Baiguan’s Favorite Charts and Articles of the Year

2025 in Retrospect

Dear Baiguan readers,

Thank you all for another wonderful year. Happy Holidays!

This year, we welcomed inquisitive minds from over 132 countries into our community. In the spirit of making every post informative and actionable, I want to begin our year-in-review with three of our favorite “Charts of the Year.”

Baiguan’s Top 3 Charts of 2025

As many of you know, Baiguan is driven by data. Our research and product team at our parent company, BigOne Lab, ensures you receive the most objective information possible through our signature “Charts of the Week“ series. Kudos to the team that makes this newsletter possible!

While many data points are time-sensitive—much like investment decision-making itself—a few have proven to be more enduring.

Here are three of our favorites:

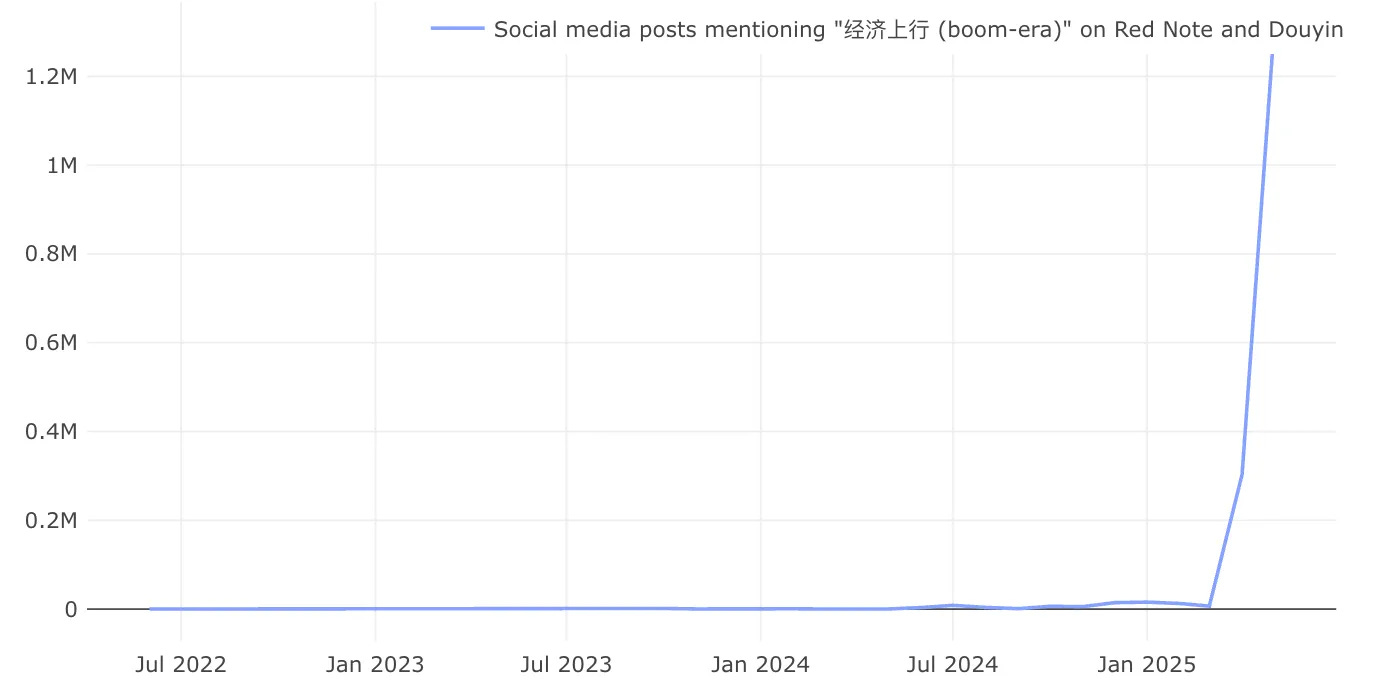

No. 3: China’s “Boom-Era Vibe”

In response to China’s current economic challenges, young people are increasingly adopting a “boom-era vibe” fashion style. This style, which features bold colors, makeups, and outfits, is inspired by the optimism of early-2000s China.

