A firsthand look at how China’s exporters are reacting to US tariffs

On-the-ground surveys, conversations, and field interviews with Chinese exporters

What do US tariffs really mean for China’s exporters—not just in theory, but in practice? While headlines and research reports focus on the macro impact, the more telling stories might lie in the workshops of Dongguan or the ports of Ningbo. How are business owners on the ground adjusting? Are they holding steady, pulling back, or pivoting to new markets altogether?

As I shared in last week’s newsletter "How big of a problem are tariffs for China's economy?", the direct impact on China's GDP of US tariffs is relatively limited. But that doesn't mean there's no pain.

Based on the estimates by Goldman Sachs's research team, 10-20 million workers in China may be exposed to US-bound exports. Although 10-20 million is a small portion of the total workforce, many of China’s exporters are private, small to medium-sized firms. For them, it’s not about long-term projections—it’s about surviving the next quarter. If profits vanish, so do the orders. Some may be forced to shift to other overseas markets, though that’s no easy task when it means giving up access to the world’s biggest consumer market. Others might turn to domestic sales instead, but that risks adding further pressure to China’s already deflationary environment, where intense local competition continues to squeeze profits.

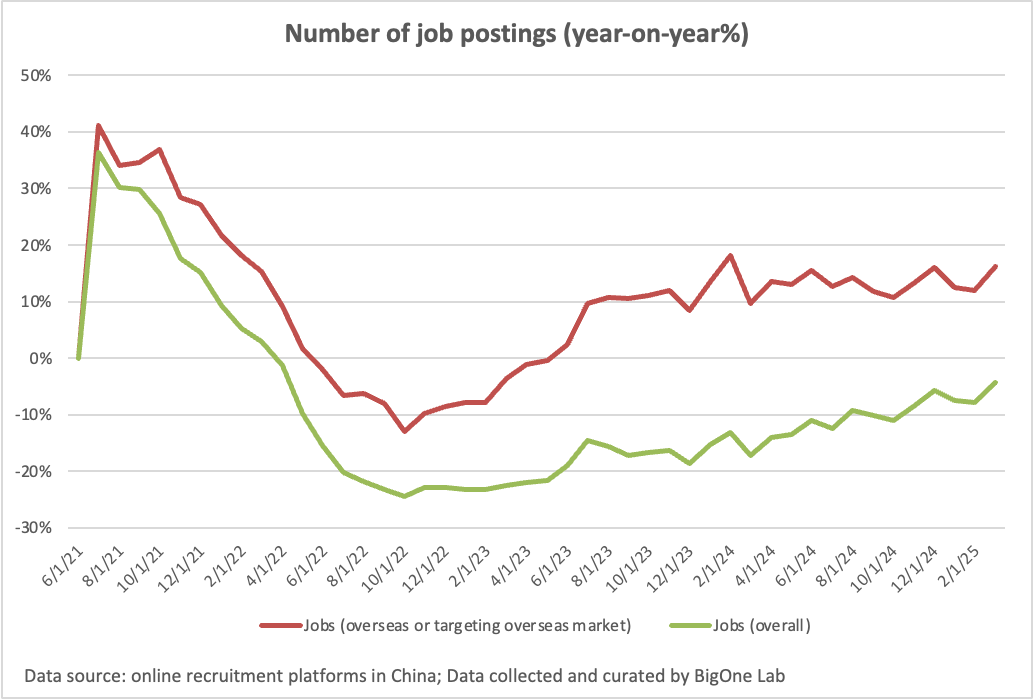

And let’s not forget: overseas-facing jobs are one of the few bright spots in an otherwise tough labor market in China, as I've written multiple times in our “Charts of the Week” series. Since 2023, Chinese companies hiring for overseas markets have been expanding quickly compared to the overall job market. But the tariffs war could force many to cut back hiring plans amid growing uncertainty-after all, if there’s one takeaway from Trump’s flip-flopping these days, it’s that nothing is absolute at this stage.

So beyond the outright numbers, another factor that may nonlinearly impact China's economy is confidence. Today, I will be translating a few on-the-ground stories and conversations in the Chinese-speaking world with the exporters to paint a clearer picture of how China’s export companies are really responding. At the end, I’ll also share Baiguan’s proprietary hiring data to see whether China’s export-oriented businesses are starting to dial back their recruitment efforts.

