China slowdown in August: which themes, sectors, and companies are showing structural growth? - Charts of the Week

Key sectors, consumer trends, themes, and companies worth watching

"Charts of the Week" is Baiguan's series that features key data points to help you quickly grasp the general state of affairs in China in just a few minutes. We handpick the highlights of the data charts from a variety of sources, analyzing and delivering insights trusted by 100+ top institutional and corporate clients worldwide at BigOne Lab. Don't forget to subscribe before you continue reading!

China’s August 2025 macroeconomic data show continued weakness—especially in real estate, investment, consumption, and private‐sector credit—despite some marginal improvements. In this week's issue, we have selected key charts to explain current consumer sentiment in China, as well as highlight selective sectors, themes, and companies that still show structural growth momentum amid the overall slowdown.

Overall demand slowdown

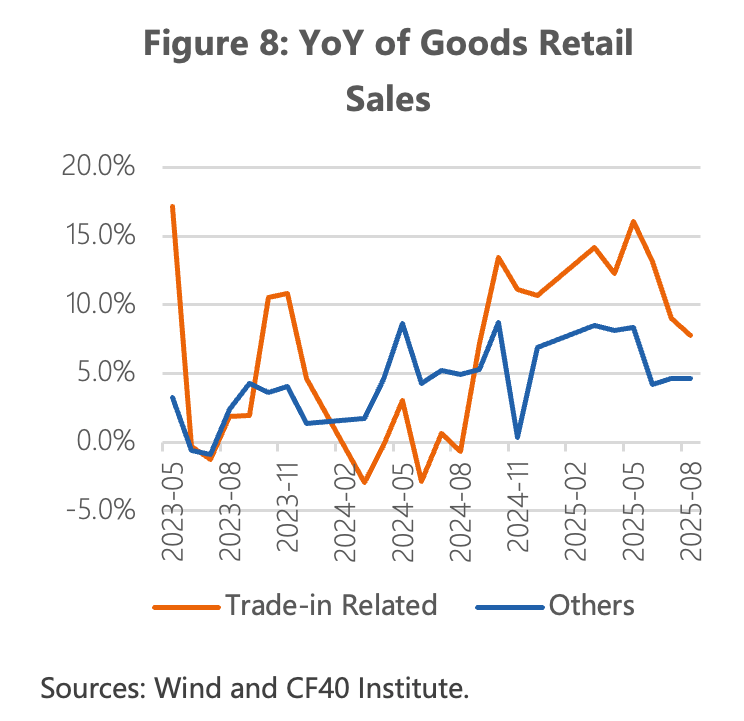

In August, consumption growth continued to weaken, with total retail sales of consumer goods rising 3.4% year-on-year — down 0.3% from July. Sales of goods under trade-in programs — a major driver of growth since Q4 2024 and throughout H1 2025 — showed noticeable signs of slowing, increasing 7.8% year-on-year, down 8.3% from the May peak.

As we explained previously, most goods eligible for the trade-in and national subsidy programs are large-ticket, non-recurring purchases such as home appliances, EVs, and digital electronics. The slowdown was therefore expected — but the key question now is whether overall consumption can achieve sustainable growth as the trade-in sales momentum fades.

CF40 Research, China’s leading economic think tank, believes that the latest macro data strengthen the case for further stimulus in Q4. You can read their latest commentary in detail here.

We’re excited to announce that CF40 Research has officially launched its Substack, managed in partnership with Baiguan! CF40 is China's leading economic think tank, founded and participated by former and current top-level economic policy makers, advisors, and researchers. Besides delivering in-depth analysis of the economy, policy, and markets, CF40 also organizes several closed-door events throughout the year, including the highly consequential Bund Summit. As a special perk, all Baiguan paid subscribers can enjoy 20% off an annual CF40 Research subscription. Paid subscribers can find the coupon link in the email header. Redeem it by Oct. 31!