This viral trend online is not only a reflection of people’s nostalgia for the era of economic growth but also a source of confidence to continue living optimistically, earnestly, and meaningfully, even in an environment of deflation and slow growth.

Chart picked from:

China's "boom-era vibe" amid a deflationary reality

It's easy to read the headlines and assume a bleak mood in China. Youth unemployment remains stubbornly high. Consumer prices are flat or falling. The "lying flat" (躺平) mindset—where young people opt out of ambition—has moved from fringe to mainstream. In economic discourse, comparisons between China's post-00s and 2010s generation and Japan's "lost decade" are becoming increasingly common.

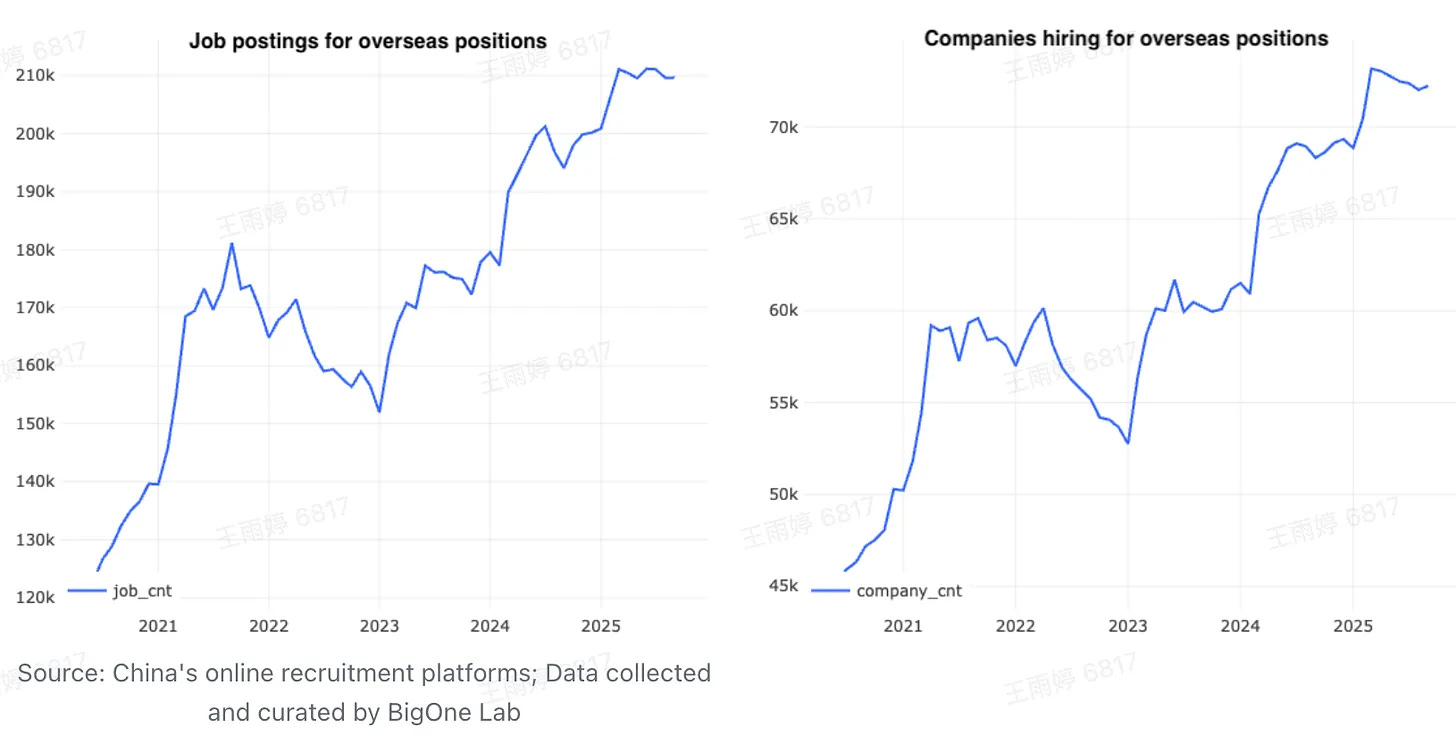

No. 2: Hiring Trends Define the US-China Trade War

Chinese exports have shown surprising resilience in the face of “Trade War 2.0.” Despite the turbulence and twists in tariff negotiations, hiring by Chinese companies for overseas positions has shown no signs of slowing down—remaining a bright spot for the labor market.