The following insights are translated from conversations and interviews with Chinese exporters across a range of industries:

First-hand views from friends in foreign trade: The real impact of reciprocal tariffs

1. A friend of mine, a regional leader in the home improvement hardware industry based in southern China, has also invested in land for a new factory in Cambodia over the past two years. Here’s the current status:

On the China side, U.S. clients have already halted new orders. However, orders placed before April 2—whether already in production or in transit—are still being fulfilled. In fact, some buyers have requested expedited shipments.

In Cambodia, even before the factory was completed, large orders had already been secured. While the sudden implementation of new tariffs has shaken client confidence, no orders have been canceled yet. The reason? Many clients are betting that Cambodia will eventually receive a tariff reduction if it is perceived as cooperative.

In response, my friend has now slowed construction on the Cambodian facility, tightened cash flow management, and is closely watching what happens after the next key date—April 9.

2. I asked: if the extreme scenario of 100% tariffs on Chinese goods were to materialize, how would the cost burden be split between clients and suppliers? He replied: if the clients are large retailers—like Costco—they would likely ask the suppliers to bear at least half the added cost. With net profit margins already compressed to 7–8% in recent years, this would mean operating at a significant loss.

Their current strategy is twofold: on one hand, actively seek similar clients in other markets to replace U.S. business; on the other hand, for existing U.S. orders, calculate whether losses under new tariffs remain tolerable. If they are, production continues—shutting down the factory isn’t an option.

3. Another friend in the flooring business told me their entire supply chain has halted production for U.S. orders. Only a small number of orders for Europe and Russia are still in progress, but they make up a minor share and can’t offset the lost U.S. volume.

4. A third friend, who works at an auto parts manufacturer, says the company is in a state of confusion. U.S. clients are reacting inconsistently—some are willing to fully absorb the tariffs, others only partially, and many haven’t made their stance clear.

They’ve paused construction on a planned factory in Thailand. On the bright side, some of their high-margin products, like industrial robots, are unaffected for now. I asked whether a 100% tariff would inevitably result in losses and whether production would continue regardless. His answer: margins were already thin even before the new tariffs. With additional costs, it’s a matter of re-evaluation.

5. I also sent out a survey to around 20 contacts in the export business, asking how they’re responding this week. Results show roughly half are suspending operations or taking a wait-and-see approach. About a quarter are considering price hikes, and another quarter are preparing to exit the U.S. market altogether.

6. Sentiment is largely pessimistic. Only 10% believe the impact will be short-lived and manageable. Half say the impact is significant but not fatal. The remaining half say it poses a severe threat to their operations, with no clear path forward.

The following insights are translated from field interviews conducted at Yiwu International Trade City, China’s and the world's largest hub for small commodity exports, home to over 80,000 vendors and millions of products. Some paragraphs have been abridged and adapted for clarity.

On the ground in Yiwu: How China’s export hub is reacting to U.S. tariff hikes

By Caoshu | April 9, 2025

In the early hours of April 9, following the U.S. announcement of a proposed 104% reciprocal tariff on Chinese imports, we visited Yiwu—home to one of China’s largest export marketplaces—for first-hand insights. Our field interviews covered vendors inside the Yiwu International Trade City, local government officials, and merchants outside the market, including cross-border e-commerce businesses.

U.S. trade accounts for less than 10% of Yiwu’s business

Despite its reputation as China’s export hub, Yiwu’s dependence on the U.S. market is surprisingly low. Vendors inside the Yiwu International Trade City told us that American orders make up less than 10% of their sales. We tried, unsuccessfully, to find a merchant with significant exposure to the U.S. Among more than ten shops we interviewed, U.S.-bound sales consistently made up a small fraction. Officially, Yiwu’s total U.S. export share is slightly over 10%, but inside the Trade City, it’s likely lower. Most merchants we interviewed expressed little concern about the tariff hike—some even said they had “barely noticed.” Out of 75,000 merchants, only about 3,000 are engaged in U.S.-bound trade.

Most tariffs previously imposed were absorbed by buyers; new tariff uncertainty leaves merchants unfazed

We located Store D, a rare example where over 10% of business is U.S.-bound. The store sells umbrellas and reported that the 20% tariffs imposed before 2025 were largely absorbed by U.S. clients. As for the newly announced 34% hike, merchants are still unclear on the operational details and haven’t taken significant action.