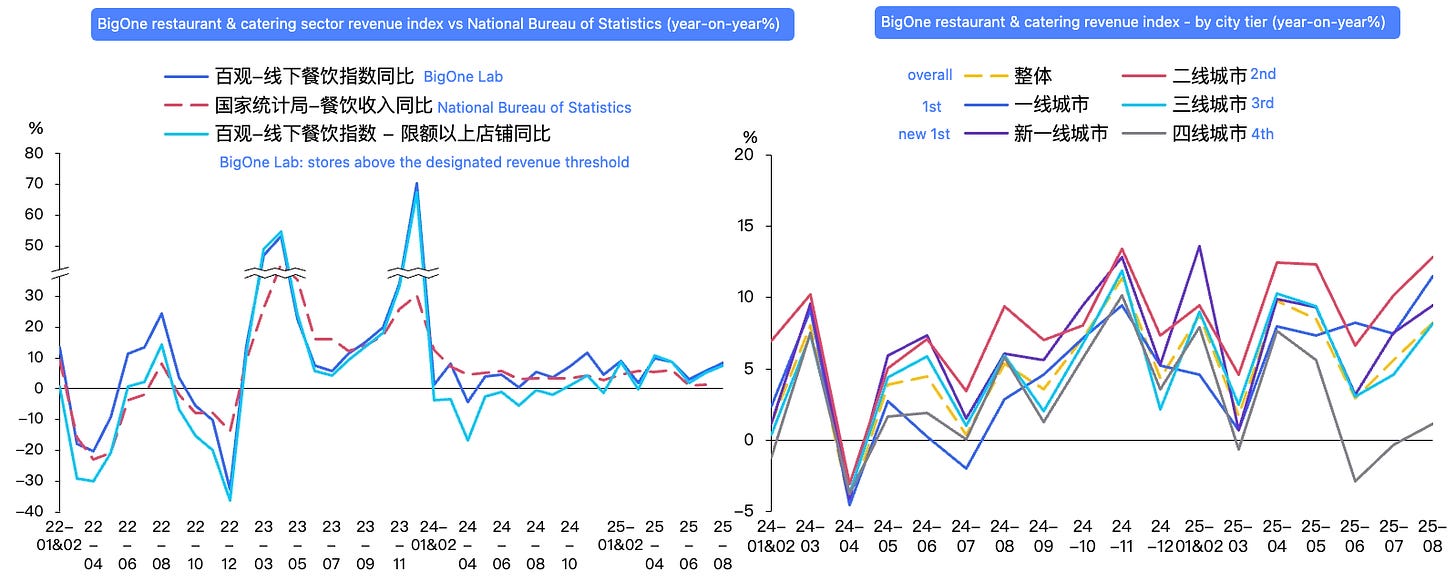

Headwind 1: The anti-extravagance mandates

In July's newsletter, I explained how China has recently stepped up its anti-extravagance and anti-alcohol policies, particularly targeting overspending on banquets and hospitality activities by the public sector and SOEs. These mandates are having real economic effects: sharp drops in demand for luxury baijiu (China's national spirit), slower catering revenue growth (just 0.9% year-on-year in June — the weakest since 2023), and much steeper declines in lower-tier cities where restaurants rely more heavily on banquets and business spending.

Since then, restaurant and catering revenue has shown notable recovery in August:

