China's October recovery: time to bet again? - Charts of the Week

China’s domestic demand, real estate, and recruitment trends in 7 charts

"Charts of the Week" is Baiguan's series that features key data points to help you quickly grasp the general state of affairs in China in just a few minutes. We handpick the highlights of the data charts from a variety of sources, analyzing and delivering insights trusted by 100+ top institutional and corporate clients worldwide at BigOne Lab. Don't forget to subscribe before you continue reading!

China’s October economic data brings a much-needed sense of optimism. The official purchasing managers' index (PMI) rose above 50 for the first time since April, signaling expansion. Retail sales also beat expectations, growing 4.8% year-on-year, suggesting deflationary pressures may be easing. These signs of recovery are what many have been hoping for.

This rebound didn’t happen in isolation. The government has been rolling out measures to stabilize key sectors, from easing restrictions on real estate to debt-swapping programs and boosting consumer demand. After months of sluggishness, these efforts may finally be gaining traction.

But is this the turning point? Or just another false dawn? What does October tell us? Recent policy announcements have been met with tepid market responses. Recall how quickly the excitement faded after the "crazy" bull rally following the PBOC’s stimulus on September 24? So, the question remains: is now the time to buy China, or will this recovery lose steam once again?

In this week’s charts, we explore key trends from the 618 shopping festival (China's biggest annual online sales event), real estate, and recruitment to help you make sense of where things might be headed. Stay tuned for deeper insights below.

*Disclaimer: The views expressed here are my own and do not constitute specific investment advice.

Real estate and recruitment show stabilizing trends

In recent weeks, China has continued rolling out policies to support the real estate sector. For example, cities like Beijing and Shanghai have introduced tax breaks to reduce home purchase costs, helping to stimulate demand in the housing market.

Our data indicates that the real estate market is showing signs of rebound, with first-tier cities and municipal capitals displaying a noticeable improvement in confidence. In the second week of November, our data from over 140 cities revealed that the transaction value of second-hand homes saw a month-on-month (MoM) increase of 1% and a 68% year-on-year (YoY) increase, signaling ongoing improvement.

The average transaction price also saw a MoM increase of 2%, though it’s still down 4% YoY. This suggests that prices may be nearing the bottom and starting to stabilize.

In terms of property viewings, the data shows a slight MoM decrease of 3% across more than 80 sample cities. While the number of viewings has decreased slightly, the market’s overall heat remains high, with demand still strong across the board.

