The deep transformation of China’s consumption structure: a complex picture beyond “downshifting”

Horizon Insights Research Series #2

For many of you who are investing in China, the name Horizon Insights (弘则研究), a well-respected independent research provider, shouldn’t be a new one. Founded in 2015 but with a core team that was formed almost 2 decades ago, Horizon Insights has proven one thing: despite a “young” sell-side research industry that has been dominated by high-turnover trading, hearsays, and all sorts of short-term behaviors, and despite a major market downturn in the last few years, independent research can still survive and prosper in China.

This is why when the Baiguan team met the Horizon Insights team, we instantly bonded. Both of us take pride in our respective craftsmanship. Both of us share a common goal in identifying facts, filtering out noise, and deriving actionable insights that are actually relevant for those of you who have a genuine stake in this market.

Several weeks ago, we kicked off a special collaboration series between Baiguan and Horizon Insights. Their strengths in macroeconomic, FICC, and equity research complement our data-driven focus, offering readers one of the most comprehensive takes on China today.

In the last post, Horizon’s founder and chief strategy analyst, Mr. Ma Dongfan, explored a pressing question: How has macroeconomic research misjudged China? He argued that relying on old tools like fiscal stimulus and real estate to track China’s economy misses the deeper structural transition underway. In today’s post, Mr. Ma turns to consumption, unpacking the shifts reshaping China’s consumer landscape:

The Deep Transformation of China’s Consumption Structure: A Complex Picture Beyond “Downshifting”

Dongfan MA, Founder & Chief Strategy Analyst, Horizon Insights

China’s consumer market today is at the center of a heated and often contradictory debate. On one side, concerns over a “balance sheet recession” and “consumption downgrade” remain prevalent, with real estate prices in decline and parts of the traditional consumer sector stagnating. On the other side, the concert economy is booming with tickets selling out instantly, and non-essential goods are experiencing counter-cyclical growth. This seemingly fragmented reality, in fact, reveals that China’s consumer market is undergoing a profound structural transformation — one that cannot be captured simply as “good” or “bad,” but rather as a systemic reconstruction across channels, supply, and market tiers.

I. The “Contradictions” in Consumption Data: Appearance vs. Essence

From a macro and traditional industry perspective, China’s consumer market does show signs of weakness:

Growth slowdown: Over the past three years, the annualized growth of total retail sales of consumer goods has fallen significantly compared to the ~10% seen between 2010 and 2020, highlighting weaker macro consumption momentum.

Pressure on traditional sectors: In 2024, the catering industry in Beijing and Shanghai saw profit declines of 80–90%. Hotel average daily rates kept falling, and airline ticket prices dropped consistently between 2024–2025. Together, these figures underpin the concerns about sluggish consumption.

Yet, another set of data paints a very different picture.

Entertainment boom: The concert economy remains in an extremely overheated state, with shows across genres selling out instantly — acting as the “contrarian” force in the consumption market.

Non-essential consumption growth: Products like Pop Mart’s designer toys or Lao Pu Gold’s jewelry — both considered non-essentials — are seeing robust growth, defying the conventional wisdom that such categories should be hit hardest during consumption downgrades.

Segment upgrades: Pet-related spending remains strong, with treats and premium pet food turning into hotspots, suggesting stable or even rising purchasing power among certain groups.

Lower-tier market vitality: Categories like household goods in third- and fourth-tier cities continue to show resilient demand for quality.

This contradiction makes clear that a single pessimistic lens is no longer sufficient to describe the reality of China’s consumer market. At its core lies a deeper structural transformation.

II. Channel Revolution: Systemic Substitution of Old Consumption by New

The most striking feature of China’s current consumption structure is the revolution in distribution channels, which is reshaping the entire market landscape.

1. Explosive growth of new online channels

Between 2022 and 2025, while total retail sales of consumer goods remained flat, live-streaming and social commerce platforms — such as Douyin, Kuaishou, Xiaohongshu, and WeChat Channels — maintained 30% annualized GMV growth. Between 2024 and 2025 alone, they added about 2 trillion RMB in GMV. Against the backdrop of a ~50 trillion RMB consumer market, this incremental growth is highly significant.

In contrast, traditional channels are stagnating: conventional e-commerce has plateaued (with 5%-10% growth), and offline consumption has entered relative contraction. This dynamic — new online channels displacing traditional ones — essentially redefines the meaning of “new consumption.”

2. Chain reactions from channel transformation

The rise of social commerce goes far beyond shifting sales venues; it is driving fundamental changes in the logic of consumption:

Reconstructed operating logic: New channels rely heavily on online traffic operations. Recommendation systems, digital ads, content marketing, and viral word-of-mouth have become central tools for promotion, triggering explosive growth for certain products. Pop Mart, Lao Pu Gold, and even some home appliance brands exemplify this trend.

Financial model shift: New consumption enterprises tend to show “low sales expense, high gross margin, fast revenue growth” — in sharp contrast to the traditional model of “high marketing spend driving growth.”

Globally leading behavior: China’s social commerce is now far ahead of global peers. The “flash sale” phenomenon — where hot items sell out instantly — contrasts with the U.S., where similar clearing takes 10–15 minutes. Top Chinese livestreamers also generate nightly sales far exceeding their U.S. counterparts, highlighting the unique dynamism of Chinese consumer behavior in these new channels.

Rebuilt trust system: Livestream shopping represents a reconstruction of consumer trust. The new bond between streamer and consumer is replacing the old logic of brand-building through mass advertising.

