Is Laopu Gold's Rally Over? 6 Charts on Recent Performance — Charts of the Week

After a 36%+ correction, let's examine the fundamentals: sales growth, recent price hikes, and consumer sentiment on social media.

“Charts of the Week” is Baiguan’s series that features key data points to help you quickly grasp the general state of affairs in China in just a few minutes. We handpick the highlights of the data charts from a variety of sources, analyzing and delivering insights trusted by 100+ top institutional and corporate clients worldwide at BigOne Lab.

In the past, this series primarily covered broad macro trends. Now, we’d like to use the same format to give you quick updates on specific companies or industries we’ve discussed before. Let us know in the comments if you find this useful — your feedback will help us decide whether to continue this format.

Back in June this year, I wrote about Laopu Gold (HKG: 6181), a rapidly rising brand in China’s luxury market with the potential to become a homegrown luxury giant. In that article, I explained how Laopu’s unique position in traditional Chinese craftsmanship and its connection to cultural heritage have helped it resonate with younger Chinese consumers.

The stock has corrected by more than 36% since its peak in July. After an meteoric rise of over 800% since its IPO in June 2024, it’s a good time to review whether the company’s actual sales and broader consumer sentiment in China justify its current valuation or if we’re entering speculative territory. In today’s newsletter, I’ve selected 6 charts that are key to understanding this question:

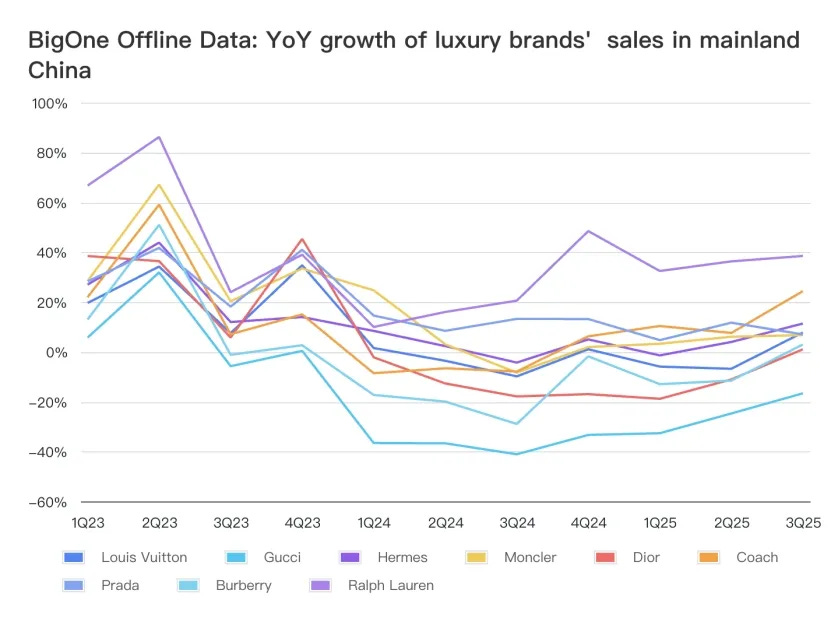

The tailwind: the broader luxury industry is seeing signs of bottoming out in Q3 China

Most luxury brands showed an improving or accelerating year-over-year growth in Q3 2025, possibly boosted by the improved sentiment among middle-class and wealthier households as China’s equity market delivers upbeat returns YTD.

But not every jewelry brand enjoyed the same growth

Laopu continued to take market share from international fashion houses, largely boosted by the gold rally since 2024.