As the Chinese industry transforms, this global expansion would be a long-term trend even without a trade war. This year, we are now seeing Chinese companies export not just industrial capacity and raw materials, but high-value brands and cutting-edge technology.

Chart picked from:

China Q3 in Review: Is the Ground Still Shaky? — Charts of the Week

“Charts of the Week” is Baiguan’s series that features key data points to help you quickly grasp the general state of affairs in China in just a few minutes. We handpick the highlights of the data charts from a variety of sources, analyzing and delivering insights

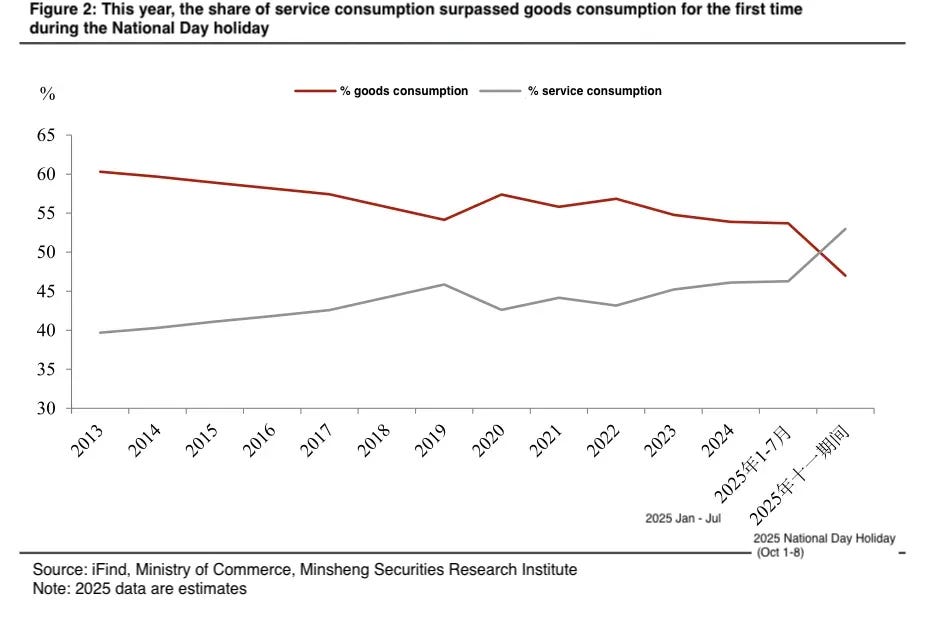

No. 1: The Structural Shift Toward Service Consumption

For the first time, during this year’s eight-day National Day holiday, service spending accounted for a larger share of total consumption than goods. Despite the broader deflationary environment, services led the way in 2025.

Service consumption is no longer just the next logical step for growth; it is now a structural reality. As China approaches the critical economic threshold of a per-capita GDP of $14,000, this milestone signals a shift from a manufacturing-driven economy to a ‘post-industrial society,’ where growth is increasingly propelled by services.

Chart picked from:

What China National Holiday Data Reveals? — Charts of the Week

“Charts of the Week” is Baiguan’s series that features key data points to help you quickly grasp the general state of affairs in China in just a few minutes. We handpick the highlights of the data charts from a variety of sources, analyzing and delivering insights

Your Favorite Articles of 2025

As you all know, we have curated our newsletter into three distinct sections—China context, investment, consumer—to provide a well-rounded understanding of China’s economy. Since then, we’ve also added the podcast as an additional way to provide you with more real-time, contextualized insights into policies, geopolitics, and international relations that matter to your interest in China.

Below are the most popular pieces from each section, based on your engagement:

China is highly renowned for large-scale infrastructure projects, and many even jokingly refer to her as a ‘infrastructure maniac 基建狂魔.’ However, behind these massive projects often lies generational strategic planning, carrying the technological breakthroughs and long-term vision of multiple generations. Through China’s newly initiated Yarlung Tsangpo Hydropower Project, we get a glimpse into why China is building the world’s highest hydropower station in the Qinghai-Tibet Plateau:

Deepseek’s sudden rise has not only provided a much-needed boost to China’s tech sector but also made global investors realize that Chinese technology still holds significant investment value. Amid the broader trend of diversification into non-US assets, Chinese assets—especially AI and tech—have become some of the best investment targets that exist outside of the U.S. This has also acted as a catalyst for a strong performance in China’s capital markets in 2026.