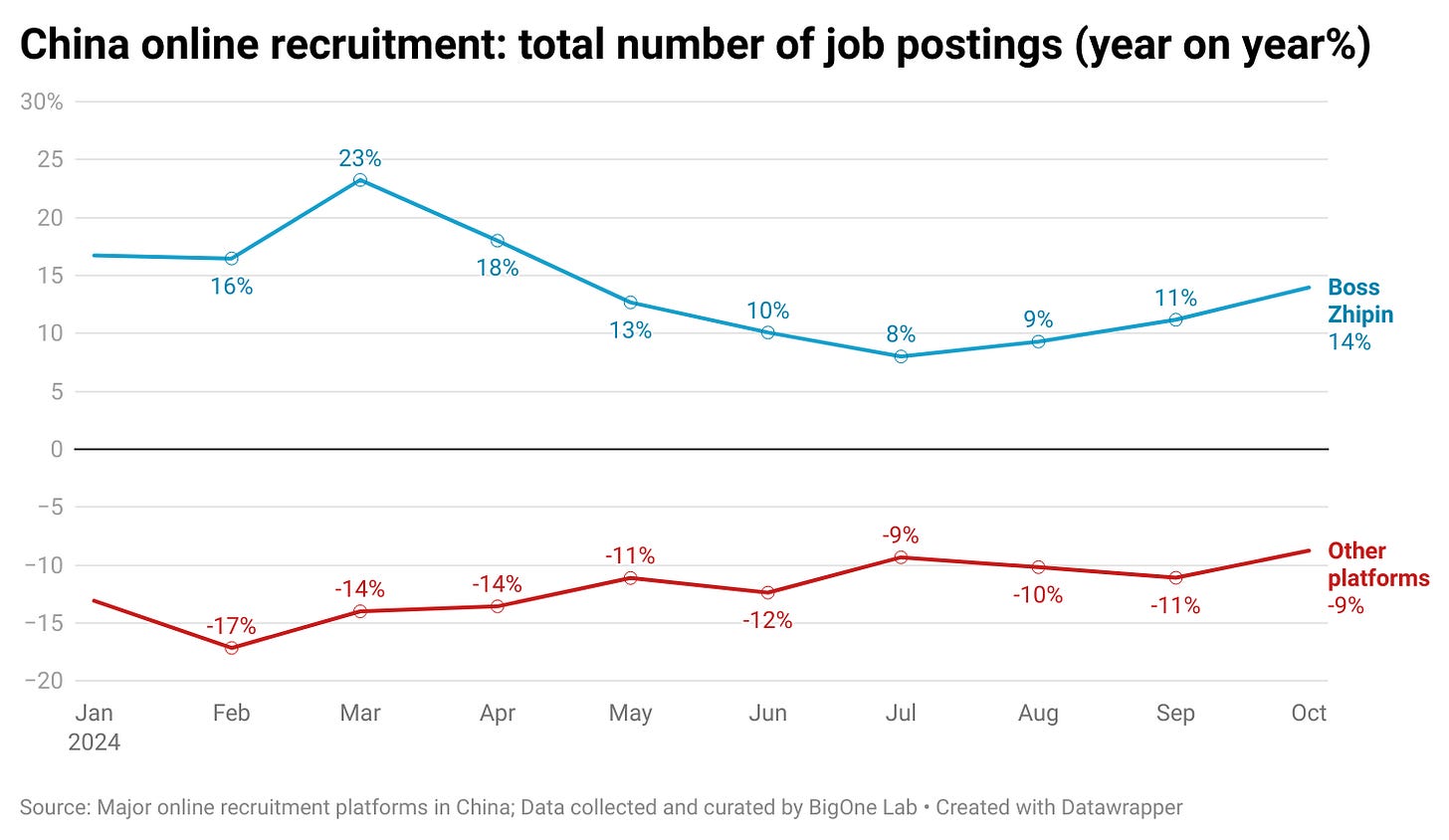

The total number of job postings continued to improve across major online recruitment platforms in China. On Boss Zhipin, China's largest online recruitment platform, the total number of jobs grew 14% year-on-year, marking continued accelerated growth compared to 11% in September and 9% in August, respectively.

As the real estate sector—still a cornerstone of China’s economy—shows signs of stabilization and the job market continues to improve, these developments suggest a broader macroeconomic stabilization in October. This, in turn, enhances the outlook for household confidence.

What does China's biggest annual online sales event tell us about the domestic demand?

China's largest annual online sales event, "Double-11," extended its duration this year, starting on October 14, marking the longest Double-11 in history. The extended event period highlights strong consumer demand, with major e-commerce platforms reporting significant year-on-year growth in gross merchandise value (GMV):

Tmall, JD.com, and Douyin are estimated to grow 12%, 13%, and 31% year-on-year, respectively, during this year’s Double 11 period compared to the comparable period of last year, according to BigOne Lab's estimate (the parent company of Baiguan).

While the "double-11" data appears promising, I remain neutral for the following reasons:

The extended length of this year’s sales event compared to last year inflates the total sales figures, making direct comparisons less meaningful.

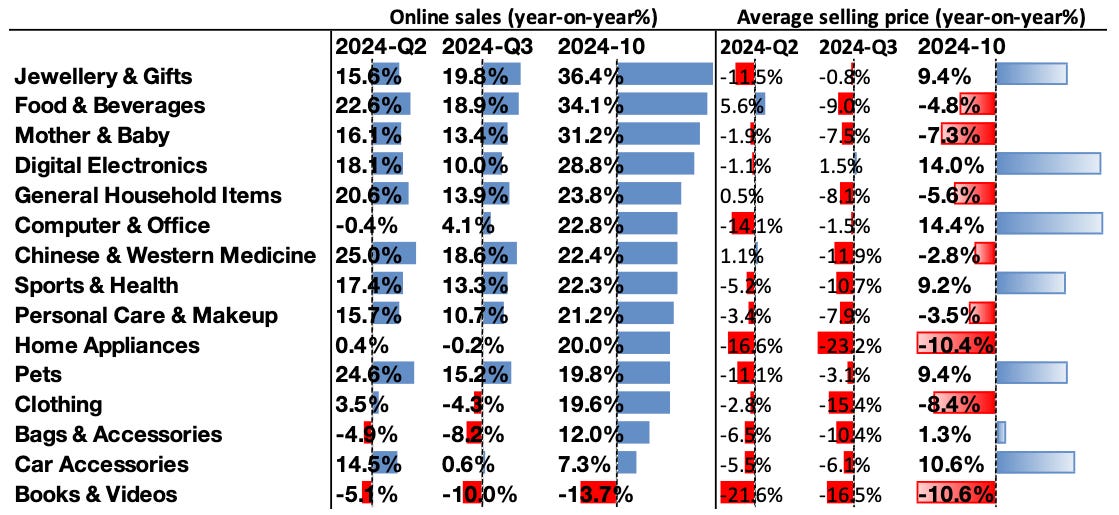

Although most categories experienced double-digit year-on-year growth, the strongest gains came from products supported by trade-in programs and government-issued cash vouchers, particularly digital electronics, computers, and office equipment. These purchases mostly involve high-value, non-recurring items like large home appliances or electronics. While they drive short-term sales, they may not translate into sustainable domestic demand or consistent revenue growth for individual companies.

