. Before 1986, real estate investment in Japan represented only 8% of GDP. During the bubble, this proportion increased to nearly 11%. As demand expanded, the supply of real estate also grew rapidly. However, when the real estate bubble burst, the oversupply needed to be addressed, leading to a decline in the proportion of real estate investment to below 8%. Japan did not initiate this process until 1998.

Before this, banks maintained their balance sheets without taking action, allowing oversupply to continue. It was only during the financial crisis in Japan in 1998 that serious efforts were made to address the issue of oversupply. It took until 2003 for the supply to stabilize, and since then, the proportion of real estate investment has remained at around 6.5%, which is 1.5 percentage points lower than before the formation of the bubble. It took Japan more than ten years from the bursting of the price bubble to recover, and approximately five years from the outbreak of the financial crisis and the elimination of oversupply.

The situation in the United States is similar to that of Japan. Before 2002, real estate investment in the United States accounted for approximately 8% of GDP. Starting in 2003, real estate investment began to rise rapidly. Following the burst of the bubble, the supply quickly decreased. However, the difference lies in the fact that the United States promptly took measures to address the excess supply after the bubble burst, causing real estate investment to drop to around 5% at one point. In contrast, Japan took at least six years to achieve the same result.

After 2013, clearing the excess in the United States ended, and real estate investment has returned to a relatively normal level, accounting for nearly 7%, one percentage point lower than before the bubble. It took the United States about five years from bursting the bubble in 2008 to the economy returning to normal.

The situation in Spain is also similar. During this process, there is little that the market can do, as it takes time to clear the excess supply and repair the broken leverage before the market can stabilize.

It is worth noting that China does not seem to have experienced a significant accumulation of oversupply. The peak of real estate investment as a percentage of GDP in China occurred in 2013, and since then, the proportion of real estate investment has rapidly declined and is expected to decrease to around 5.5% by 2024.

If one believes that from 2016 to 2021, China experienced a significant real estate bubble, from the perspective of investment, there seems to be no significant expansion of the oversupply trend, or it appears quite mild. In contrast, after 2021, the decline in supply has been highly notable.

In summary, popular opinion suggests that China is experiencing the bursting of a real estate bubble. However, in terms of oversupply, the performance of the Chinese real estate market is significantly different from a typical real estate bubble. The oversupply is not very apparent, and the clearance of oversupply (if it exists) is very thorough, with the process being rapid and the extent very significant.

Price correction in the Chinese second-hand housing market: possible completion by 2023

From the perspective of transaction volume, the formation of the real estate bubble led to a significant increase in speculative demand, flooding the market and causing a surge in transaction volume. However, when the bubble eventually bursts, the decline in prices reduces the willingness of market participants to engage in leverage, resulting in the disappearance of speculative demand and a decline in average demand. Consequently, transaction volume rapidly shrinks. It typically takes considerable time for transaction volume to reach its lowest point, as there is a need to eliminate the excess supply and gradually restore balance in the market.

We focus on observing the second-hand housing market in the United States. This is because, after the bubble burst, real estate companies reduced their investments, decreasing supply in the primary housing market and affecting transactions. However, the second-hand housing market remained unaffected by this trend. Additionally, after the bubble burst, some demand shifted from the primary housing market to the second-hand housing market, increasing the volume of second-hand housing transactions. As a result, the conclusions drawn from observing the second-hand housing market are conservative.

During the bubble formation process in the United States, the volume of second-hand housing transactions rapidly increased, from over 500,000 units per year to over 700,000 units, with an expansion rate of nearly 40%. After the bubble burst, the volume of second-hand housing transactions halved and remained at the bottom for a long time until after 2013, when the transaction volume gradually returned to normal levels and investments also steadily normalized.

During this process, there were significant fluctuations in second-hand housing sales in 2009 and 2010. These fluctuations were caused by landlords who could not afford their mortgage payments, resulting in many foreclosures by banks. The annual data continued to decline and remained very low, consistent with the data at the investment level.

In the process of the Spanish housing bubble burst, the magnitude and duration of the adjustment in the second-hand housing market are similar to those in the United States, as well as in the Netherlands and the United Kingdom. In most cases, the observations on the second-hand housing market are similar, with a significant decline in transaction volume, usually around 50%, and a bottoming out period of about five to six years, followed by a gradual recovery to normal levels. Indeed, there are some exceptions, but this is a typical pattern.