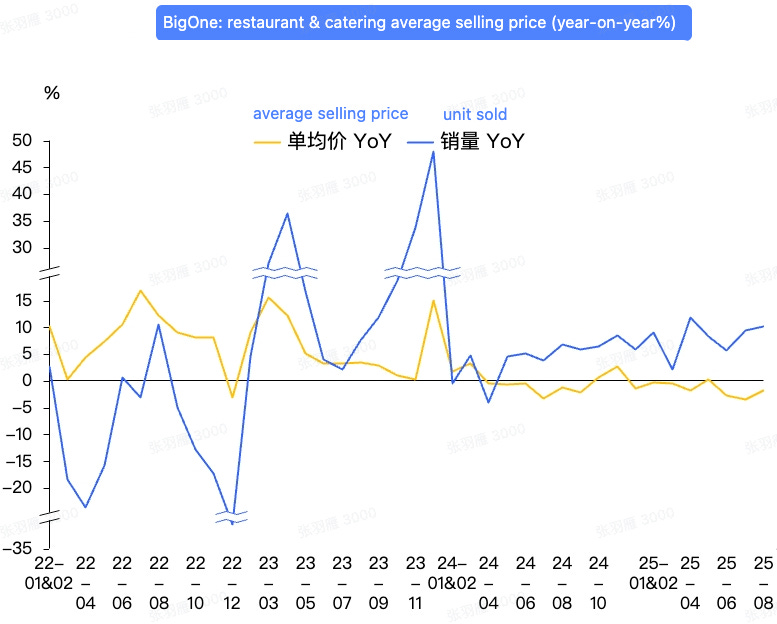

However, the overall average selling price continued to decline year-on-year in August, reflecting intensifying price wars and deflationary pressure:

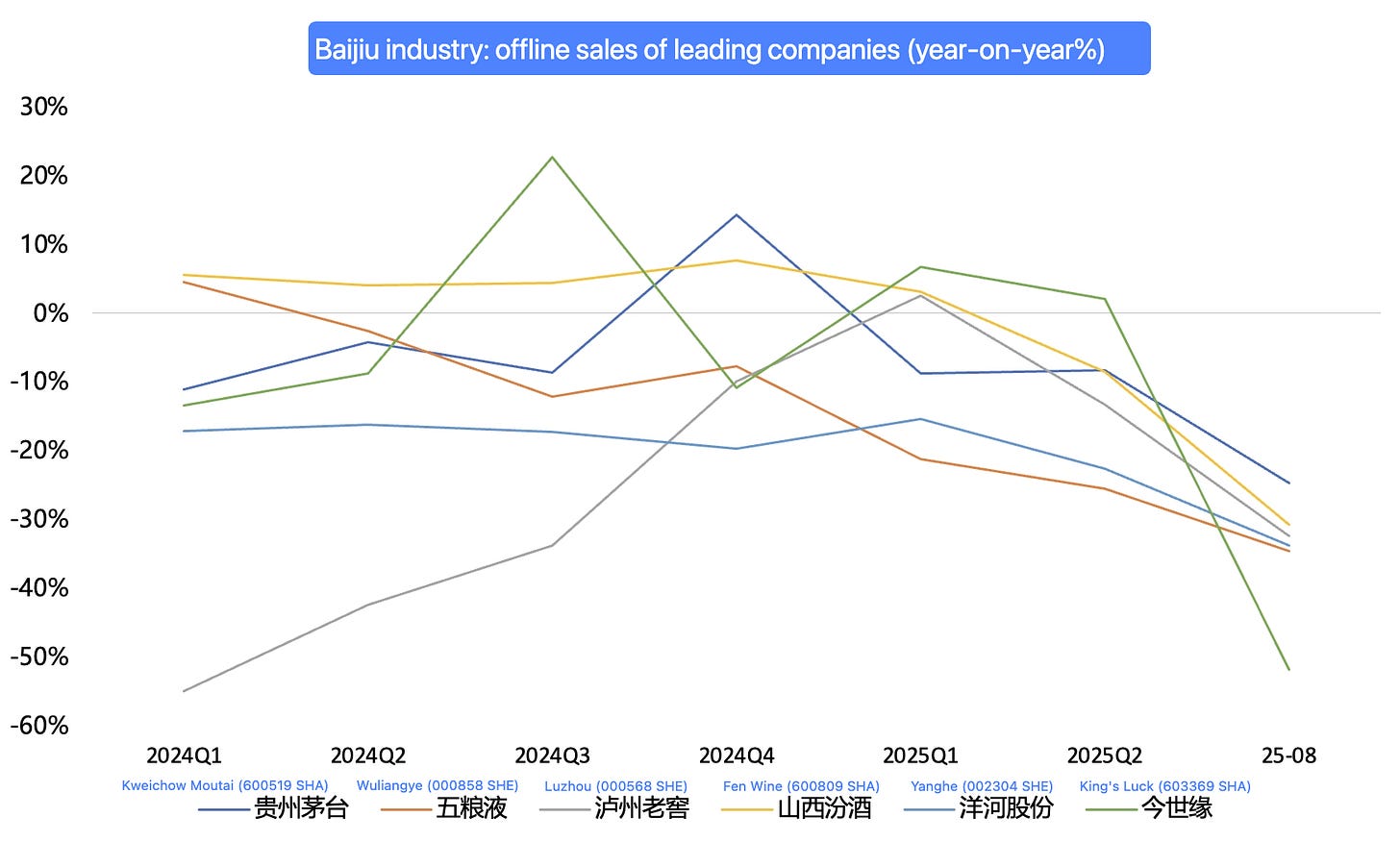

For baijiu in particular, sales have yet to show signs of bottoming out, based on observations from our panel of offline channels such as liquor stores and convenience stores:

Headwind 2: Intensifying food-delivery price wars

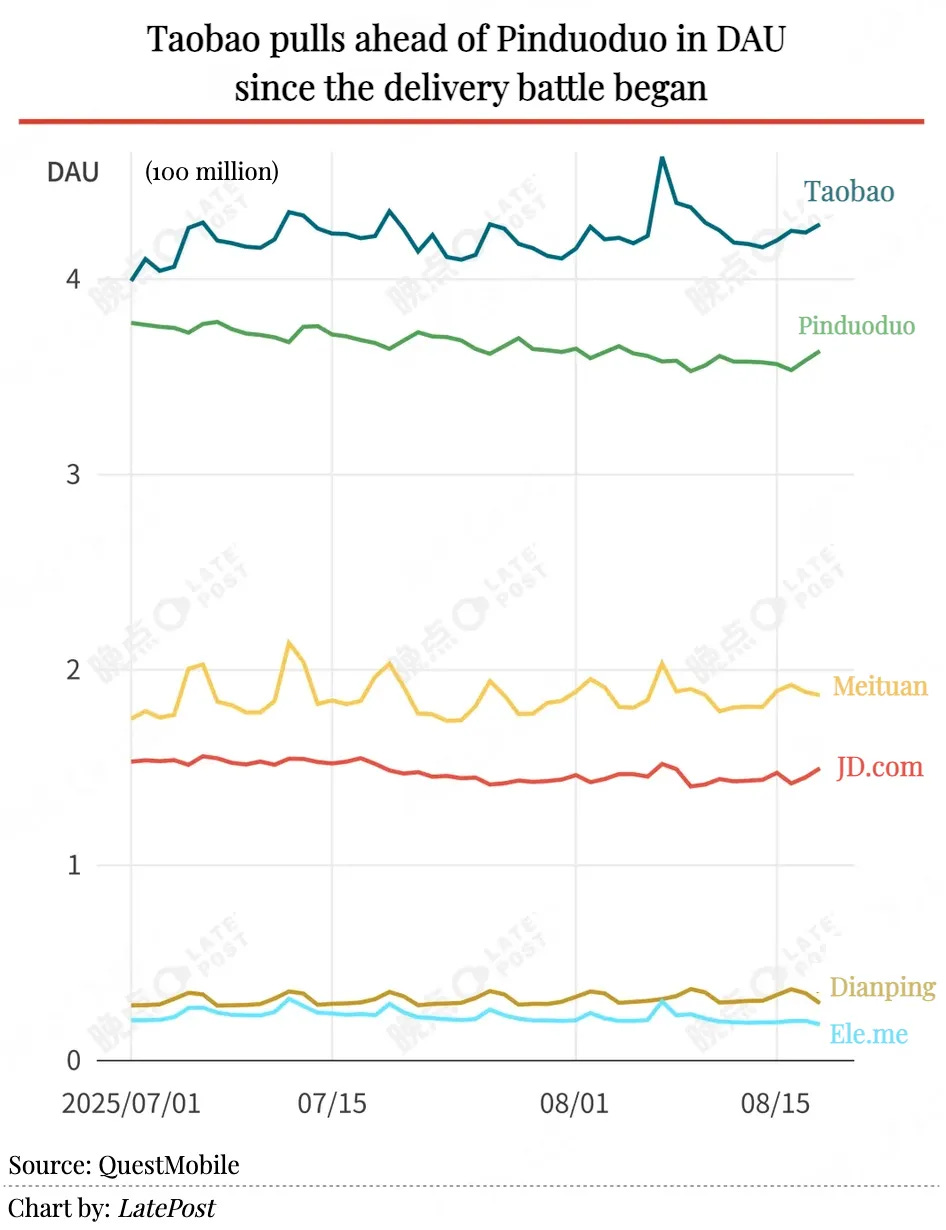

Since February this year, JD has aggressively entered China’s food‐delivery / instant retail market, directly challenging Meituan and Ele.me with heavy subsidies, new rider benefits, and social media advocacy. But the price war has only intensified since then, with China's internet giants burning massive cash to subsidize heavily. Industry‐wide cash burn exceeded US$4 billion in Q2 alone.

Earlier this month, we explained how Alibaba is gaining momentum in China’s food-delivery subsidy war: its Taobao Flash Buy service is starting to outpace rivals like Meituan and Pinduoduo in key metrics:

According to BigOne Lab's data, Meituan’s instant delivery order volume reached 2.71 billion in August 2025, representing 8.9% year-on-year growth, a notable deceleration from July’s 16% growth.

However, at the same time, the intensifying price wars have boosted O2O demand for freshly made drinks — which are heavily subsidized — benefiting brands such as Luckin Coffee, Mixue, and other tea chains.

Which themes, sectors, and companies are showing structural growth amid the slowdown?

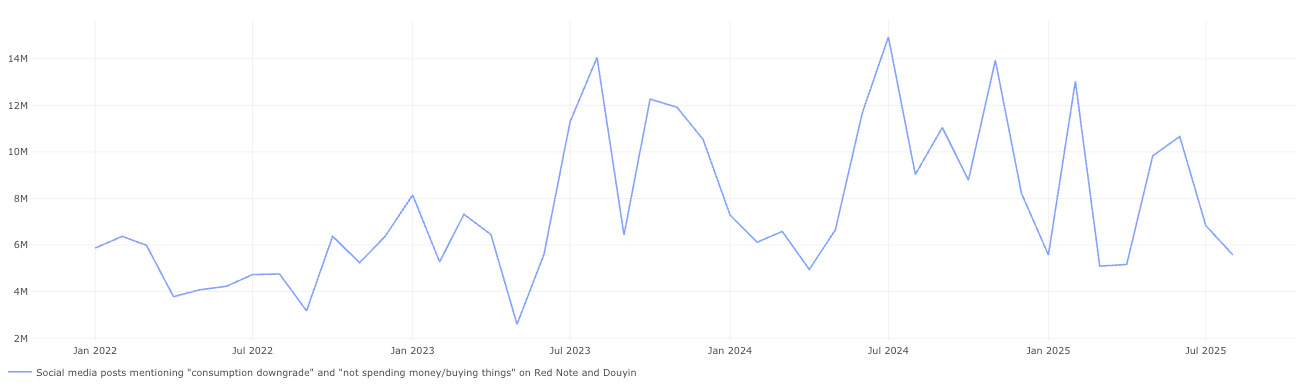

First and foremost, in July and August, consumers appear less concerned with the “consumption downgrade.” Fewer people are discussing or reacting to posts containing keywords such as “trade down,” “consumption downgrade,” “not spending money,” or “not buying things” on Douyin and RED (Xiaohongshu):