While the real estate and job markets showed signs of stabilization in October, concerns remain about the sustainability of these trends and whether more policies directly supporting welfare and domestic demand will be introduced next year. Most of the stimulus measures implemented so far have focused on debt restructuring and supply-side adjustments. Additionally, the return of Trump to the U.S. presidency poses significant uncertainty to China’s exports in the years ahead. Without substantial macroeconomic changes, particularly on the demand side, the October rebound may lack a solid foundation for continued growth.

Opportunities to consider

Jewelry and gift sales experienced a strong rebound in both volume and price, driven primarily by gold and gold jewelry. This topic was covered in detail in a previous post.

Sales in the Sports & Health category continue to rise steadily in both total revenue and average selling price, reflecting sustained consumer demand despite the absence of nationwide subsidies, such as those available for appliances. We explored this trend in a prior post.

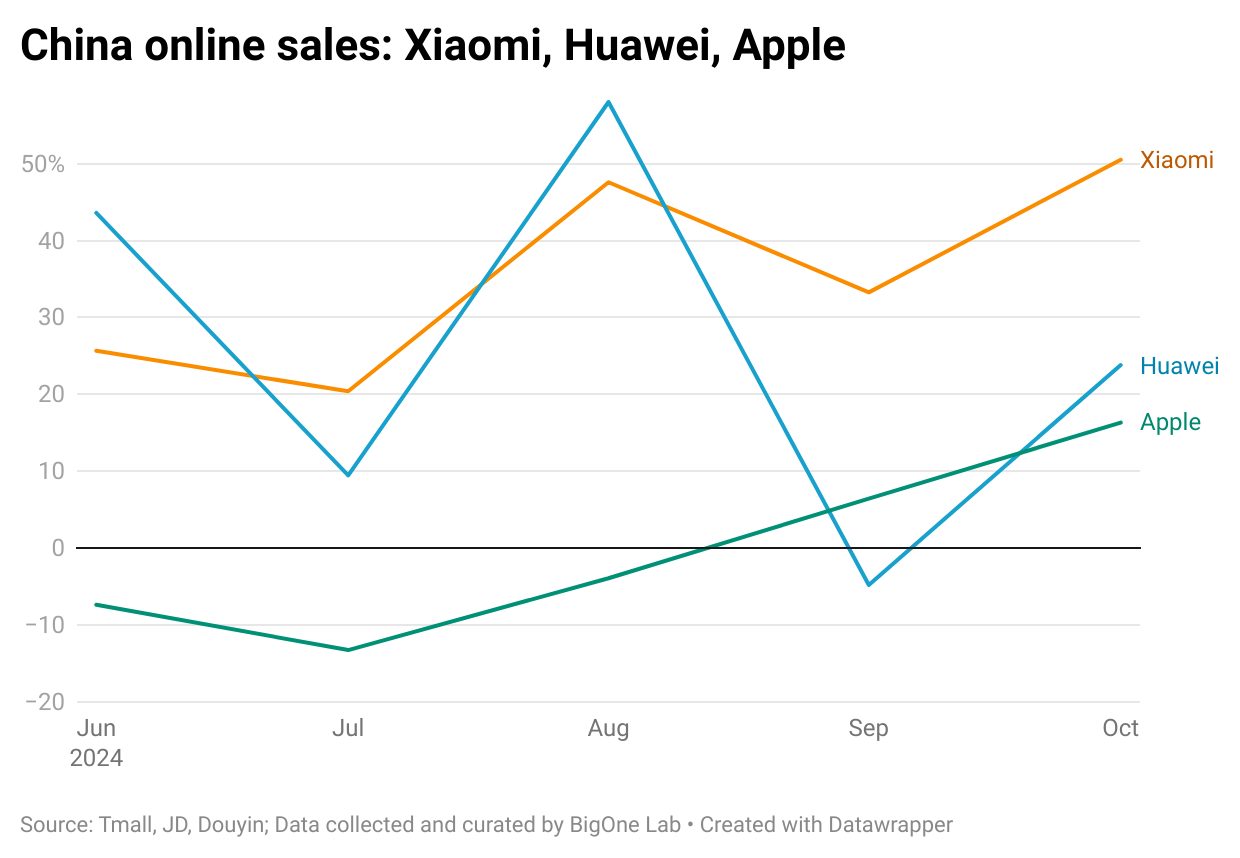

