Pinduoduo sets sights on expansion; BABA's cloud business; Meituan faces new threat - Charts of the Week

Understand the latest investment opportunities in Chinese equities in 14 charts

Week of Jun 27, 2023

This edition of "Charts of the Week" offers an overview of important events involving major players in various industries, using BigOne Lab's proprietary data. We have selected the top companies you should pay attention to from the 4,000+ publicly listed companies we track.

Disclaimer: The purpose of this article is to provide an overview of the industry leaders in China and is not intended to constitute individual investment advice. This is not a recommendation to buy or sell stocks.

Tickers / companies covered in this issue:

China E-commerce: BABA, JD, Kuaishou, Douyin, Pinduoduo

China Internet: BABA, Boss Zhipin, Meituan

China Consumer: Estee Lauder, L’oreal, P&G, Proya, LVMH, Gree, Midea, Robam, Hair, Xiaomi, ECOVACS, Breo Technology

China EVs: BYD, Li, Tesla, Xpeng, Nio

*This post is exclusive to our professional-tier readers. To get a sense of what is offered, you are welcome to check out this older post in the same series:

China E-commerce

Domestic consumption is recovering, but consumers remain cautious

China's economy has been recovering at a slower-than-expected pace since the beginning of 2023. The K-shaped recovery, with the wealthy becoming richer and other consumers cutting back discretionary spending, has been the primary theme of China's domestic consumption.

In May 2023 (including pre-sale for the 618 shopping festival), the Gross Merchandise Value (GMV) of China's major e-commerce platforms, including Kuaishou, Douyin, Tmall, and JD, increased by 13% compared to the previous month. The comparable month-on-month change in 2022 and 2021 was 29% and 16%, respectively. (Note that the 2022 MoM growth is affected by the low base caused by Covid lockdowns in March and April 2022)

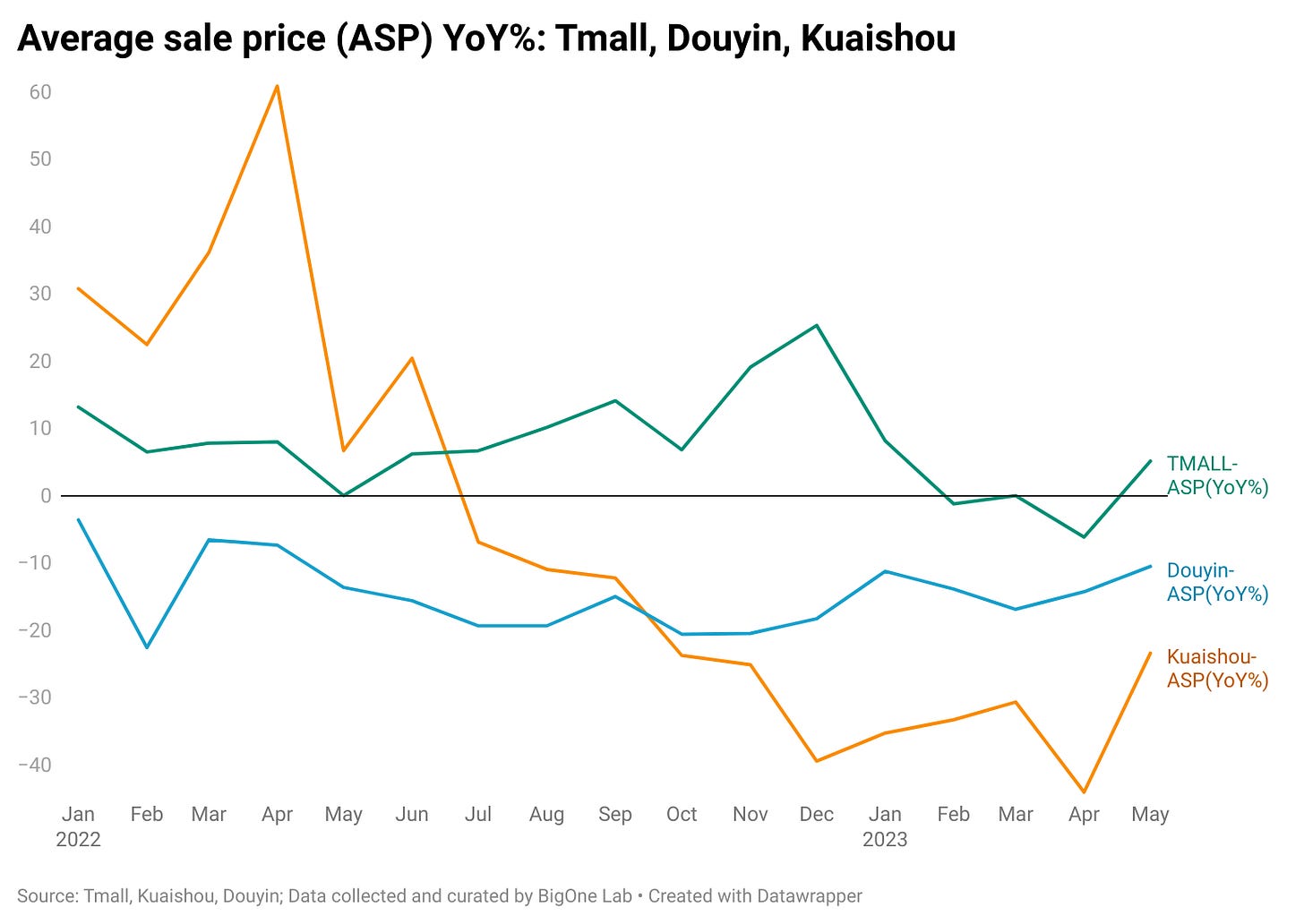

Kuaishou and Douyin are slashing prices

In the slow recovery environment, Tmall and JD are facing increasing pressure from Pinduoduo, as well as live-streaming e-commerce platforms Douyin and Kuaishou. (On these platforms, consumers can often find cheaper alternatives or better prices.)

In May, the average sale prices (ASP) on Tmall, Douyin, and Kuaishou were 82, 51, and 35 CNY, respectively. The ASP on Kuaishou and Douyin has been decreasing at a faster pace since the beginning of 2022.

*Note that the average selling price (ASP) may vary between different categories, and the chart only shows an overall comparison.