High product margins and FOB pricing make tariffs less impactful under Yiwu’s trade structure

Yiwu’s export volume to the U.S. accounts for only a small portion of its overall trade. U.S.-bound exports from Yiwu tend to be apparel, accessories, and seasonal products like Christmas decorations. Tariffs are calculated based on the FOB (Free on Board) price. For example, a garment retailing for RMB 300 ($40) in the U.S. may have an FOB price of just RMB 30. A 30% tariff on RMB 30 only raises the cost to RMB 40—still a small portion of the final retail price. Many Yiwu products operate on healthy margins, and under FOB-based tariff schemes, they’re relatively insulated from small or moderate tariff changes.

Store E sells Christmas decorations. For the 2025 holiday season, shipments are already underway in April, with months of ocean freight and downstream retail preparation ahead. Remarkably, about 99% of the world’s Christmas products are shipped from Yiwu.

Cross-border e-commerce and the “$800 Rule” don’t apply to Yiwu’s mainstream model

The Yiwu International Trade Market operates mainly under China’s “1039 model,” where goods are consolidated into full shipping containers and sent overseas—typically via sea freight. This is a B2B bulk model, not the air-freight-based small-parcel model used by platforms like Temu or Shein. The much-discussed cancellation of the U.S. duty exemption for cross-border e-commerce parcels under $800 (aka the "de minimis" provision)has minimal relevance to Yiwu’s traditional export model. While the exemption’s removal may significantly impact cross-border e-commerce giants, the Yiwu market, where such operations are rare, remains largely unaffected.

To clarify: cross-border e-commerce certainly exists in Yiwu and across China, but it is not Yiwu’s mainstream. Yiwu’s defining trait remains its volume-based, containerized trade structure, exemplified by the widely used “1039 model”.

Yiwu’s trade scene remains bustling despite tariff concerns

Foreign buyers discussing business over meals in hotel restaurants.

A group of Thai buyers negotiating with shop owners inside Yiwu International Trade City.

A dedicated area in the market tailored to serve African traders.

Christmas-themed sections draw international buyers preparing for the holiday season.

Conclusion: structural resilience buffers Yiwu from the U.S. tariff shocks

The proposed U.S. Tariff hikes have had minimal effect on vendors within the Yiwu International Trade City. However, cross-border e-commerce sellers operating outside the market may feel greater pressure. This resilience reflects Yiwu’s unique trade ecosystem, which is diversified, price-competitive, and structurally less dependent on the U.S. Looking ahead, as China pivots toward export diversification, non-U.S. markets are increasingly shaping China’s global trade narrative—with Yiwu as a leading example.

How’s hiring holding up for overseas-facing positions?

Looking at hiring trends on China’s major recruitment platforms, the number of job postings for overseas positions—or domestic roles targeting overseas markets—rose 11% year-on-year in March (that’s the red line in the chart), continuing a solid growth momentum.

March also saw a strong export performance overall, with exports up 12.4% year-on-year. But much of this strength likely came from front-loading orders ahead of Trump tariffs.

As some of the on-the-ground stories above have shown, many businesses were caught off guard by the new tariffs. Some had been expecting exemptions or rollbacks to come through eventually, while others simply couldn’t prepare given the unpredictable nature of the situation.

(I’ll be tracking this data point closely in our upcoming “Charts of the Week” series, which follows China’s macro trends. Subscribe and stay tuned!)

At Baiguan, we strive to provide objective and actionable insights for investors and business owners with a stake in China.

To stay updated on macro shifts, I recommend following our "Charts of the Week" series, where we provide biweekly updates on key economic indicators such as real estate and consumption. I also break them down into 8-minute video roundups on our YouTube channel.

For more timely discussions, consider joining our private Discord channel for paid readers. There, I share trade ideas—both the ones I like and the ones I’m avoiding—through the lens of a global asset allocator.

To further support your decision-making, we offer a daily digest of equity research from top sell-side institutions in our Discord community for paying members. This includes coverage of macro trends and specific company analysis (like buy rating, price targets, etc.), along with a 3-minute audio summary each day to help you quickly absorb key insights.

If you want in-depth and timely equity research papers, and to join our paid community to exchange ideas on China's investment and general affairs, consider getting a paid membership today!