Will China's surprising consumption growth in May last?

Long-term drivers from corporate profits and consumer excitement

2 weeks ago, China announced the widely anticipated May consumption data, and the results looked surprisingly great. CNBC:

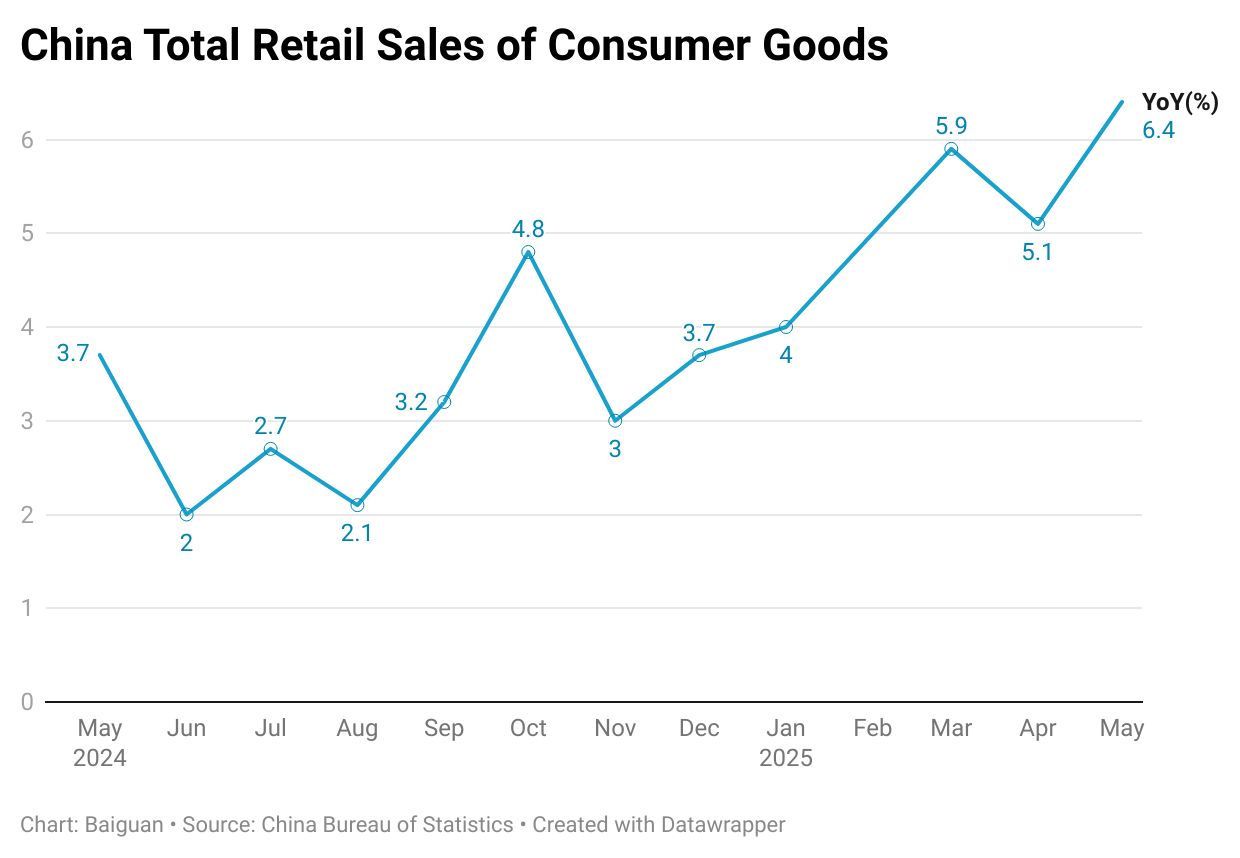

Retail sales last month jumped 6.4% from a year earlier, data from National Bureau of Statistics showed Monday, sharply beating analysts' estimates for a 5% growth in a Reuters poll and accelerating from the 5.1% growth in the previous month.

This growth rate has reached a new high since late 2023, after hitting bottom in the summer of 2024, despite US-China trade uncertainties since early April.

Linghui Fu, NBS spokesperson, attributed the improving consumption in May to the ongoing consumer goods trade-in program, a surge in online shopping ahead of the “618” e-commerce event and a rise in foreign tourists as the country expanded its visa-free entry list to include more countries.

But, as we pointed out a few days ago, the macroeconomic situation hasn’t significantly improved yet. Deflationary pressure persists, real estate prices haven’t stabilized, while job hiring demand and employment situation haven’t really seen any major improvement. Moreover, as we have recently warned, June consumption data may not turn out to be as spectacular as May's.

Is this growth in consumption sustainable while macroeconomics is still weak? What are the long-term trends that will help it grow if we look beyond the monthly ups and downs?

Related to this question are several important domestic events in China that shouldn’t evade your attention. I believe these events, ranging from Chinese automakers’ recent pledge to shorten payables to suppliers, to a fascinating regional football tournament, to POP Mart’s phenomenal rise, are intertwined, pointing towards the path of development of not only China’s consumer market but its economy as a whole.

[The rest of the article will be reserved for paying subscribers of Baiguan. Paying subscribers also enjoy access to Baiguan’s hyper-active Discord community as well as complimentary access to China Translated]

Where is the income to consume?

As early as last December, we called out that China is serious about boosting domestic consumption, a week before the Central Economic Work Conference, which later put domestic consumption at the top of the Chinese government’s agenda.