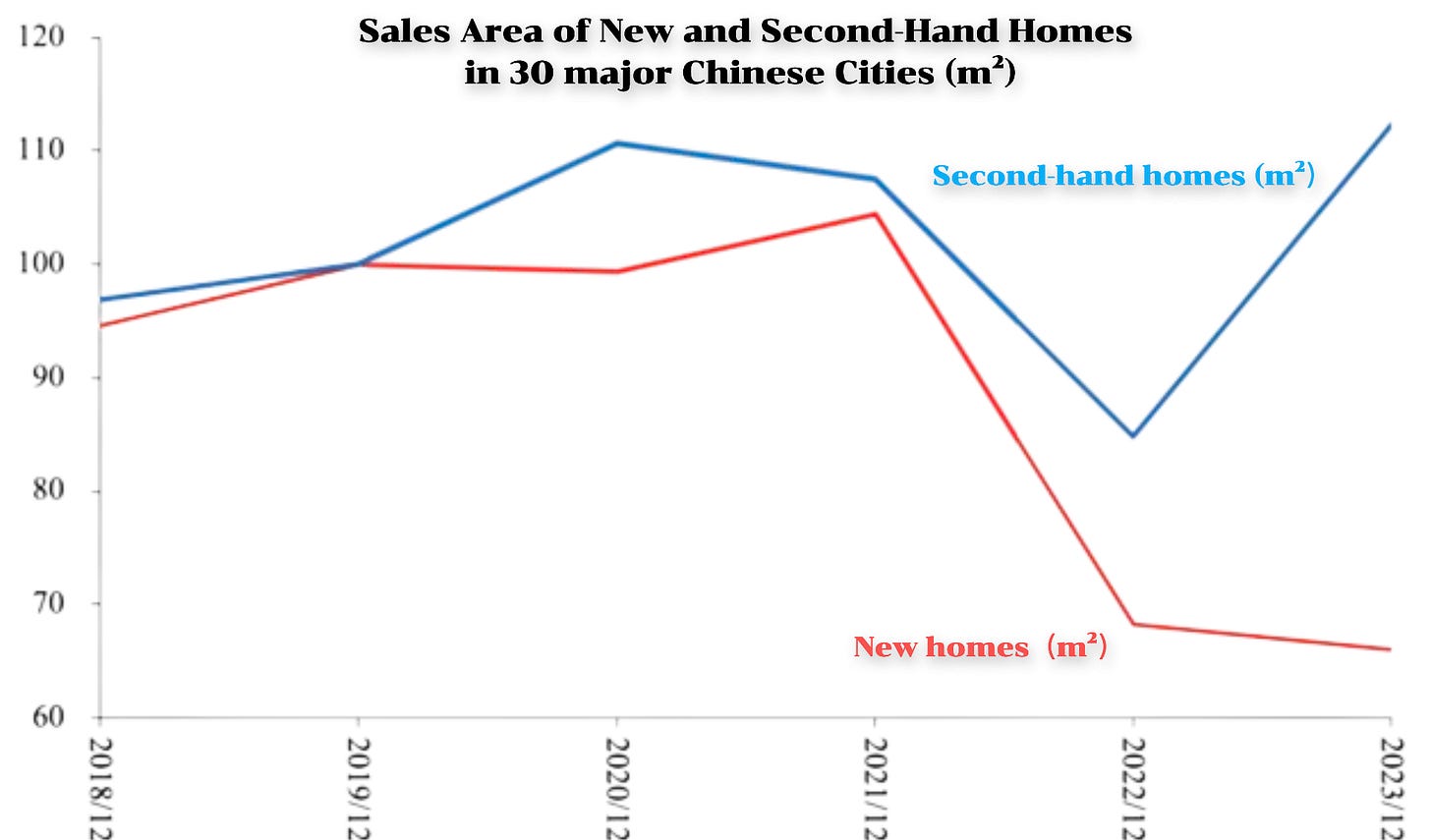

The situation in China is somewhat different. From the data disclosed by the governments of 13 cities that we could easily collect, based on the benchmark of ownership transfer, the transaction volume of first-hand homes has been continuously declining since 2021. It was expected to decrease to around 70% by 2023. The transaction volume of the second-hand housing market only declined for one year in 2022, and it has only declined for two years since its peak in 2020. There was a significant increase in transaction volume in 2023, achieving double-digit growth.