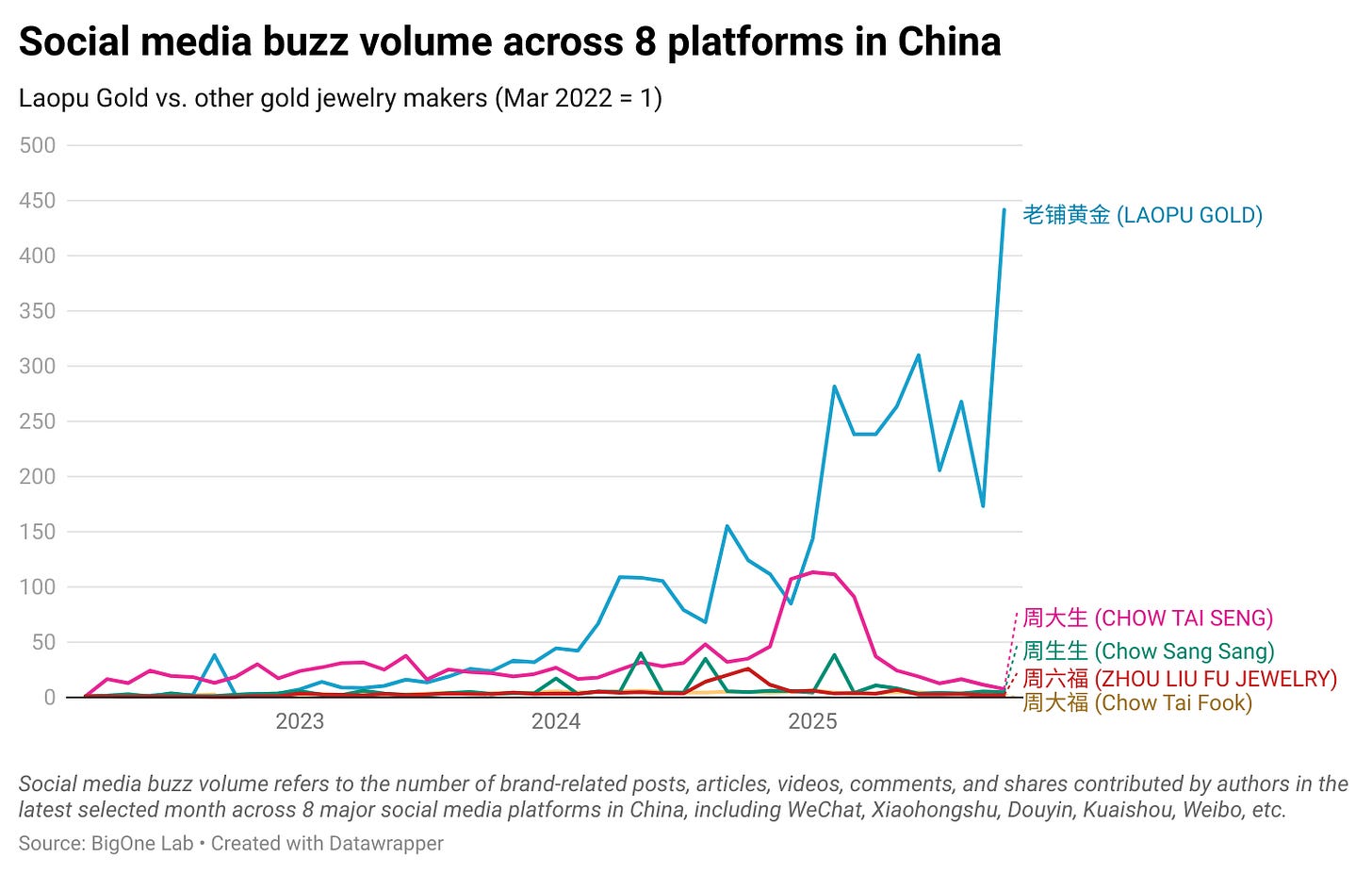

But the gold price isn’t the sole determining factor

Although the gold price rally should benefit overall gold jewelry makers, not every leading brand in China experienced the same explosive growth in online discussions compared to Laopu Gold.

For instance, when analyzing the top keywords mentioned in social media posts about Laopu:

Fewer posts specifically mentioned keywords related to the investment features of gold jewelry (such as gold price, gold bars), whereas it’s more common to see these discussions with other leading jewelry makers.

There were also more mentions of specific consumption scenarios, such as “young people“ and “bloodline awakening“ (a social media trend where young Chinese consumers increasingly appreciate the beauty of gold jewelry as they grow older, something they didn’t care for in their childhood).

