After we published the last Baiguan Radio episode on RMB appreciation, we were approached by Mr. João Philippe de Orléans e Bragança, a long-time reader and listener of Baiguan, who would love to share his take on this topic as well.

João is a macro investor and a portfolio manager at Absolute Investments, Brazil’s largest hedge fund with $11bln in AUM. João lives in São Paulo, but has lived for many years in Asia, mostly in Singapore, but also in Shanghai, which is his favourite city.

We are thrilled for Baiguan Radio to become a forum for all of you to exchange and debate your insights. So please find us whenever you have something to say.

Table of contents

00:00 – 07:14 | Why RMB is appreciating

07:14 – 13:49 | Why now?

14:11 – 18:20 | How far can RMB go?

18:20 – 22:05 | Do small currency moves matter?

22:06 – 28:59 | Will RMB appreciation boost domestic consumption?

29:00 – 33:26 | What are the implications for investing?

Written Summary

1. Why is the RMB appreciating?

Joao’s starting point is not capital flows or short-term speculation, but valuation in real terms.

His core claim is simple: China is cheap.

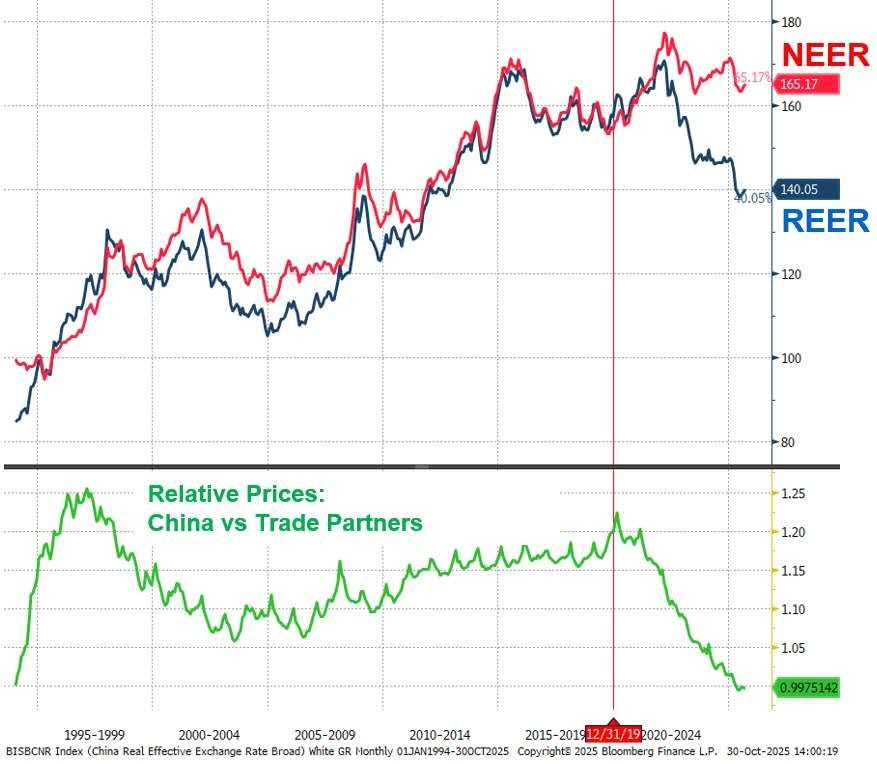

Over the past several years, China has experienced close to zero inflation, while most major trading partners have gone through sustained inflation of 2–5%. This inflation differential has accumulated. As a result, China’s relative price level today is meaningfully lower than it was five years ago.

“China is very cheap.”

This cheapness is not about wages or nominal exchange rates alone. It reflects a real price adjustment that has not yet been fully reflected in the currency.

A second supporting factor is real interest rates. While nominal rates in China are not high, near-zero inflation means real rates are positive. This contrasts with Japan, where inflation exceeds nominal yields, resulting in negative real rates.

He also addresses the apparent contradiction between a large trade surplus and a weak currency. A strong export balance does not automatically translate into RMB demand because exporters often keep proceeds offshore, earn higher USD yields, or fund overseas expansion. As a result, trade surpluses alone are insufficient to drive appreciation.

The key shift comes from the PBOC fixing. Since around May, the fixing has consistently hinted at tolerance for RMB strength. While subtle, this signal matters because it changes expectations.

Once exporters believe depreciation is no longer a one-way bet, they reassess their choices.

“I can make 4–5% in dollars. But if my currency appreciates 3%, it’s basically the same.”

At that point, holding USD offshore is no longer an obvious dominant strategy. Behavior starts to shift incrementally.

2. Why now?

Joao also lays out several reasons why Beijing may accept, or even welcome, modest appreciation at this moment:

RMB internationalization has regained importance after geopolitical shocks and a long, strong-dollar cycle.

Industrial upgrading: a weak currency functions as a hidden subsidy. Allowing appreciation forces firms to confront margins, move up the value chain, and invest in branding rather than relying on FX.

External signaling and diplomacy: even a small appreciation is noticed by trade partners and can help alleviate the external pressure around trade imbalances.

US-China detente: Joao interprets the post-Seoul environment as offering a window to experiment without destabilizing expectations.

3. How far can RMB go?

Joao is explicit that this is not a call for aggressive or sudden appreciation.

He introduces a useful re-anchoring framework:

“7 pre-COVID is roughly equivalent to 6 today.”

This reflects the accumulated inflation differential between China and its trading partners. In real terms, today’s RMB is much weaker than the headline number suggests.

However, Joao does not argue that RMB should or will quickly move to 6.0. Instead, he frames something like 6.5 over roughly a year or two as plausible under stable or weaker USD conditions, emphasizing gradualism and control.

The precise endpoint matters less, in his view, than the shift away from a one-way depreciation narrative.

4. Do small currency moves matter?

A central theme of the conversation is that incremental moves can have outsized effects.

At the corporate level, many Chinese exporters operate on thin margins. Even modest currency changes can materially affect profitability, forcing firms to rethink pricing, cost structures, and long-term strategy.

At the psychological and narrative level, Joao argues that headline numbers matter disproportionately.

“The headline number — 6, 7, or 8 — changes the dynamics.”

These numbers shape confidence, expectations, and international perception well beyond their mechanical impact. A move from 7.2 to 6.8 may look small on paper, but it can significantly alter how businesses, investors, and policymakers think about risk and direction, and can also affect people’s perception of the size of China’s GDP compared with the US.

5. Will RMB appreciation boost domestic consumption?

There is an argument that RMB appreciation could meaningfully boost domestic consumption. Joao is skeptical that RMB appreciation addresses China’s consumption constraints.

His diagnosis is that China’s consumption problem is not primarily about goods prices or FX. The binding constraints are:

high precautionary savings,

weak service consumption,

labor market insecurity.

“Consumption is not something FX can really fix.”

He also notes that current policy priorities place greater emphasis on technology and autonomy, with consumption playing a secondary role.

6. What are the implications for investing?

The final part of the conversation turns to markets.

For equities, the key implication is the removal of a major tail risk scenario — namely, a disorderly move toward USD/CNY 8. Even without large appreciation, eliminating that downside changes risk perception and compresses risk premia.

For bonds, low nominal yields look different when combined with near-zero inflation and potential FX gains, improving their attractiveness to global investors.

For spillovers, Joao suggests that a stable or modestly stronger RMB could be supportive for other currencies, particularly in Asia, though the effects will not be uniform.