3. Adaptive shifts in corporate strategies

The channel shift has forced businesses to rethink strategy:

Rise of private-domain operations: As direct consumer access shortens, companies increasingly depend on private membership and “private domain traffic,” reducing reliance on mass-media advertising.

Rapid iteration of regional brands: New channels have lowered geographic barriers, enabling regional brands to scale and iterate quickly, overturning the old norm where nationwide expansion required long lead times.

III. Supply-Side Upgrades: Accelerating Product Iteration

The structural change in consumption is not only demand-driven but also rooted in supply-side advances. China’s consumer goods industry is undergoing a qualitative leap.

1. Dual breakthroughs in design and supply chain

Flexible supply chains: Many companies have significantly improved efficiency and production flexibility, enabling fast responses to demand shifts.

Accelerated design cycles: Stronger design capacity, including secondary creations, drives rapid iteration in both aesthetics and functionality. Firms like Miniso embody this “ultra-fast consumer response” capability.

2. Global leadership in speed of product iteration

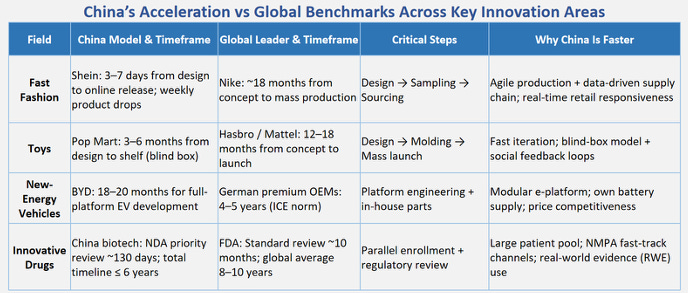

Chinese companies are setting the pace worldwide in product development:

Automotive: Chinese carmakers now take ~18 months to design a new model, well ahead of global peers.

Consumer goods: Categories like toys and collectibles iterate much faster than overseas counterparts. Pop Mart, for example, manages complex products involving hundreds of components and steps, yet maintains a high frequency of design updates — directly fueling market expansion.

Though luck still plays a role in creating blockbusters, China’s accelerated cycles significantly raise the probability of success, making iteration speed a key global competitive edge.

3. Employment structure adjustments

Channel and supply-side shifts are also restructuring employment:

Traditional consumption sectors (e.g., chain restaurants) face pressure, with slower job growth.

Livestreaming and social commerce, meanwhile, have created millions of new jobs. Estimates suggest every 1bn RMB in GMV supports ~12,000 jobs. With livestream/social commerce GMV approaching 5 trillion RMB, this sector has generated over 50 million jobs (40% full-time, 60% part-time). In recent years, it has created ~20 million full-time positions and added income for another 30 million people.

This transformation in employment further underpins the rise of the new consumption ecosystem.

IV. Market Tier Shift: Restructuring and Integration

The trend of consumption moving into lower-tier markets is another important dimension of China’s transformation, shaped by population flows and shifting habits.

1. Population flows driving restructuring

In recent years, there has been a clear migration from first-tier cities to second- and third-tier ones. Cities like Suzhou, Wuxi, Changzhou, Hangzhou, and Xiamen have become hotspots for inflows, reshaping market tiers:

Consumption behaviors from first-tier cities are increasingly diffusing into lower tiers.

Third- and fourth-tier cities are seeing new consumption scenarios open up, expanding opportunities for brand penetration.

2. Characteristics of lower-tier consumption

The rise of lower-tier markets is not simply about “cheap consumption,” but shows clear shifts toward quality and branding:

Expansion of milk tea shops and chain stores reflects the growing acceptance of standardized branded products.

The spread of online channels makes premium brands and products more accessible, accelerating consumption upgrades in these regions.

V. Conclusion: Challenges and Opportunities in Structural Change

What China’s consumer market is undergoing is not a simple story of expansion or contraction, but a profound structural transformation characterized by multiple forces:

Channel: Social and livestream commerce is displacing offline and traditional e-commerce.

Supply: Flexible chains and rapid product iteration are overtaking traditional production models.

Market: Downward tier integration reshaping consumption layers.

Corporate Strategy: A shift from “ad-driven + distributor networks” to “private domain operations + digital reach.”

If we focus only on traditional offline retail, distributor-based brands, or oversupplied catering chains, the picture appears bleak — a “consumption winter.” But if we turn to social commerce (already nearly 10% of retail, still growing at 30% annually), new brand growth, and supply chain-enabled rapid iteration, we see instead a “consumption spring.”

China’s consumer sector remains vast at ~50 trillion RMB. In a moderate pricing environment, it both attracts overseas visitors and nurtures structural opportunities. To understand this transformation, we must move beyond the simplistic binary of “downgrade vs. upgrade,” and instead recognize the interplay of channel revolution, supply-side upgrade, and market tier shifts. This is the source of both the complexity and vitality of China’s consumption market — and the key to capturing its future opportunities.

For inquiries or collaboration, contact us by replying to this email or at: subscribe@hzinsights.com

About Horizon Insights —Established over a decade ago, Horizon Insights is dedicated to delivering in-depth, cycle-aware insights into Chinese assets. Our core team comprises well-regarded investment research professionals who have been working closely together for almost two decades and have earned the trust of over 1,000 institutional and professional investors worldwide. Our research is recognized for its independence and foresight, grounded not in noise but in long-term conviction and depth. We’re grateful to connect with you through this Newsletter, and we look forward to ongoing, thoughtful dialogue.