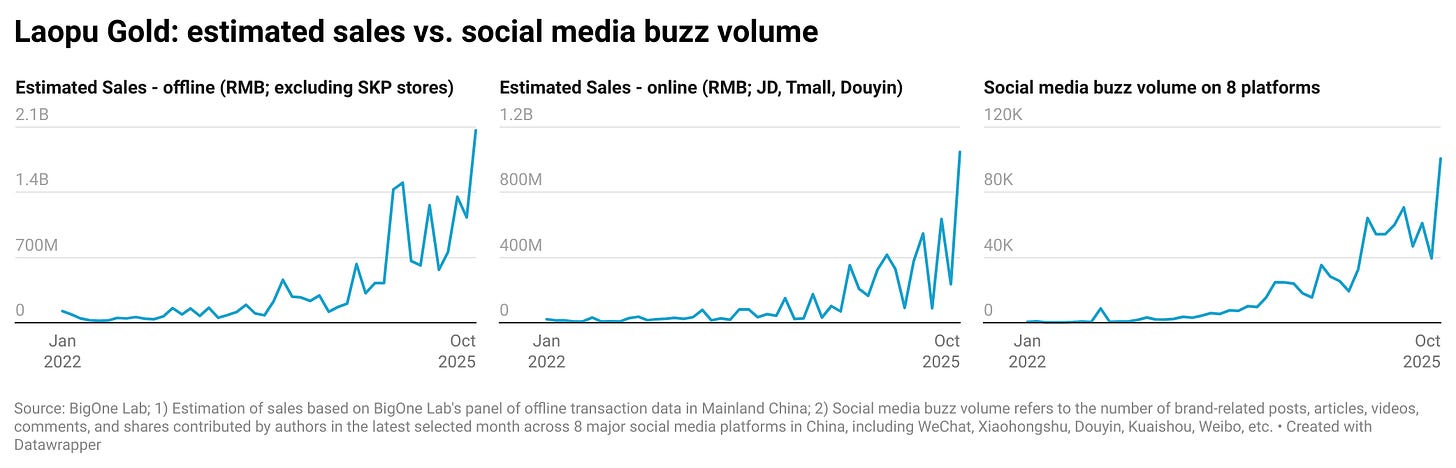

Social media discussion indeed matters for sales:

For Zhou Liu Fu Jewelry, the marketing campaign where they collaborated with Jiuhua Mountain (one of China’s four famous Buddhist mountains) in March this year gained good attention from young consumers, as seeking fortune and good wishes from temple visits has become increasingly popular among young Chinese in recent years. (We covered this trend in our 2023 newsletter: “The Zen effect in China: Three Buddhism-inspired consumer trends.“)

Chow Tai Seng also saw increased awareness on Red Note this year after launching products featuring Cloud Brocade, another Chinese traditional craftsmanship that is deemed as the intangible cultural assetintangible and resonates greatly with consumers.

Laopu’s sales are virtually a mirror of its social media awareness: as the company’s stock price increased 8x, so did its sales and social media buzz rise.

These nuances show that while the gold price rally certainly boosted overall sentiment for gold jewelry, this tailwind isn’t an automatic guarantee of sales. Consumers are becoming more discerning about product craftsmanship and design.

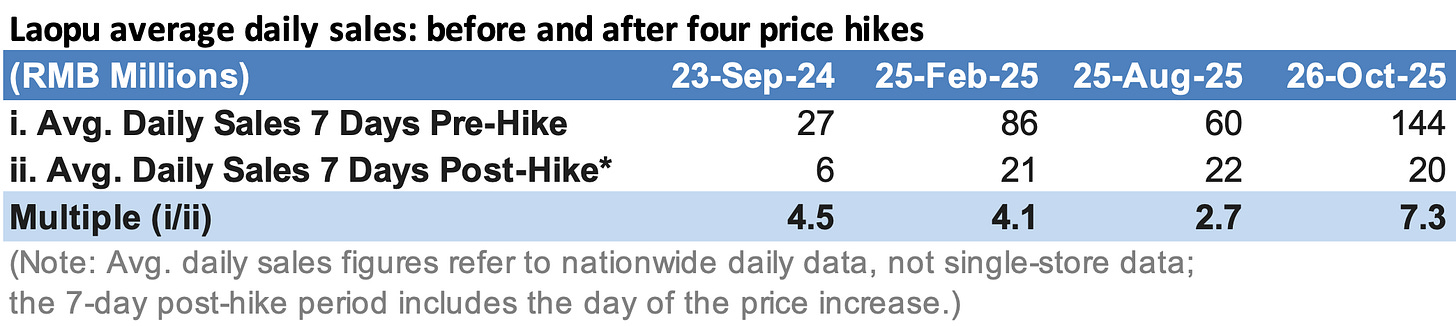

Laopu’s recent sales

According to our offline payment data, BigOne Lab estimates that Laopu Gold’s sales in mainland China in October grew 551% YoY (excluding SKP stores and after regional adjustments), accelerating from 79% in September and aligning with the YoY growth rate in August.

The acceleration in September was mainly due to the price increase in October and the opening of new stores in Shanghai.

The price hike

Notably, or perhaps benefiting from the continued rise in gold prices, the daily sales surged before the price hike in late October. However, after the price increase was completed on October 26, the daily sales data dropped significantly, with the decline speed surpassing that of previous price hikes.

myself as individual investor, I do find the analysis of a specific company quite interesting, along with the various data you describe. Thank you for trying this.

(Sorry for the repeated posts - those were just typos.)

Since I subscribe to Baiguan to educate