Since then, there have been many doubts about whether the Chinese government is doing enough to shepherd its economy from over-dependence on production to a re-focus on consumption. Despite the formal launch of Trade War 2.0, China has not initiated a large-scale consumption-boosting program beyond the existing trade-in subsidies program, nor has it attempted to overhaul its tax regime, which still greatly favors production.

Changing the growth model of an economy as large as that of China is never meant to be done within a day, and it’s not going to be solved by a bazooka firing of consumer subsidies, which might create a short-term high, but would only create long-term negative effects without realizing the necessary structural reforms.

But subtle changes are taking place.

Let’s look at the basics here. If you need higher spending, you need higher income and, more importantly, higher income expectations. People won’t spend unless they feel they have the courage to spend more. This is especially relevant for a culture that is more inclined towards saving rather than spending, such as China's (more on this in the next section).

China is in a challenging position regarding income expectations. The real estate market has not shown a clear and definitive sign of price stabilization yet, while the domestic stock market, which only accounts for a minority of household wealth, is at best flat for the year.

However, the wealth effect is not the only factor that can influence income expectations. Ultimately, the bulk of household income is derived from employment, which in turn stems from business profits.

Business profits in China have slightly recovered to positive growth this year, after a disastrous 2024. For all the companies listed on China’s A-share market, the aggregate profit for the first quarter of 2025 grew by 3.47% on the back of a slight revenue decline of -0.38%. This compares with an aggregate profit decline of -2.96% in 2024 and a slight revenue decline of -0.22%.

A return to positive profit growth on the back of flat revenue growth translates to an improving aggregate net profit margin, from 7.24% in 2024 to 8.85%.

Active cost-cutting by businesses is the main reason behind the improvement in profit margins despite no growth in revenue. However, another factor that we can’t ignore is that Chinese society as a whole, including government authorities, has come to realize that this “involution” is detrimental to our interests.

For quite some time, Beijing has been quite vocal about creating the so-called “unified market” and reducing the inter-regional over-competition. Starting this year, Beijing has also been quite visible in tempering the natural urge of Chinese businesses to overcompete. For example, when JD renewed the “food delivery war”, the government wasted no time in holding talks with all of the major delivery platforms to warn against “disorderly involution”. When competition in the EV sector became unsustainable and started to threaten the survivability of auto suppliers, all major EV makers, in an unprecedented move, publicly pledged to shorten payable days to 60 days after being summoned by the government ministry. And right at the time of writing this essay, China’s legislature is writing “anti-innovation” into law.

Beyond these active efforts to protect business margins, we also start to witness the emergence of many “premium” businesses with strong profit margins. The rise of POP Mart and Laopu Gold, two companies we at Baiguan have written multiple times about (most recently here and here), are two strong cases in point.

Over the last several decades, Chinese companies have gradually progressed through different stages. According to Mr. Liu Chuanzhi, founder of Lenovo, it is called “贸工技 trade-manufacturing-technology”. Initially, they were just traders of foreign goods. Then they became manufacturers for foreign brands. Afterwards, they became the master of many key technologies. At each stage, profit margin improves significantly from the previous stage.

Now, we may have reached the final stage: brands, culture, and stories, where most of the value is generated.

POP Mart and Laopu Gold are just the beginning of this decade-long trend. The emergence of more such brands with global branding power will serve as a strong, structural boost to China’s business profits, which in turn will help create a virtuous cycle of higher income expectations and ever more profits.

Consumer excitement

But I don’t think boosting income is the only pathway to boosting consumption. It is a necessary but not a sufficient condition. Someone might earn a lot of money, but if they just put their money into deposit accounts, it doesn’t do much to help consumption at all. As more income does not necessarily lead to increased spending, it will, in turn, restrict income growth and send the economy back into a deflationary spiral.

In this sense, Chinese people’s long-standing tendency to save rather than consume is also a key factor for our over-investment and overcapacity issues.

Given the same level of income, are Chinese people going to spend more?

To spend more, you need new excitement. You need new things that Chinese people are excited about, so they want to spend more on. And this is beyond the smartphones, the automobiles, and the home appliances that Chinese people already have in abundance.

I believe we are also seeing the emergence of these new forms of excitement. At Baiguan, we have featured the “Goods” culture, sports, and pets, and we continue to observe new and interesting phenomena.

In my personal newsletter China Translated, I recently wrote about this brand-new thing called Jiangsu City League that’s generating a lot of buzz for this summer. It’s an amateur, regionally organized football match among 13 prefecture-level cities in Jiangsu Province in the eastern part of China.

The game has also ignited intense but friendly rivalries and meme battles that tap into local pride, history, and culture, with cities using matches to showcase unique traditions, cuisine, and tourism, boosting local economies.

This game draws large crowds. Each match attracts tens of thousands of spectators, and the tickets are usually sold out.

For each match, that’s tens of thousands of people who otherwise would not have travelled to the stadium, stayed at the local hotels, drunk beer, and utterly enjoyed themselves had this game not existed. That’s what I mean by new excitement.

I am confident that this is only the beginning, too. After all, Jiangsu City League is but a scaled-up version of the “Village Super League” in the mountainous province of Guizhou, which we featured as early as 2023, and it’s very likely that, after the success of Jiangsu City League, the same game will spread to more regions as well. And it will not just stop at football. There will be numerous unknown new excitements waiting to be revealed.

We should have faith that Chinese people will find ever more ways to enjoy themselves.