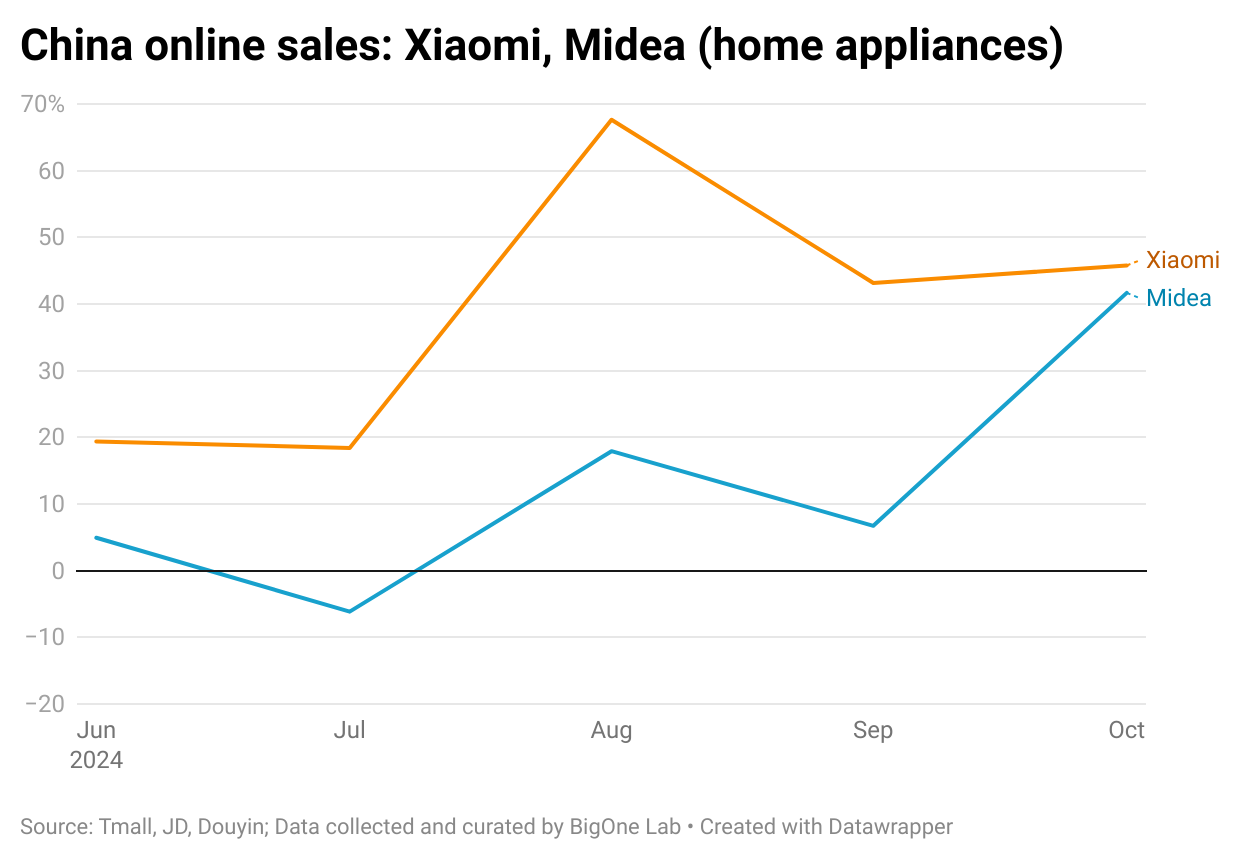

In the home appliances sector, Xiaomi (1810.hk) emerged as the standout performer, surpassing competitors like Huawei and Apple (NASDAQ: AAPL) in smartphone sales, and outperforming established leaders like Midea (000333.SZ) and Haier (600690.SS) in home appliances.

Behind the paywall, I will share the latest online sales data for Tmall (BABA:NYSE), JD (NASDAQ: JD), Douyin, and Kuaishou (1024.HK) as of October, offering insights into the competitive landscape for investors. Additionally, we will provide an analysis of full-channel sales (online and offline) for leading sports brands, including Lululemon in China (NASDAQ: LULU), Li-Ning (2331.HK), and Anta(2020.HK), through October.

This post is sponsored by BigOne Lab, our parent company. BigOne Lab proudly announces the introduction of the China Mobile Payment dataset, covering high-frequency offline sale performance of brands such as LULU, Hermes, LV, Starbucks, POP MART, Miniso sportswear, luxury, coffee and tea chains, and specialty retail sectors that were previously undercovered by data. If you are interested in subscribing, please contact more@bigonelab.com