China's retail rises 7.6% YoY in October - Charts of the Week

Understand China’s latest domestic consumption, real estate, and market sentiments in 15 charts

*This post is our premium content. Thank you for being a valued paid subscriber.

October economic data highlights

In October 2023, the consumer price index (CPI), which measures inflation, dropped by 0.2% compared to the previous year, a worse-than-expected decline. However, China experienced a surprising increase in import activity. Specifically, there was a 13.52% rise in crude oil imports compared to the previous year, as strong domestic consumption of gasoline and aviation fuel during the Golden Week holiday boosted demand.

The rise of the domestic-made

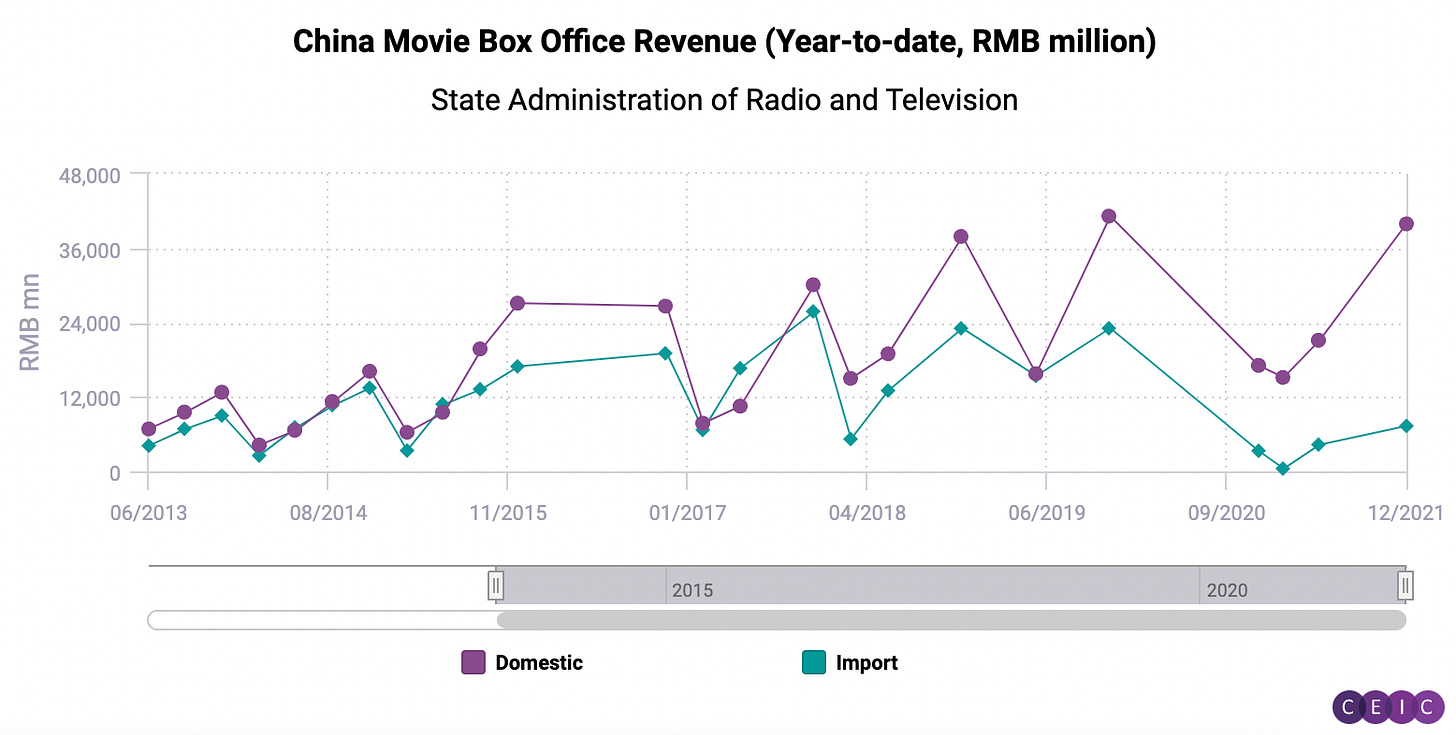

Nationwide box office revenue has surpassed the same period in 2021

As of October 2023, the year-to-date box office revenue has reached 49.2 billion RMB, exceeding the level of 2021.

However, there are contrasting trends between revenue generated by domestic movies and imported movies. Revenue from imported movies has generally been on a decline, particularly noticeable in the recent years leading up to 2021.

As of November 13, 2023, the top 10 movies with the highest total box office revenue in 2023 are domestic movies, according to the box office data from 猫眼Mao Yan, one of the largest online movie and event ticket-booking services in China.

Chinese consumers are showing a growing preference for domestic skincare brands

During the pre-sale phase of the 618 festival, China's biggest e-commerce discount event that takes place annually during the week of November 11, we observed that domestic brands dominated the highest growth in online sales.

Among major skincare brands, the top 3 gainers during the 618 pre-sale phase are all domestic brands: Comfy, Proya, and Chando. On the other hand, the bottom losers include Shiseido and SK-II.

Beauty stocks in China are facing significant challenges, with companies like Shiseido and Estée Lauder experiencing sharp declines in sales and stock prices. We have previously observed and published these trends multiple times in our newsletter, including consumers swapping premium foreign brands for domestically made ones and the negative impact of the Fukushima water release on top brands.

In particular, we have also observed that consumers' preference for domestic brands has been evident for a long time. The release of Fukushima's water has only worsened the situation for Japanese premium brands. Read our full story.

China Export

In US-dollar terms, China's exports decreased by 6.4% year-on-year in October 2023, a worse-than-expected decline. Job posting data continues to indicate a recovery in China's exports**,** with the number of overseas positions offered by Chinese companies growing by approximately 9.7% on major online recruitment platforms.

Read our full story on China's companies going global:

Continue reading to unlock our latest update on:

China's employment outlook: We also cover the latest job demand situation for junior positions, featuring job posting data across major online recruitment platforms in China.

Domestic consumption and consumer sentiments: Track China's gross merchandise values (GMV) across major e-commerce platforms including JD.com, Douyin, Kuaishou, and Tmall, highlighting current buying trends and the pace of recovery in discretionary spending.

Real estate: Get briefed on transaction volumes for existing homes in 82 Chinese cities

To get a sense of what is offered, you are welcome to check out this older post in the same series: Charts of the Week