According to CRIC data on 30 major Chinese cities, the transaction volume of second-hand homes in China's second-tier cities reached a historical high in 2023. In comparison, new homes dropped to 70% of their peak, while the transaction volume of second-hand homes in 2022 only decreased to 80% and experienced a significant increase in 2023, reaching a historical high. Similar conclusions can be drawn from data with different data measurements.

Based on the government's public data, the transaction volume of second-hand homes in China experienced a significant increase in 2023, while new homes declined by 8%. This rise in second-hand housing transactions differed from the market adjustments observed during bubble bursts. This situation raised two main questions: firstly, why did second-hand housing transactions substantially increase? Secondly, what accounted for the disparity in performance between the second-hand and first-hand housing markets?

Data from a third-party real estate broker (Beike) showed the second-hand housing and rental prices index in 25 cities (November 2018 as the base, with a value of 100). Data from 25 cities was representative of China's provincial capital cities.

The rental index of 25 cities showed that the rental market has shrunk since the pandemic outbreak, and the rental index dropped to 90% in November 2018. Some believed the residential prices in these 25 cities were the "last straw of the housing bubble" from 2020 to 2021. Despite a 10% decrease in housing rents, residential prices have risen 8%. The rise in prices deviated from the fundamentals.

By the end of 2021, housing prices in these 25 cities have started to decline from their peak and have fallen by nearly 20%. The price index is significantly lower than in November 2018, and the absolute level of housing prices may have fallen to the level of the end of 2017 or the first half of 2018. The valuation of housing prices relative to rents has also undergone a significant correction and is currently slightly better than in the second half of 2018.

Since 2018, the disposable income of Chinese residents has increased by 30%. As a result, after two years of adjustment, the rental yield in second-tier cities has returned to 2018, and the house price-to-income ratio has returned to the level before 2017.

Considering the affordability of loans, the bad news is that residents’ expected income is declining, but the good news is that mortgage rates are much lower than before. Assuming a reasonable duration, the affordability of loans remains relatively unchanged compared to income.

We know that the period from 2016 to 2017 marked the beginning of a significant increase in real estate prices. According to these indicators, residential property valuations in second-tier cities have returned to the level seen in the early to mid-stages of this round of the housing market bubble. This implies that valuations are relatively low and prices are affordable. Consequently, there is a rise in inelastic demand entering the market, leading to an increase in transaction volume.

The above is an explanation from the valuation perspective of why the volume of secondary housing transactions has increased. If we combine the micro-level valuation changes with the macro-level absence of oversupply, our basic conclusion is that the price correction in China's secondary housing market was nearing completion in 2023.

A further extended conclusion is that the residential market in China is currently experiencing a substantial price correction, rather than a bubble burst. This correction can be attributed to the sudden epidemic outbreak, which has led to declining rents and decreased residents' expected income. During the same period, however, housing prices have continued to rise, causing asset prices to deviate from fundamentals and forcing prices to be adjusted downwards to return to equilibrium.

The core issue of the current macroeconomy is to restore the functionality of the primary housing market as soon as possible

There could be three reasons for the further contraction of the primary housing market.

One reason is that local governments impose price controls on the primary housing market, preventing prices from fully correcting. This makes it difficult for the market to clear, leading to unreleased transaction volumes and hindering the market from functioning normally. This means the adjustment process cannot be completed smoothly and thoroughly. On the other hand, secondary housing prices can fall more freely. Once they adjust to a reasonable range, inelastic demand can be released.

Secondly, there is delivery risk in the primary housing market, and there is a possibility of further expansion of delivery pressure.

Thirdly, the supply of first-hand homes is shrinking too quickly, with companies reducing land acquisition and construction, resulting in fewer new housing units being launched.

Comparing this with the adjustment in the second-hand housing market, if the government can eliminate delivery risks, block the liquidity risks of real estate companies, and guide the downward adjustment of prices in the primary housing market, we can expect the stabilization of the primary housing market.

In this sense, I believe that the core issue of the current macroeconomy is to restore the primary housing market's functionality quickly.

It is essential to emphasize and be highly vigilant that if the liquidity risks of real estate companies continue to spread, there are still many variables and uncertainties affecting its future evolution.

Reads more like a typical propaganda piece rather than a thoroughly researched paper.