However, behind Deepseek’s success lies an entire ecosystem of Chinese tech talent and entrepreneurship. We gained a glimpse into this ecosystem through Deepseek’s hometown, Hangzhou, in our newsletter:

Hangzhou: The city behind DeepSeek’s rise and why it’s just the beginning

DeepSeek has arguably been the biggest bomb in both the AI and investment worlds in recent weeks. This Chinese AI startup, a side project of a quantitative hedge fund, has sent shockwaves through the global AI industry with its open-source LLM that rivals OpenAI's o1 in performance, yet operates on a fraction of the budget. Its success even triggered a sell-off in the U.S. semiconductor stocks, with Nvidia losing 17% of its market value in just one day.

Chinese consumer aesthetics and values are undergoing a subtle transformation. Young consumers are increasingly prioritizing a brand’s core values over mere functionality or low prices. This shift reflects the rapidly changing social climate, and we can observe these changes through the lens of Arc’teryx’s recent headline-making epic fail this year.

Arc’teryx Is Cooked in China

Last call for our China tour in Shanghai & Hangzhou, taking place October 27–30. This consumer and tech discovery tour will visit companies that represent China’s growing consumer and technology sectors, such as Alibaba AI, Deep Robotics, Proya, and JNBY Group.

In this standout episode of Baiguan Radio, we dived into why the post-Geneva trade truce was fundamentally unsustainable. Moving beyond simple tariff calculations, the discussion explores the “hazy” world of non-tariff measures—from rare earth metals to tech restrictions—that now define the qualitative core of the US-China relationship.

US-China trade on verge of collapse, student visas, ex-drug regulator downfall, BYD is Evergrande? and impending disaster at a major HK real estate developer - Baiguan Radio #32

This week, Johnny of East8’s Newsletter and I sit together to talk about several sensitive topics including:

In 2025, we tried a new thing or two ...

While our Charts of the Week series traditionally focused on macro trends, this year we piloted several posts dedicated to precise, direct investment opportunities. Our goal was to provide professional analysis of high-interest companies and sectors:

Is Laopu Gold’s Rally Over? 6 Charts on Recent Performance — Charts of the Week

Winners and Losers of China’s Delivery Platform Price War - Charts of the Week

In 2025, as more domestic brands like Pop Mart gained international recognition, we launched the ‘China New Consumption Series‘ to help you understand the stories, values, talents, and strategies behind these emerging names. Most importantly, the series gives you a glimpse into the underlying psychology and reasons behind why consumers are increasingly embracing domestic brands (hint: it’s not just nationalism or patriotism).

Furthermore, we explored trends that, while not always directly investable, are essential for your radar. Many of these live in academic journals or go under-reported, but we brought them to the forefront in our “China Tech Series,” such as our look at China’s next “rare earth-level” secret weapon.

This year, we also developed strategic collaborations with Horizon Insights and CF40 Research to deliver more high-quality research about China.

Finally, we hosted the very first Baiguan China Tour in October, visiting Shanghai and Hangzhou. We welcomed a private cohort of 13 guests from over six countries, with diverse backgrounds including family offices, institutional investors, tech, personal investors, and more. What began as a trip focused on investment targets ended as a community of friends who still stay in touch in our WeChat groups today. It was a rare and wonderful experience, not only for our guests but also for the Baiguan team, to learn from such a diverse and impressive group of readers.

As we wrap up 2025, we are already looking forward to an even better 2026. Please let us know which Baiguan sections or series were your favorites this year—your feedback helps us tailor our content to your interests.

Feel free to comment or send us an email with any feedback! Also, don’t forget to check out the exclusive benefits for our paid subscribers!

Happy Holidays and a Happy New Year to you and your families. We will see you in 2026!

精彩!

Happy New Year to you and Baiguan. see you in 2026!