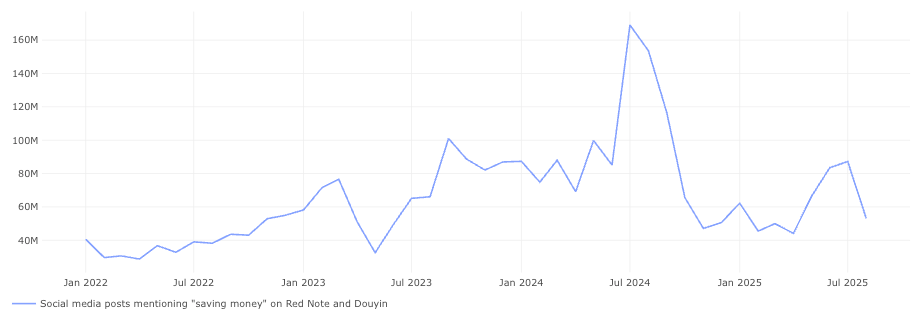

The sentiment may have been partially supported by the recent equity-market rally, with fewer people discussing “saving money” in August:

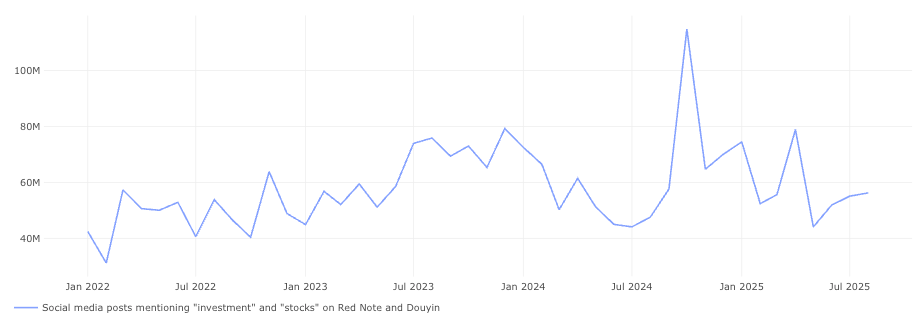

And more people are discussing investment-related topics, although enthusiasm is still below the levels seen last October:

Let's explore some interesting themes and sectors that still offer structural growth opportunities.

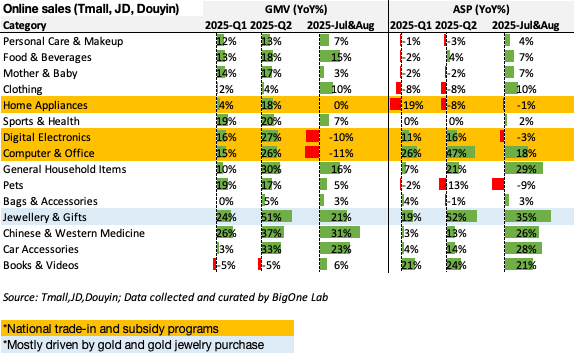

According to the online sales data we track at BigOne Lab, we also observe a notable slowdown in sectors that are boosted by national subsidies and trade-in programs, including home appliances, digital electronics, and computers.

Notably, household items — including furniture, bedding, home furnishings, and other lifestyle items — continue to enjoy strong and sustainable growth in both sales and prices. This aligns with a broader trend among Chinese consumers toward home optimization and indoor experience upgrades.

Another standout sector is jewelry and gifts, largely driven by gold and gold jewelry purchases, which has also seen robust growth in both sales and average selling price.

Laopu Gold, China’s star “new consumption” name that returned a whopping 510% over the past year, announced another price increase in August. According to the offline payment panel we track,

I cover four key themes/sectors, along with a few companies worth tracking, in the full analysis behind the paywall. To get a sense of what is offered, you are welcome to check out this older post in the same series: Charts of the Week. You can also get free access by sharing us.