China's Q3 GDP grows 4.9%; a visual overview — Charts of the Week

Understand China’s latest domestic consumption, real estate, and market sentiments in 15 charts

*This post is our premium content. Thank you for being a valued paid subscriber.

September economic data highlights

China's GDP growth in Q3 2023 reached 4.9%, surpassing expectations of a 4.4% increase. With the current pace of growth, it is likely that the full-year 2023 growth target of around 5.0% will be achieved.

The consumer price index (CPI) remained unchanged in September compared to the previous year. This was primarily due to a decrease in food prices (down by 3.2%), while non-food prices increased by 0.7%. Meanwhile, the producer price index (PPI) experienced a year-on-year decline of 2.5%, which is the smallest decrease since March.

Consumer confidence and real estate, boosted by the national holiday "Golden Week" and recent stimulus measures, continue to recover. (You will see more charts on domestic consumption and real estate in today's post).

Market sentiment remains at the bottom

China's stock market, represented by the MCHI (MSCI China ETF), had the weakest performance compared to the global market in 2023. This includes Japan, India, Russia, and the broader emerging markets' benchmark indices.

China Export

In US-dollar terms, China's exports decreased by 6.2% year-on-year in September 2023, which is better than the consensus of 7.6% and the 8.8% decline in August.

Job posting data indicates a continued recovery in China's exports. In September, the number of overseas positions offered by Chinese companies grew by ~9% on major online recruitment platforms.

China's automobile exports, especially to Russia and Mexico, are on the rise. Read our full story on China's companies going global:

Employment Outlook

In September, urban unemployment stood at 5%, down from 5.2% in August.

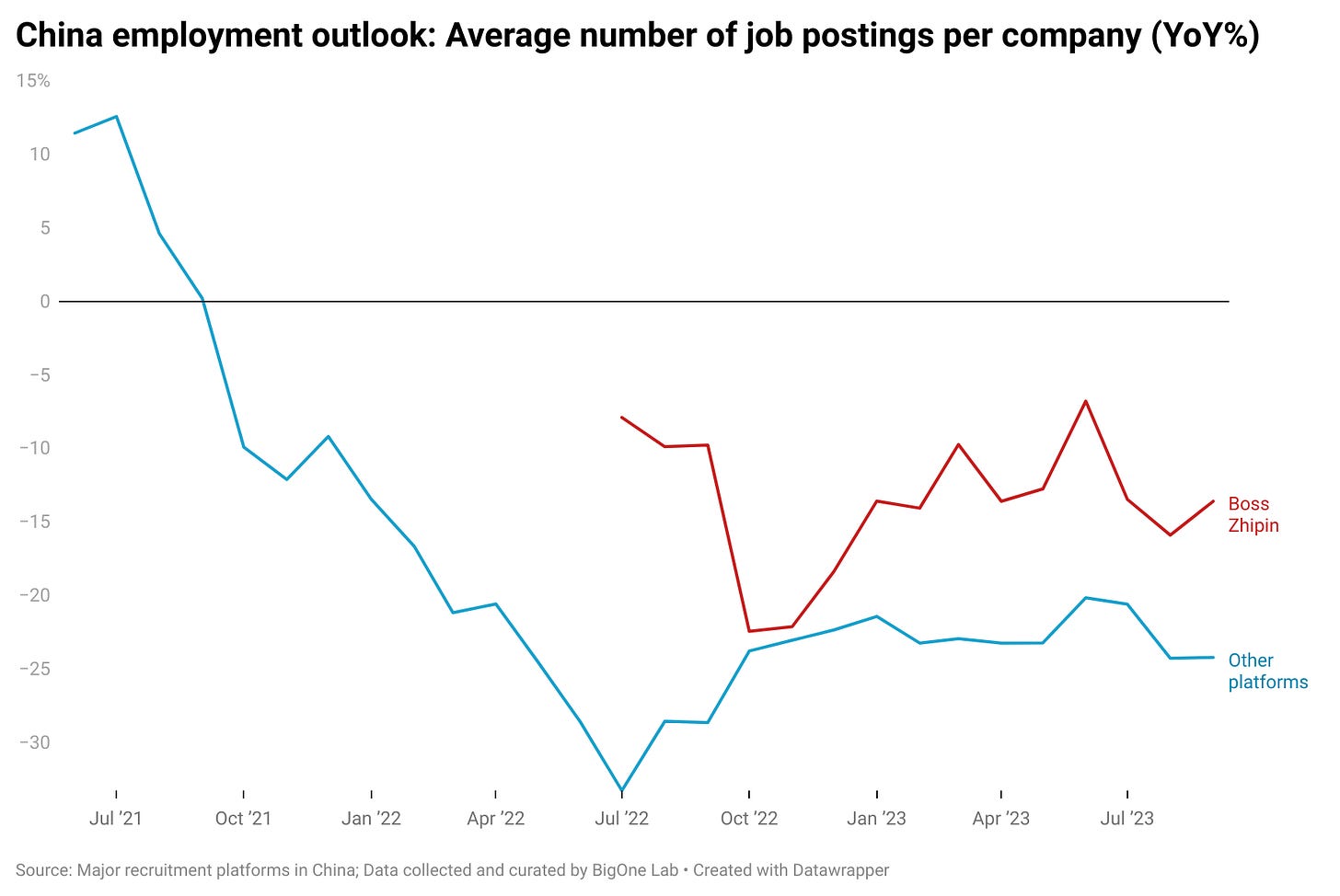

The average number of job postings declined by 14% year-on-year on Boss Zhipin and by 24% on other online recruitment platforms, showing a slight improvement from August.

Continue reading to unlock our latest update on:

China's employment outlook and income expectations: We also cover the latest job demand situation for junior positions, featuring job posting data across major online recruitment platforms in China.

Domestic consumption and consumer confidence: Track China's gross merchandise values (GMV) across major e-commerce platforms including JD.com, Douyin, Kuaishou, and Tmall, highlighting current buying trends and the pace of recovery in discretionary spending. We will also provide an update on the purchasing behavior of Chinese consumers for Japanese skincare and makeup products since the Fukushima water release.

Real estate: Get briefed on transaction volumes for existing homes in 82 Chinese cities (up to October 15)

To get a sense of what is offered, you are welcome to check out this older post in the same series: Charts of the Week